These mutual fund schemes got the maximum flow during June quarter. Do you own any of them?

Morningstar India’s report on domestic fund flows in Q1 FY22 gives insights on the estimated flows, asset trends, and performance of equity and debt funds

1/10

The size of the Indian mutual funds industry has risen to Rs 35.3 trillion as on July 31, 2021 compared to Rs 33.6 trillion as on June 30, 2021, according to AMFI data released on Tuesday. Equity and bond funds have seen large net inflows (investments exceed redemptions) in July. But which schemes got the maximum inflows and which ones saw outflows? Morningstar India’s report on “Domestic Fund Flows - Q1 FY22” gives insights on the estimated flows, asset trends, and performance of domestic funds focused on the Indian equity and debt market.

2/10

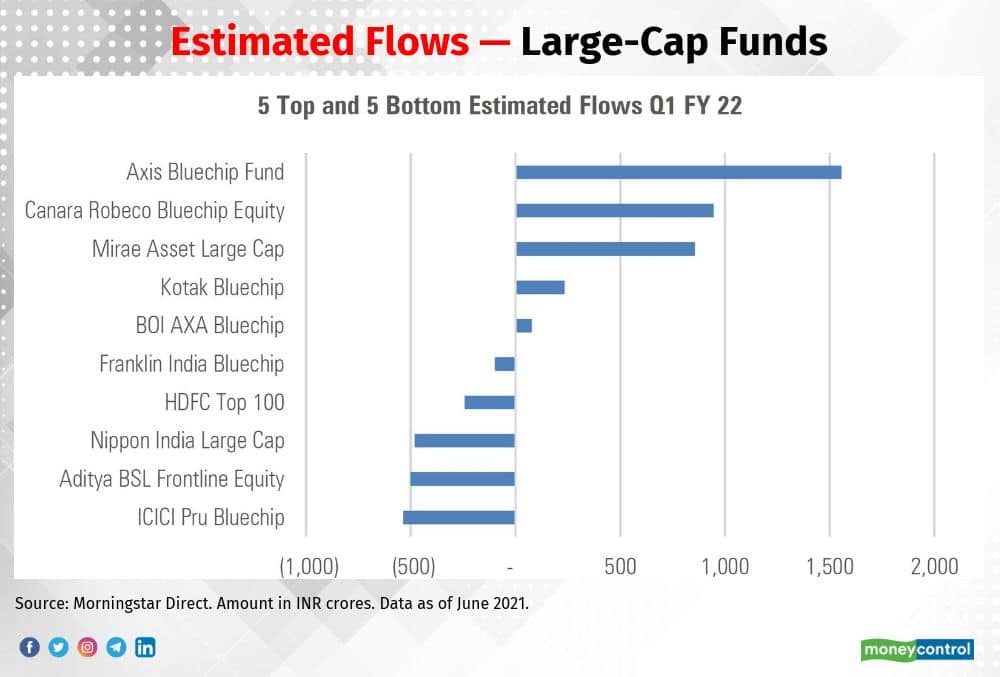

Large-cap funds witnessed net inflows worth INR 1,810 crores in first-quarter fiscal 2021-22, after three consecutive quarters of net outflows.

