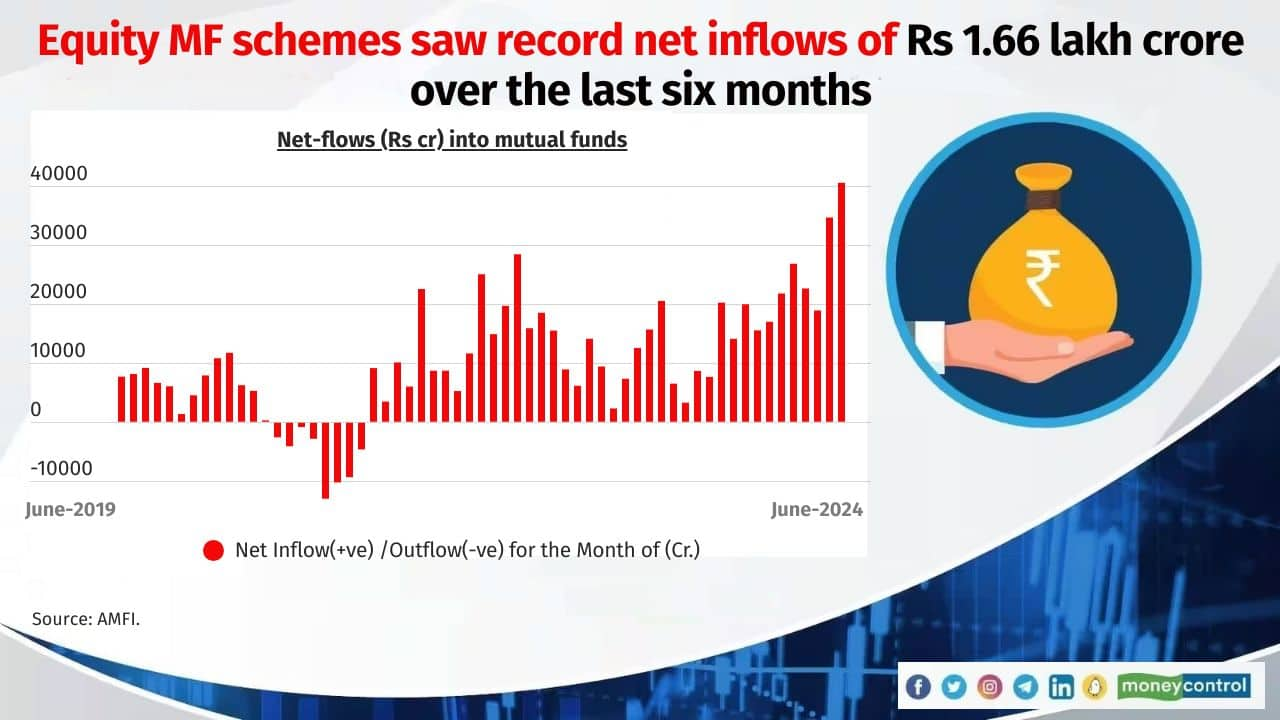

Record inflows: Top 10 stocks that MFs shopped big for in past 6 months

Over the past six months, equity mutual funds attracted record net inflows of Rs 1.66 lakh crore. Fund managers deployed the money in the beaten down quality stocks

1/11

The Indian stock market continues its record run despite an increase in volatility. Over the past six months, the market has seen some wild swings in the run-up and after the Lok Sabha elections, the result of which was declared on June 4. The volatility, however, hasn’t deterred investors, who have continued their investment journey in equities through mutual funds. Equity mutual funds got record net inflows of Rs 1.66 lakh crore over the past six months, AMFI data shows. Volatility offers fund managers an opportunity to take new positions in the beaten down quality stocks. Here are the top 10 stocks that mutual funds increased their exposure in during the December 31-June 30 period. These stocks saw a significant increase in the number of shares (in percentage terms) in the mutual fund holdings. While drawing up the list, we only considered stocks in which mutual funds had a higher investment. Source: ACE MF.

