Top 3 stories

Top 3 stories

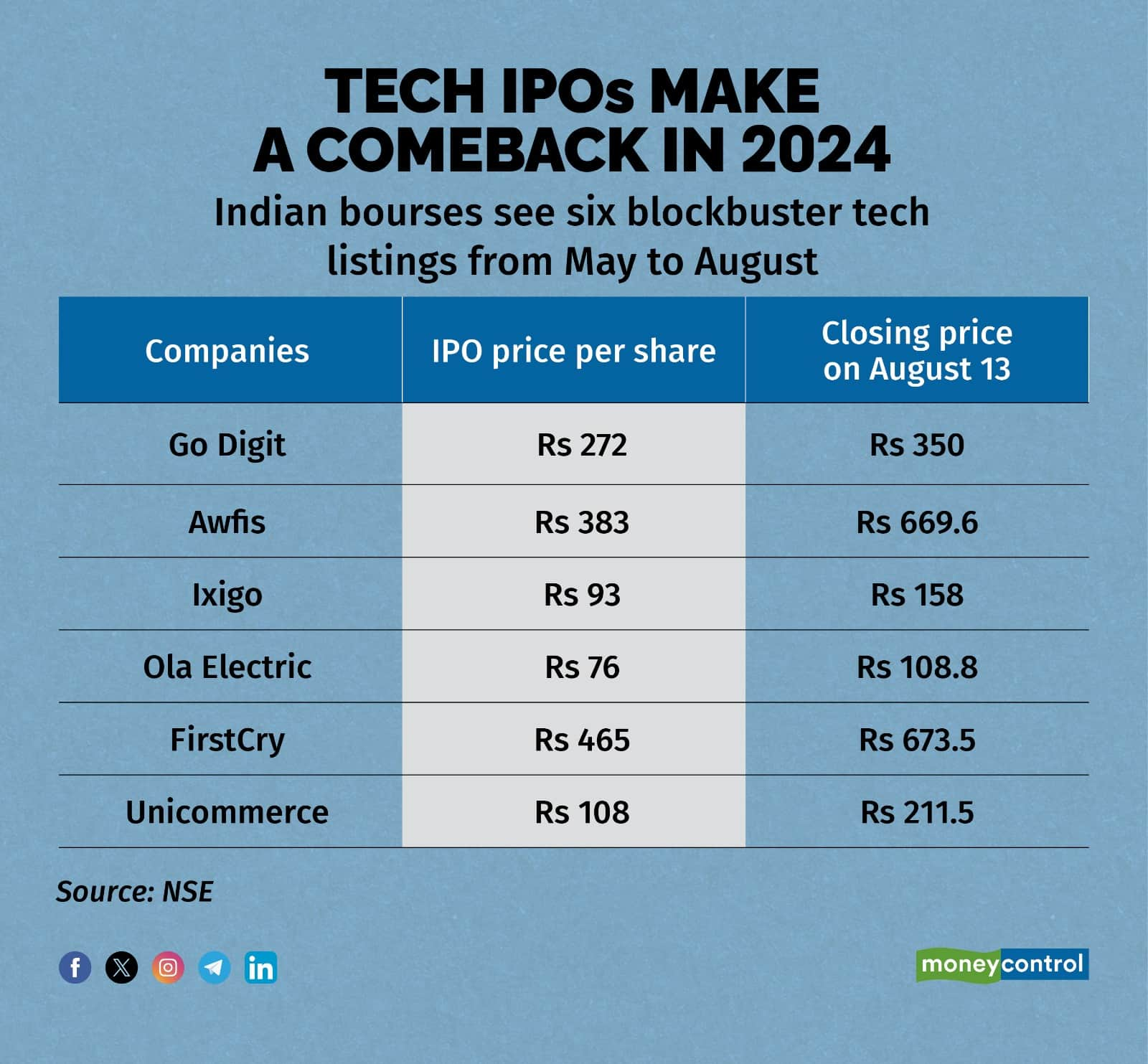

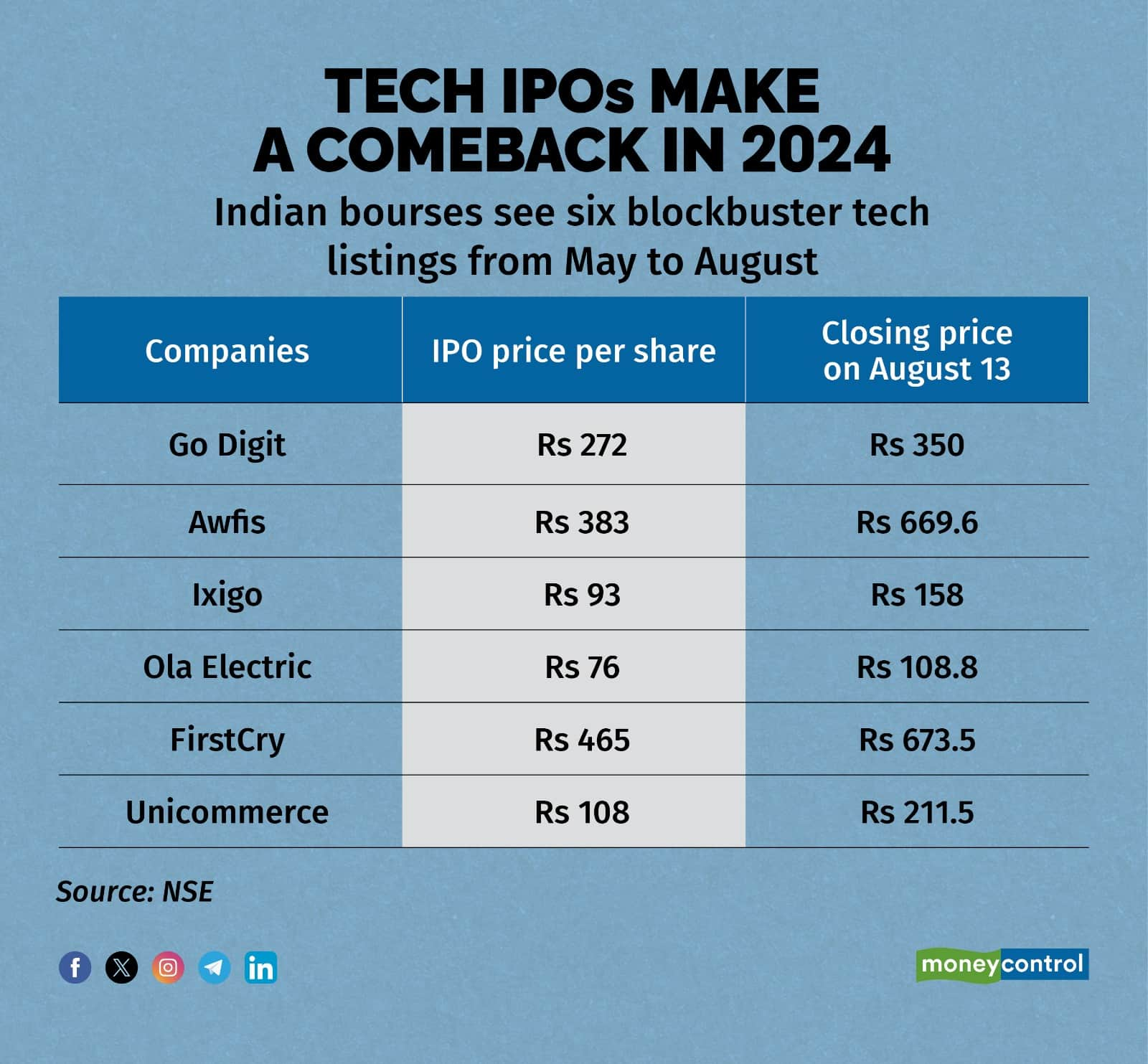

Bumper listings for FirstCry, Unicommerce

While the jury is still out on whether tech's private market funding winter is over, the sun is shining bright for the sector in the public market.