3/10

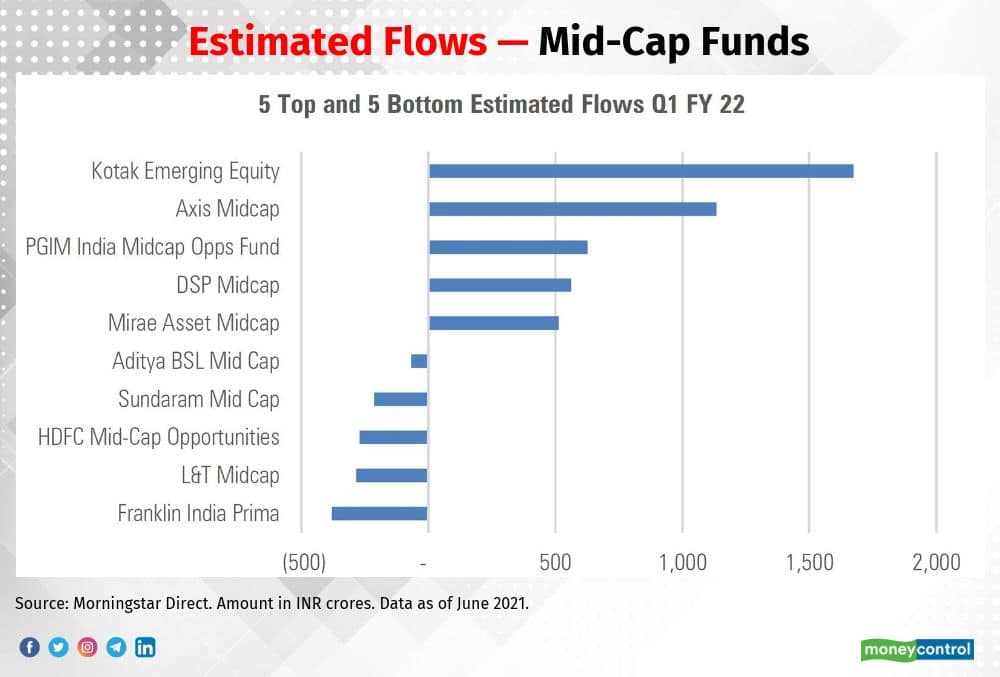

Mid-cap category witnessed the highest net inflows in the open-end equity asset class during the quarter ended June 2021. HDFC Mid-cap Opportunities Fund remains the largest mid-cap scheme in the category with assets of Rs 29,508 crore, as on June-end, as per Morningstar.

4/10

After witnessing net outflows for three consecutive quarters, the small-cap category finally managed to turn the corner with net inflows in June quarter. Nippon India Small Cap Fund remains India’s largest small-cap mutual fund scheme, with assets of Rs 15,353 crore as on June-end, as per Morningstar.

5/10

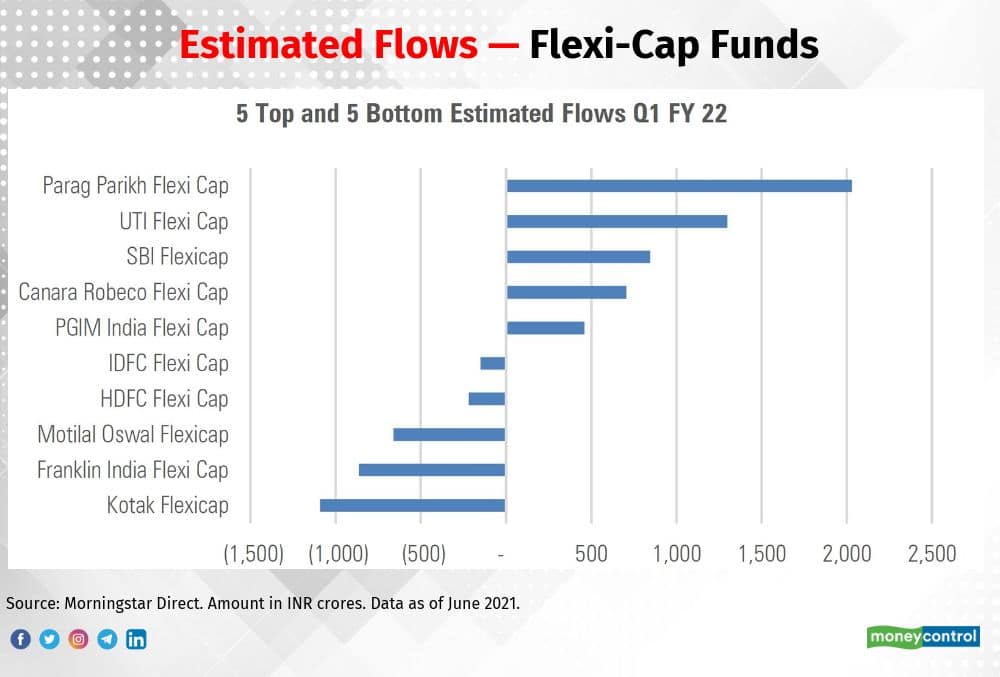

The recently introduced category flexi-cap attracted investors interest remarkably in the June quarter. These funds can invest in scrips across market capitalisation, as per the fund manager’s choice.