2/11

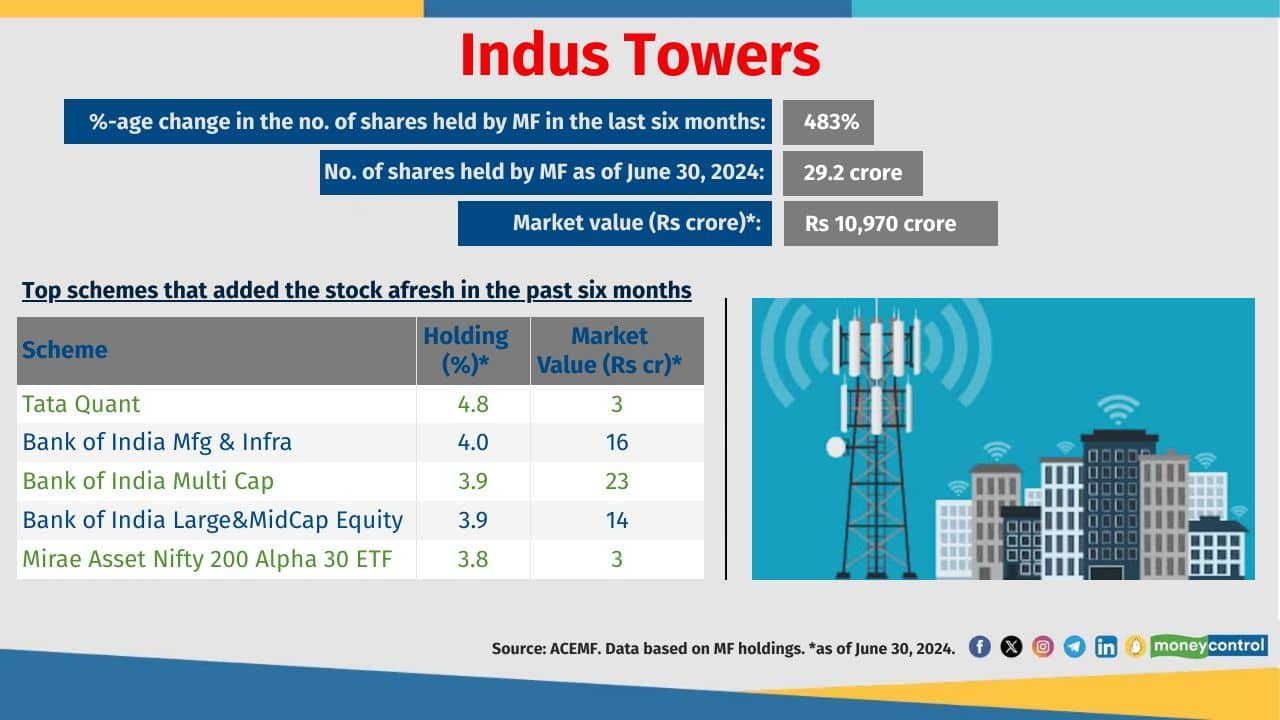

Indus Towers

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 132

Total no. of schemes holding the stock as of June 30, 2024: 188

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 132

Total no. of schemes holding the stock as of June 30, 2024: 188

3/11

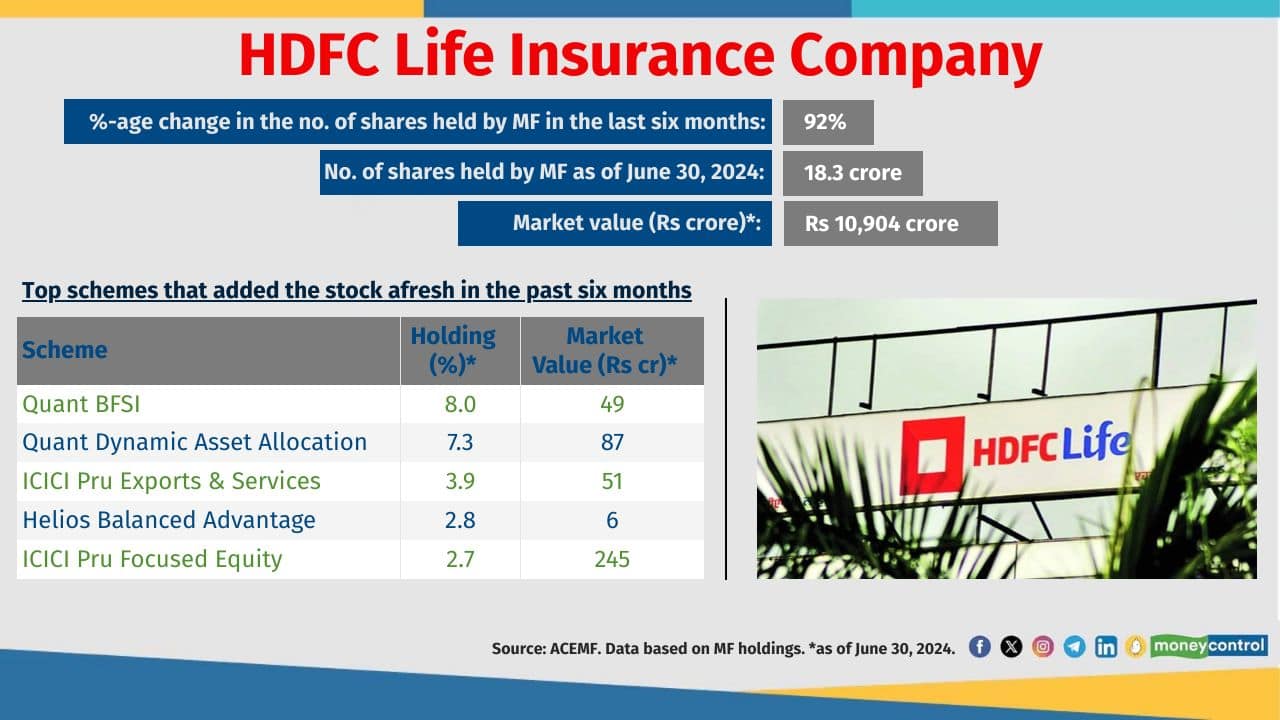

HDFC Life Insurance Company

M-Cap type: Large Cap

No. of schemes that added the stock over the last six month: 50

Total no. of schemes holding the stock: 192

Also see: Decoding the EV ecosystem, stocks, sectors: Nifty EV and New Age Automotive ETF

M-Cap type: Large Cap

No. of schemes that added the stock over the last six month: 50

Total no. of schemes holding the stock: 192

Also see: Decoding the EV ecosystem, stocks, sectors: Nifty EV and New Age Automotive ETF

