Top actively traded tax-free bonds that bring safety and returns for retirees

Moneycontrol presents a list of the most liquid tax-free bonds that also give high returns. These bonds can be a better investment solution for fixed income investors including retirees

1/10

Fixed income instruments are usually taxable in the hands of the investor. What’s the way out, then, if you still want regular income? Tax-free bonds. With 4.4-4.6 percent YTM, tax-free bonds are still an attractive buy for investors in higher income-tax slabs. For those in the 43 percent tax slab, that results in a pre-tax yield of 7.8-8 percent yields. The AAA-rated bonds are available with YTM of 7 percent or lower. Tax-free bonds are also mostly risk-free as they are issued by the government backed entities. But liquidity is important as most of these bonds are now only available in the exchanges. Moneycontrol presents a list of the most liquid tax-free bonds that also give high returns. These bonds can be a better investment solution for fixed income investors including retirees. Remember: Investments exceeding Rs 10 lakh face value worth in certain tax-free bonds will result in reduction in the annual coupon rate by 25-30 bps. This will reduce the YTM too. Barring the last series, the YTM mentioned below are for the investment made up to Rs 10 lakh face value in these bonds.

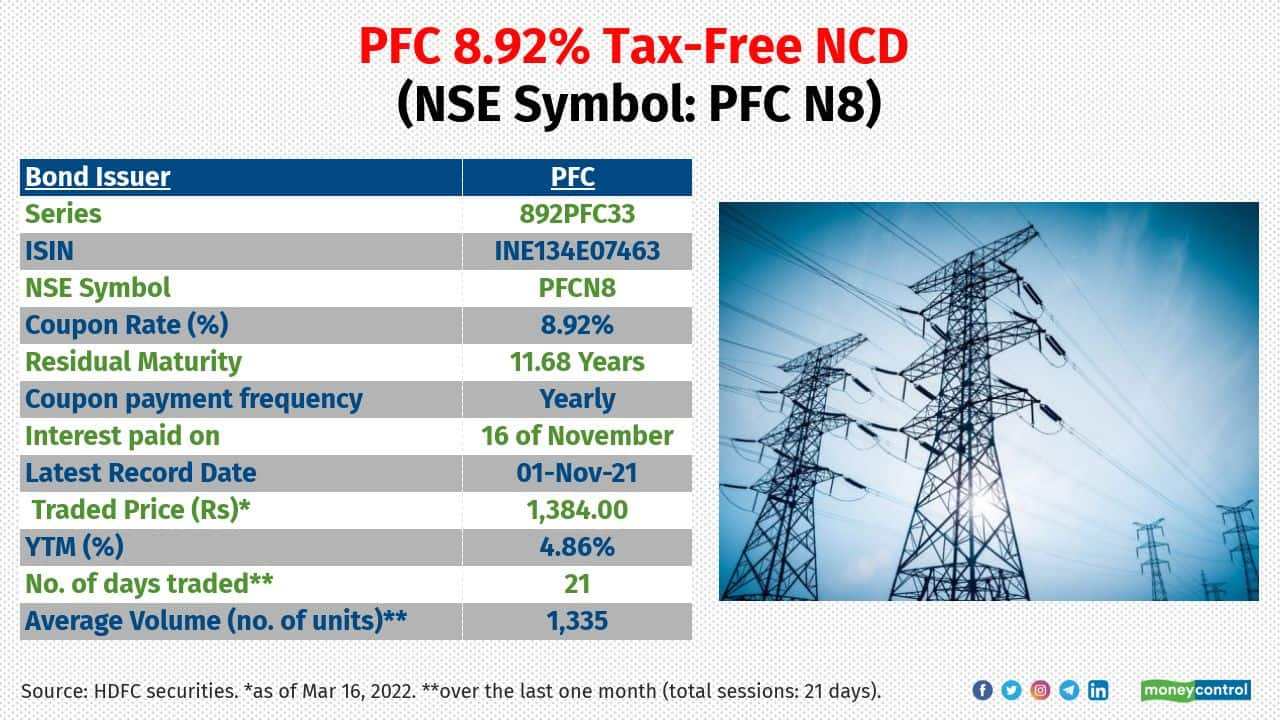

2/10

PFC was established in 1986 by the government as an institution dedicated to funding and developing the power sector in India. PFC’s net NPA stood at 2.09 percent as on March 31, 2021. CRISIL, ICRA and CARE have reaffirmed its AAA ratings on the debt instruments issued by PFC.