6/10

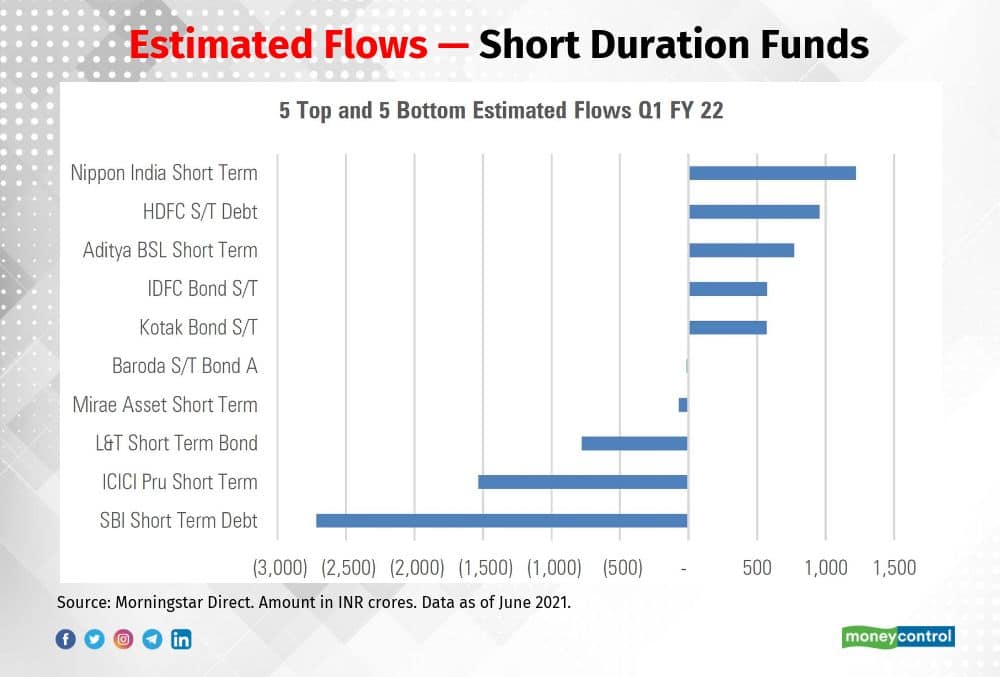

Short-Duration Funds registered net outflows in June quarter as the investors moved to very short term accrual funds due to rising yields. In the first quarter of fiscal 2021-22, the category witnessed outflows of INR 844 crores.

7/10

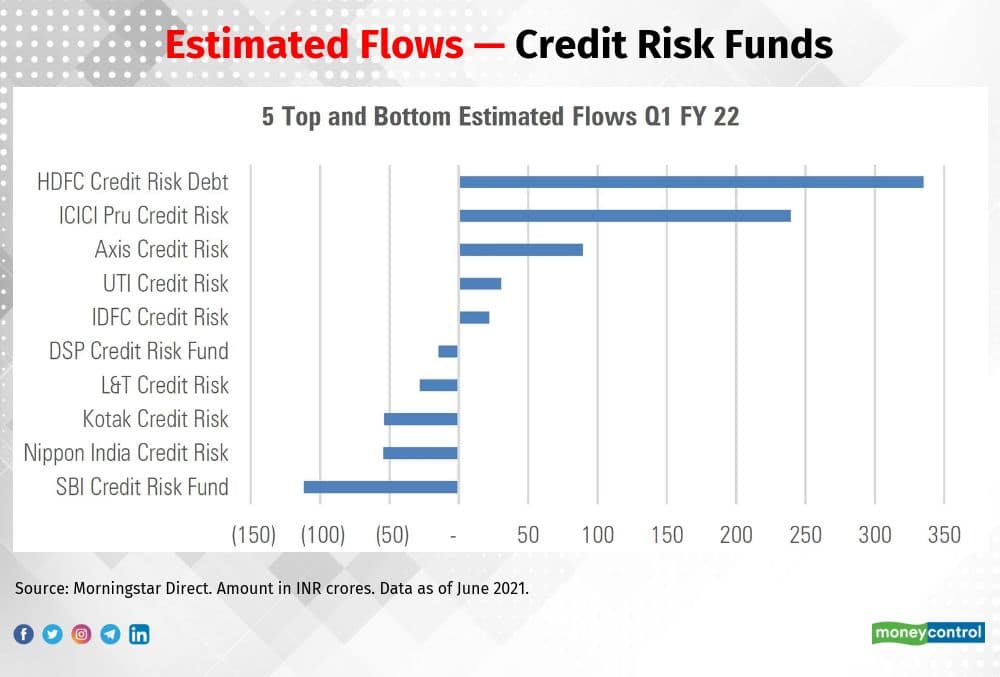

Credit-risk funds have been under tremendous pressure over the last couple of years because of a spate of downgrades and defaults, which has led to an exodus of assets from this category. Morningstar report shows, the highest net inflows in the June quarter were garnered by HDFC Credit Risk Fund (INR 335 crores), followed by ICICI Prudential Credit Risk (INR 239 crores) and Axis Credit Risk (INR 89 crores).