4/11

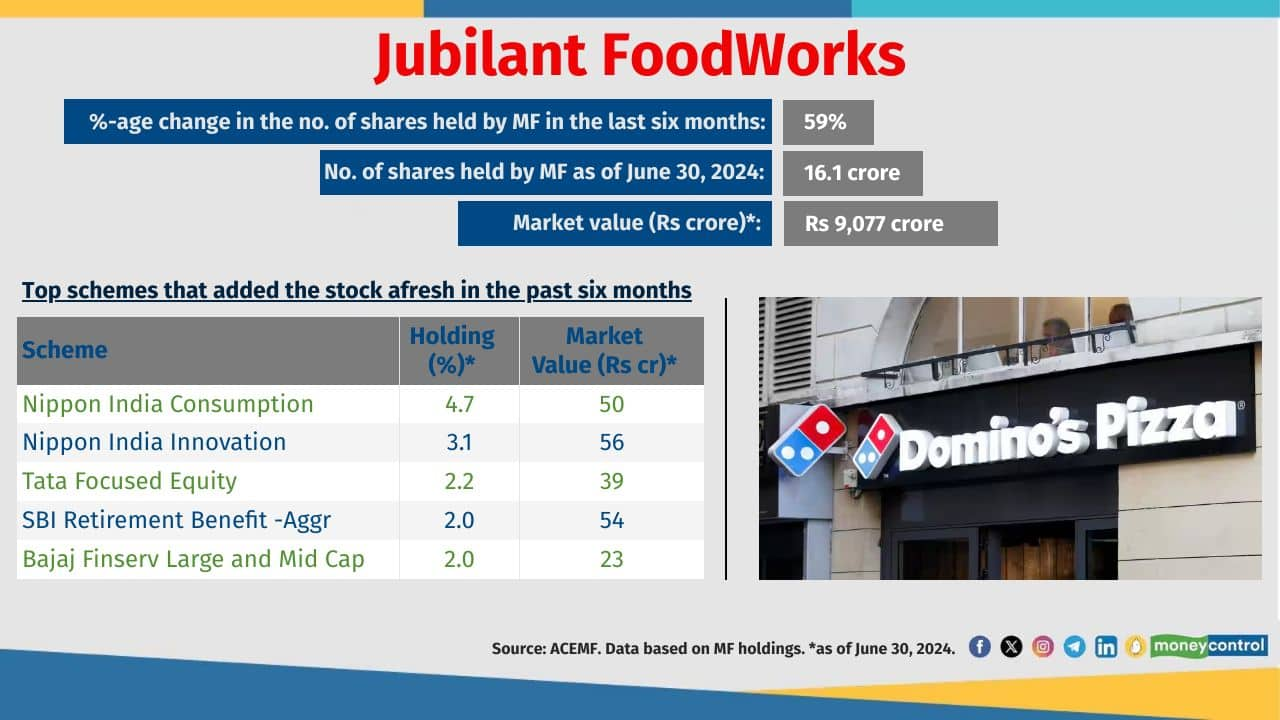

Jubilant FoodWorks

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 15

Total no. of schemes holding the stock: 138

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 15

Total no. of schemes holding the stock: 138

5/11

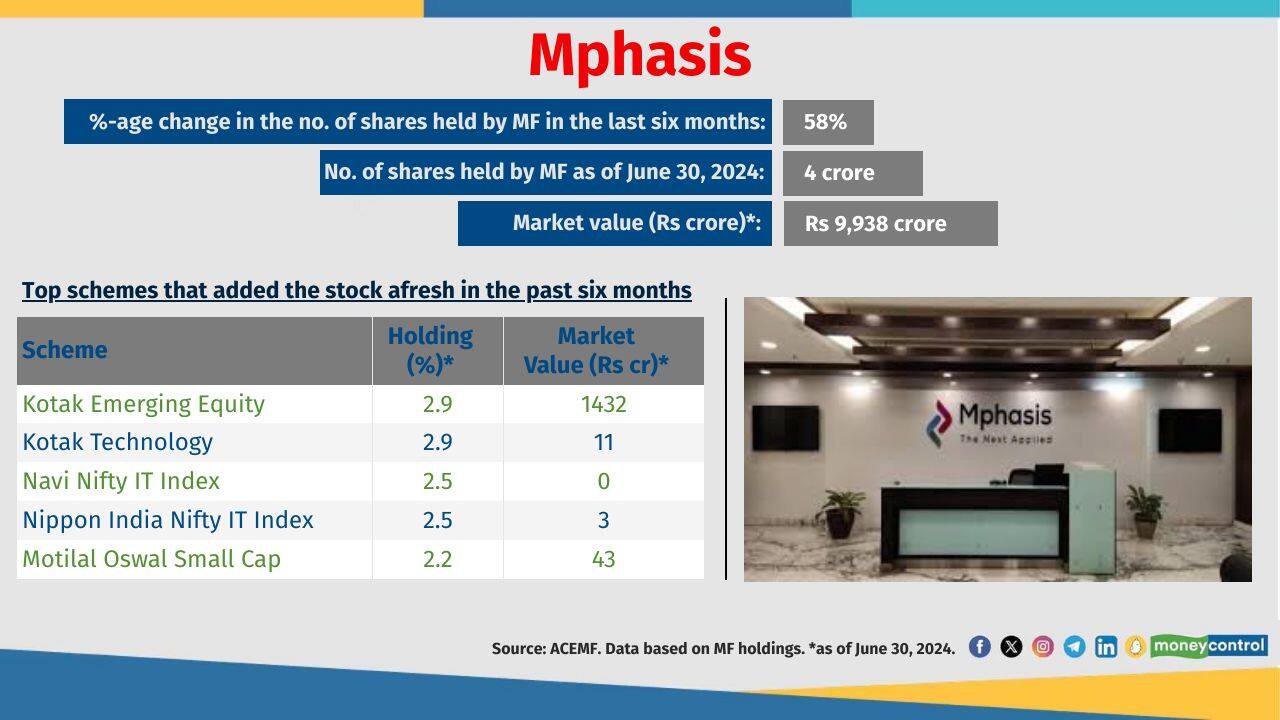

Mphasis

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 22

Total no. of schemes holding the stock: 170

