What's latest at Musk's Twitter: In his haste to lay off half of Twitter's workforce, Elon Musk seems to have forgotten what made the platform so valuable: Its employees. Here's a look at the latest from Musk's Twitter:

Meanwhile, Twitter rolled out its new Twitter Blue subscription service over the weekend, delivering a verification checkmark to any user who pays $8 per month.

Subsequently, the social media firm said it is delaying the implementation of verification check marks to customers of its new $8 a month service until after Tuesday's midterm elections in the US, according to a The New York Times report.

Here is a wrap of what has changed at Twitter since Musk took over.

In today’s newsletter:

- Meta braces for mass layoffs

- More pain for Indian edtech

- UPI frauds spike

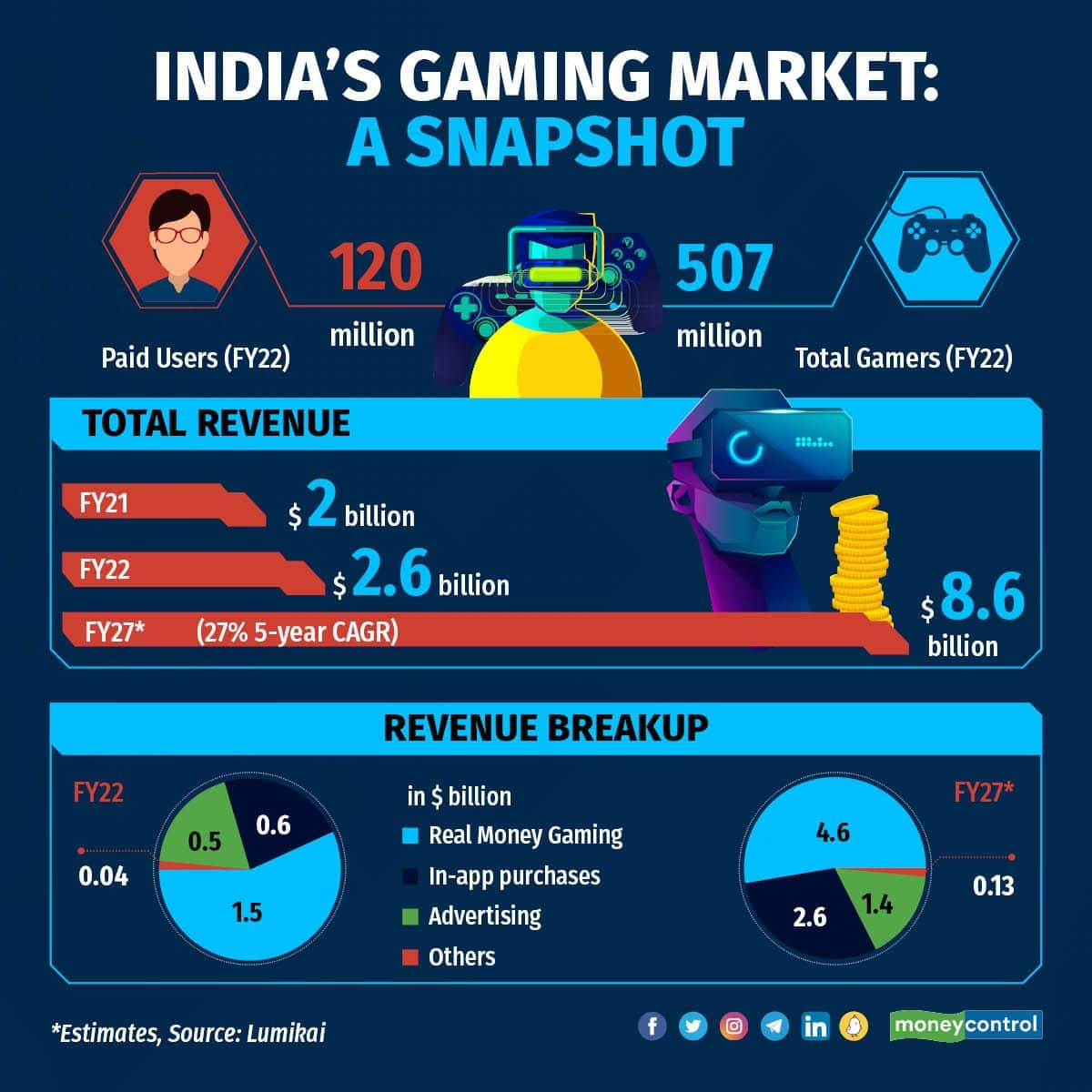

Bonus: Ever wondered how many people pay for games in India? Scroll below for more deets!