8/10

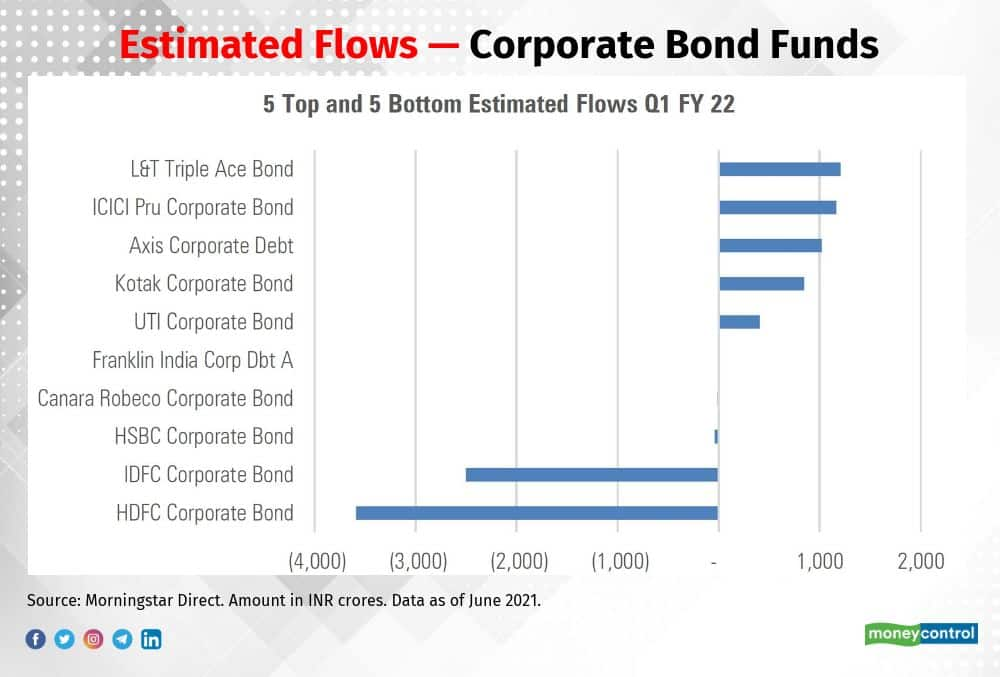

The corporate bond category is among the few categories in the fixed-income segment that has managed to consistently gather flows even during periods when the other categories saw outflows. However, in the first quarter of fiscal 2021-22, the category witnessed net flows of INR 2,818 crores, its first net outflows in over two years.

9/10

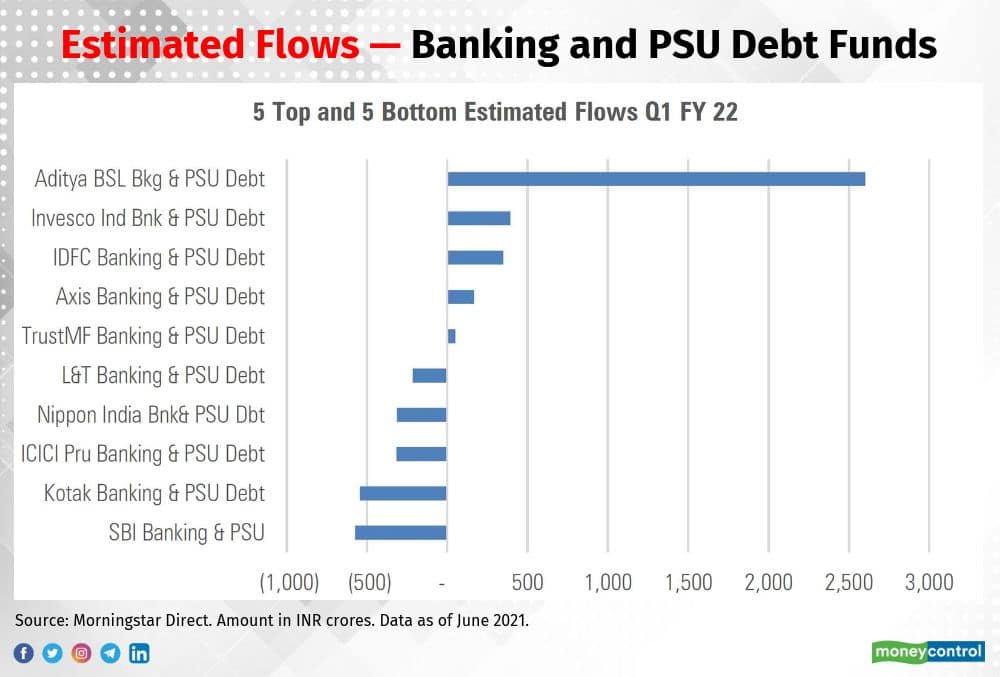

The banking and PSU debt category makes it a relatively safer investment avenue compared with some other categories that have the flexibility of taking on a higher credit risk. Over the last year, the banking and PSU category managed to get a fair level of inflows as investors chose to park monies into safer options.

10/10

Morningstar has provided estimated net cash flows for each scheme in some of the main equity and debt mutual fund categories on the basis of total net assets and returns.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!