Also see: How US-focused MFs topped the return charts

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 22

Total no. of schemes holding the stock: 170

Also see: How US-focused MFs topped the return charts

6/11

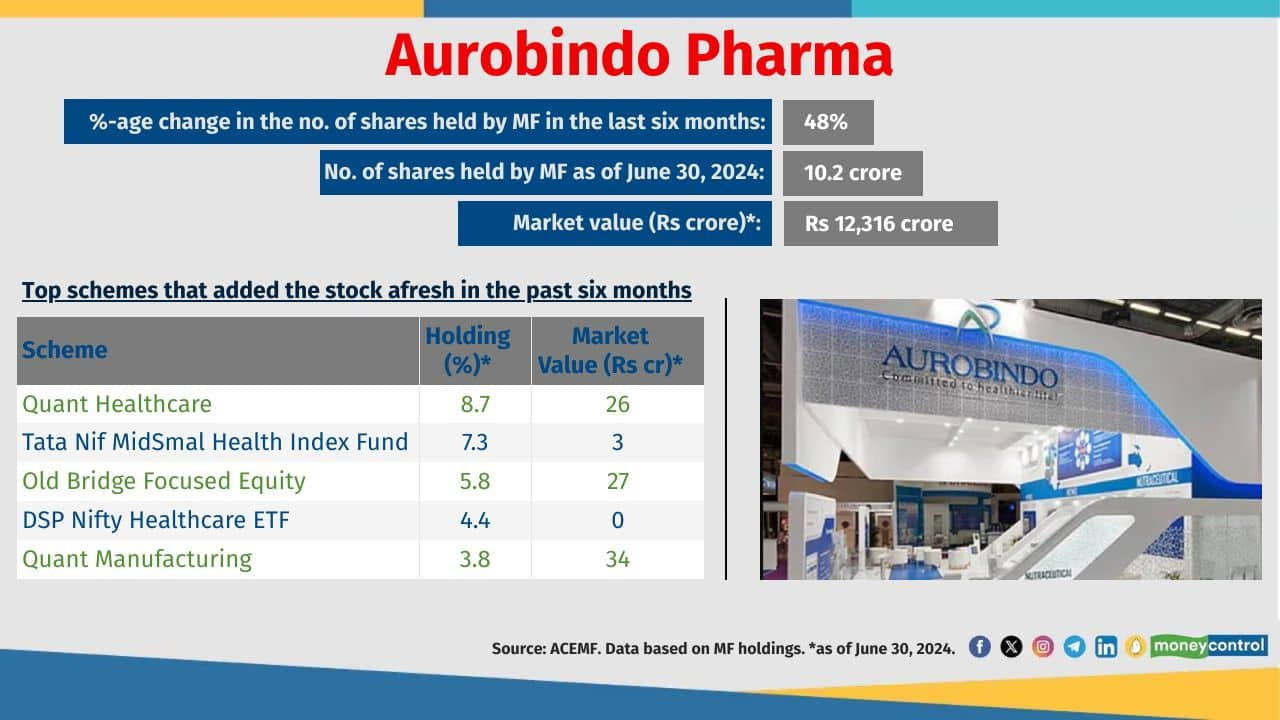

Aurobindo Pharma

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 23

Total no. of schemes holding the stock: 164

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 23