Was this newsletter forwarded to you? You can sign up for Tech3 here.

Top 3 stories

Top 3 stories

Meta braces for large-scale layoffs

Facing declining revenue and a battered stock, Facebook parent Meta is gearing up to take a step it has never taken before.

What happened?

Meta is preparing to lay off employees this week, in what could be the company's first large-scale layoffs in its 18-year history, reports The Wall Street Journal.

It said the layoffs are expected to impact many thousands of employees across the world. Meta had 87,314 employees at the end of September 30, 2022.

How did we land here?

Meta is struggling with declining revenue for the first time in its history, due to a sharp slowdown in the online advertising market and the impact of Apple's iOS privacy changes. The social networking giant witnessed a revenue drop for two straight quarters and is forecasting another drop in the ongoing quarter.

At the same time, Meta is also attempting a risky and expensive transition to the so-called metaverse, which is still several years away.

- Reality Labs, responsible for Meta's virtual reality and augmented reality efforts, has lost $15 billion since the beginning of last year. Meta CEO Mark Zuckerberg said expenses will further increase "meaningfully" in 2023.

Headcount reduction

Big picture

If Meta goes ahead with the job cuts, it will join a slew of other tech firms that have announced layoffs and hiring freezes in response to rising inflation and macroeconomic headwinds. This includes Stripe, Amazon, Lyft, Coinbase, Apple, and Snap among others.

Trouble for edtech continues…

Every day brings more evidence that the edtech industry is in the midst of a perfect storm, with layoffs and strategy shifts becoming the norm.

Driving the news

Unacademy has laid off 10 percent of its workforce or about 350 employees across verticals as the SoftBank-backed edtech unicorn’s new funding round has gotten delayed amid macroeconomic headwinds.

- The development comes four months after Gaurav Munjal, CEO and co-founder of the edtech unicorn had told employees in an internal email that the company would not exercise any more layoffs

In a separate development, K-12 (kindergarten to class 12) immersive learning platform Practically has also laid off permanent and contractual employees across departments and hasn't paid many of them for three to four months.

- In an email sent to employees, the company said that it is struggling with liquidity and falling demand for online learning solutions

- The company also told employees that it will close a funding round in November, after which it will be able to pay employee dues

- Practically will also be trimming down its B2B business “substantially” and focus more on its B2C business, which it claimed was near profitability

In response to queries, Practically said that the company is “just days away” from signing ‘large B2B (business-to-business) multi-year deals, which will help it pay dues.

What’s in store for edtechs?

With the situation worsening by the day, edtech companies are scrambling to cut costs in order to stay afloat.

Mass layoffs, reduced advertising and marketing spends, shutting down or investing less in non-core verticals, and other exercises are becoming frequent for edtech companies.

Innovation for edtech companies, or the 'tech' in edtech, is losing lustre as edtech companies invest less as a cost-cutting measure. As a result, student retention is becoming increasingly problematic for edtech companies. We previously reported on how edtech startups are trapped in a vicious cycle due to a lack of funding.

UPI frauds spike

When was your last visit to an ATM? Well, it was probably only today, but we can all agree that our dependence on ATMs and cash has diminished in recent years.

A big reason for this is the rise in the number of people who use and adopt the unified payments interface (UPI). But its growing use has turned out to be a double-edged sword, as UPI-related payment frauds are on the rise on a quarterly basis.

This was evident in a recent report by the Ministry of Home Affairs on the number of complaints received through the National Cybercrime Reporting Portal (NCRP).

By the numbers

According to MHA data, UPI contributed significantly to a 15 percent increase in the total number of complaints received on NCRP.

- While the overall number of registered complaints in the first quarter of 2022 was 206,198, it grew to 237,658 in the second quarter, representing a 15.3 percent rise

- As for UPI-related frauds, complaints jumped from 62,350 in Q1 2022 to 84,145 in Q2 2022

Not just UPI

In addition to UPI-related fraud complaints, debit/credit card fraud complaints increased between Q1 and Q2 of 2022.

- It was only internet banking complaints that fell during the time period.

Go deeper.

MC Deep Dive: Cognizant’s underperformance may give Infy the edge

Cognizant zipped past Infosys in 2012 in terms of revenue, in what was then a major upset in the IT pecking order. A decade on, it looks like Infosys is all set to reclaim its lead.

According to Kotak Institutional Equities, Infosys is catching up with Cognizant in size, with just a 6 percent difference in revenues. How do the two stack up in terms of revenues, margins, headcount, attrition and market cap?

Go deeper to find out how Infosys is stealing a march over its Nasdaq-listed rival.