Driving the news

Omnichannel baby products retailer FirstCry and Snapdeal-backed SaaS company Unicommerce made a strong debut on Dalal Street today.

- Unicommerce ended its first day at Rs 211.5 apiece on the NSE, almost double its IPO price of Rs 108 per share

- FirstCry listed at a 40% premium over its IPO price of Rs 465 and ended the day at Rs 673.5 apiece on the NSE

These strong listings follow Ola Electric's upper circuit on its listing day. Its shares closed at Rs 108.17 apiece on the NSE today, 43% above the IPO price.

Check how much money Sachin Tendulkar made from FirstCry listing; Ratan Tata earns 5-7x returns in IPO

Also read: SoftBank sitting on 106% gains in Ola Electric, FirstCry, Unicommerce

SoftBank’s two pronged approach

SoftBank, an early backer of all three companies, has a lot going for itself. Over the past year, it has been realigning its investment strategy for an AI-first world.

- While it plans to invest in AI infrastructure companies from its balance sheet, it will use the Vision Fund unit to back AI use cases

Experts believe this strategy of playing both sides of the field is advantageous, as the expenses of AI application startups become revenue for AI infrastructure companies.

Is quick commerce eating into kiranas or e-commerce?

Have you reduced shopping at the corner store near you, or are you among the people who have shifted their purchases from Flipkart/Amazon to Blinkit/Swiggy Instamart/Zepto?

Driving the news

If you’re part of the latter group, Blinkit/Swiggy Instamart/Zepto founders are citing you as examples, claiming they are growing at the expense of e-commerce, not mom-and-pop (kirana) stores.

“The advent of quick commerce has made people want things faster than they would have otherwise got from e-commerce. This has led to a direct share shift…of non-grocery use cases to quick commerce…(from) e-commerce…we are not taking share away from kiranas or…DMart,” Blinkit CEO Albinder Dhindsa had while announcing company results.

Other founders echoed this sentiment.

“Our sellers are seeing the share of modern trade decline. We’re growing partly at the cost of modern trade, one part is coming from core e-commerce and the rest, a smaller portion, is coming from disorganised markets,” Aadit Palicha, co-founder and CEO of Zepto previously told us.

During the recent Moneycontrol Startup Conclave in Bengaluru, Swiggy’s Sriharsha Majety said the kiranas sell sachets and are mostly for top up purchases so the user cohorts are different.

But, DMart has felt the pinch

Even as founders maintain they’re not taking away from value retailers, DMart has seen some impact.

- DMart has seen a 1-1.5% impact from the advent of quick commerce, according to MD and CEO Neville Noronha

- However, he said that it is difficult to attribute this loss solely to quick commerce

- The stores have not experienced any decline, and there are no red flags, according to Noronha

Is it a facade?

While quick commerce founders insist they're targeting e-commerce firms, there's a possibility that they might be downplaying their impact on kiranas to avoid regulatory scrutiny.

- Kiranas and their unions are a significant vote bank for the government; if quick commerce companies upset them, the government is likely to intervene. No company wants that, an investor in the space told us

Dig deeper

Watch the second edition of the Moneycontrol Startup Conclave, presented by banking partner IDFC FIRST Bank—Always You First

Ather rides into unicorn club with $71M funding

Bengaluru-based electric two-wheeler manufacturer, Ather Energy, has revved its way into the coveted unicorn club.

Charging ahead

The EV startup has raised $71 million in a fresh funding round led by its long-time backer, the National Investment and Infrastructure Fund (NIIF).

- This latest round values the company at $1.3 billion

Pedal to the metal

This isn't Ather's first lap around the funding track! The company has raised multiple rounds of funding since the end of 2023.

- This latest infusion comes just months after the company raised Rs 286 crore through a mix of debt and equity

Road to IPO

The unicorn status is a significant milestone for Ather, especially as the company gears up for a potential public listing by 2025.

- Ather has already roped in investment banks including HSBC, Nomura, and JPMorgan to manage its IPO