Total no. of schemes holding the stock: 164

7/11

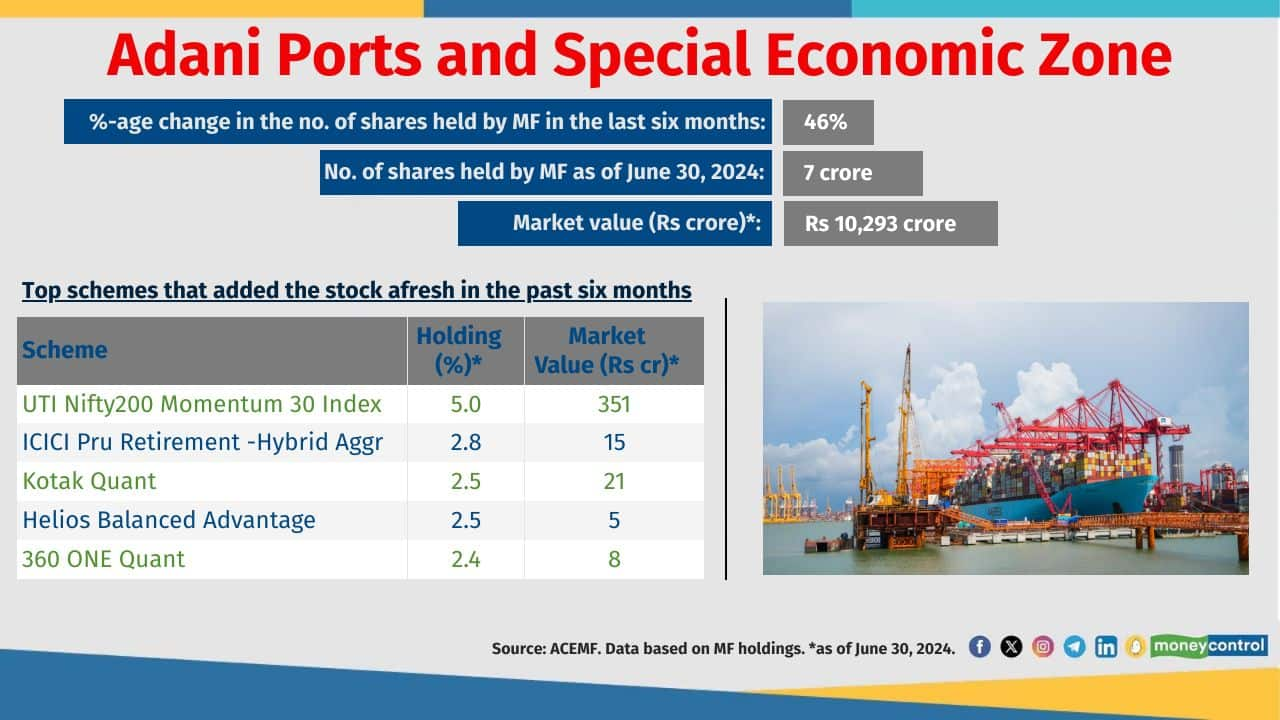

Adani Ports and Special Economic Zone

M-Cap type: Large Cap

No. of schemes that added the stock over the last six month: 62

Total no. of schemes holding the stock: 170

M-Cap type: Large Cap

No. of schemes that added the stock over the last six month: 62

Total no. of schemes holding the stock: 170

8/11

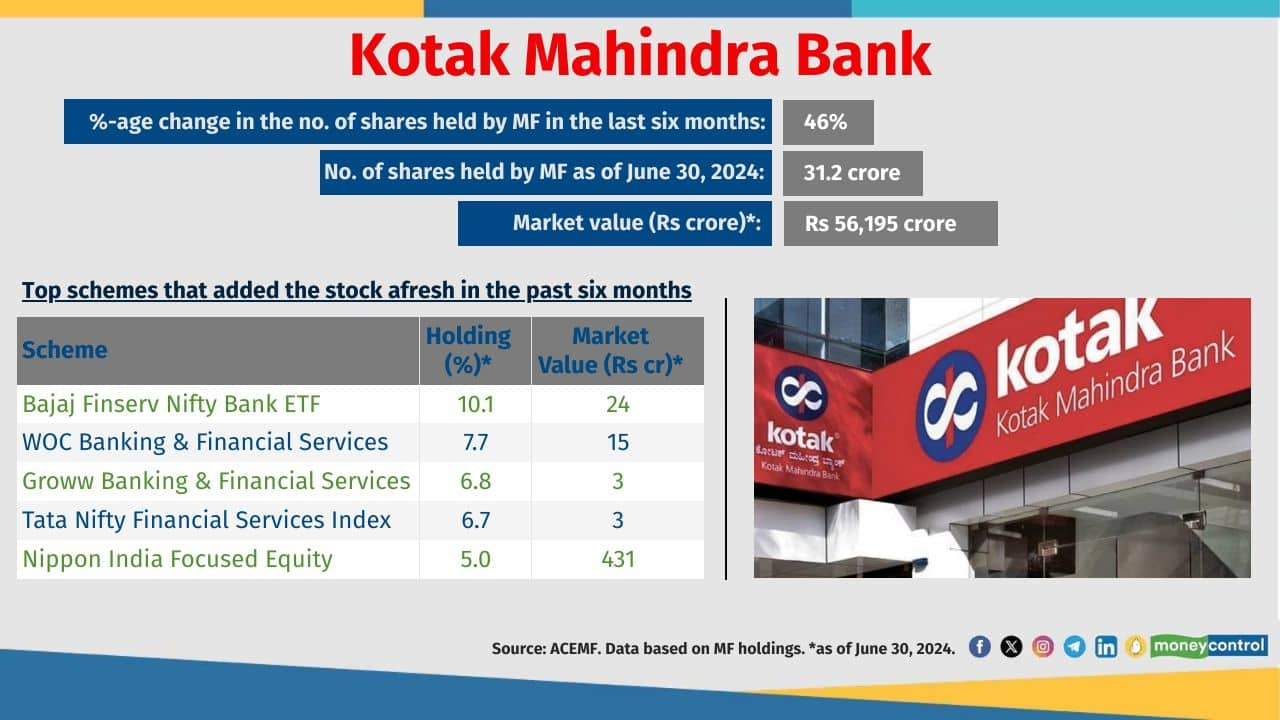

Kotak Mahindra Bank

M-Cap type: Large Cap

No. of schemes that added the stock over the last six month: 61

Total no. of schemes holding the stock: 366

See here: Top microcaps upgraded to smallcaps category on AMFI list. Do you own any?

M-Cap type: Large Cap

No. of schemes that added the stock over the last six month: 61

Total no. of schemes holding the stock: 366

See here: Top microcaps upgraded to smallcaps category on AMFI list. Do you own any?

9/11

Gland Pharma

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 15

Total no. of schemes holding the stock: 118

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 15

Total no. of schemes holding the stock: 118

10/11

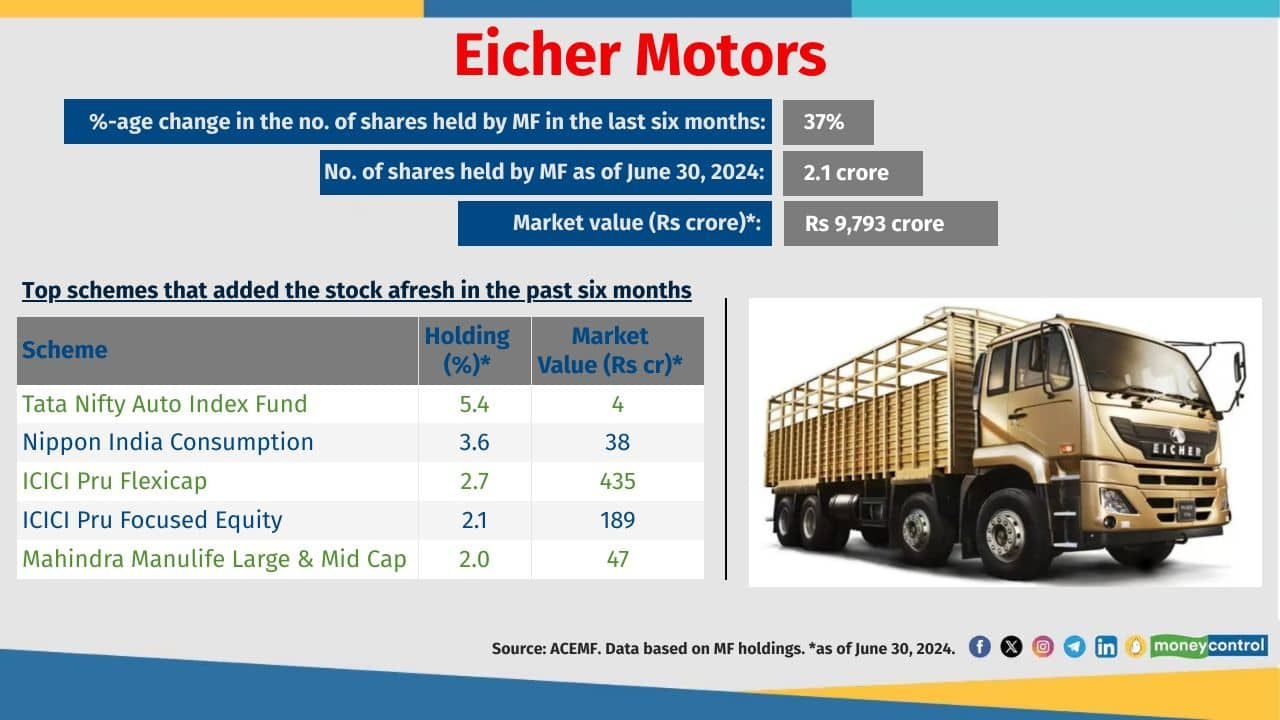

Eicher Motors

M-Cap type: Large Cap

No. of schemes that added the stock over the last six month: 24

Total no. of schemes holding the stock: 181

M-Cap type: Large Cap

No. of schemes that added the stock over the last six month: 24

Total no. of schemes holding the stock: 181

11/11

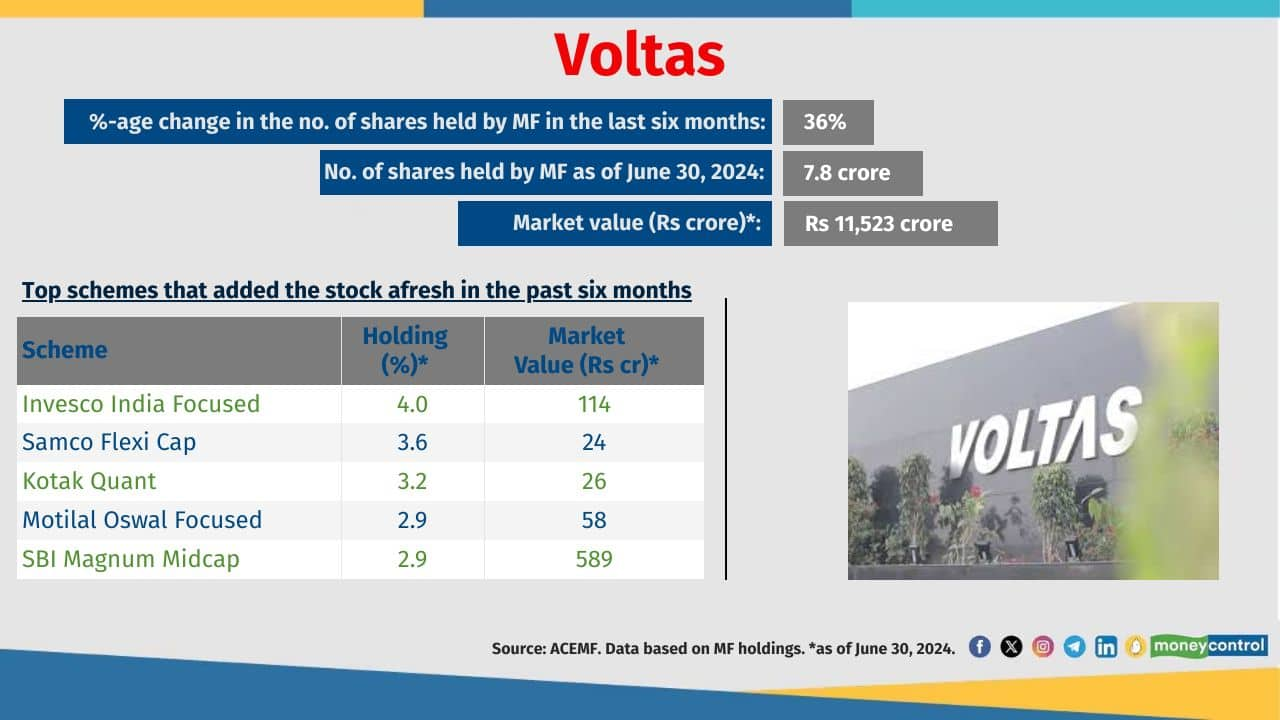

Voltas

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 42

Total no. of schemes holding the stock: 172

Also see: SIP sahi hai. Here are the top flexicap MFs that have given up to 20% over 15 years

M-Cap type: Mid Cap

No. of schemes that added the stock over the last six month: 42

Total no. of schemes holding the stock: 172

Also see: SIP sahi hai. Here are the top flexicap MFs that have given up to 20% over 15 years

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!