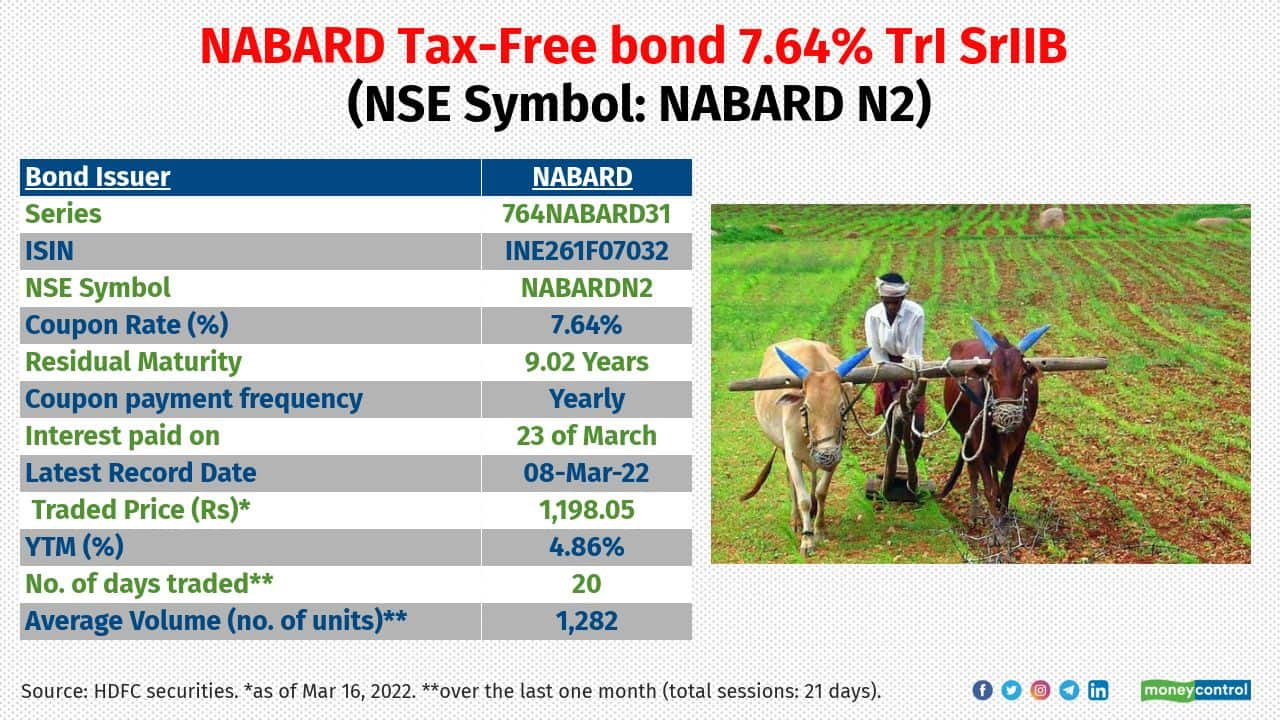

3/10

NABARD has strong linkages with the government and is an apex policy institution and nodal agency for agriculture and rural development. NABARD’s net non-performing loan ratio was 0.15 percent in 9MFY21. India Ratings has assigned AAA to the tax-free bonds issued by the entity.

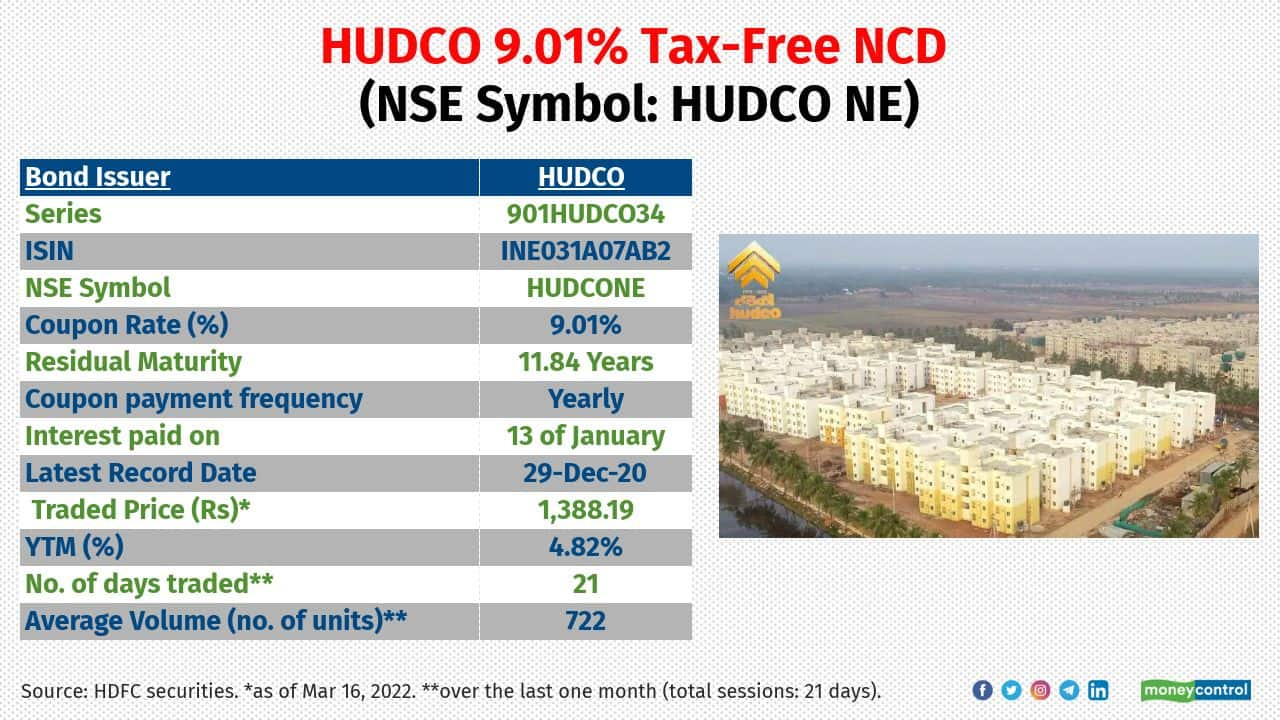

4/10

Housing and Urban Development Corporation (HUDCO), incorporated in 1970, is a listed Miniratna public sector enterprise under the Ministry of Housing and Urban Affairs. Its net NPA ratio remained stable at 0.5 percent in FY21. India Ratings and ICRA have assigned AAA to the tax-free bonds issued by the entity.

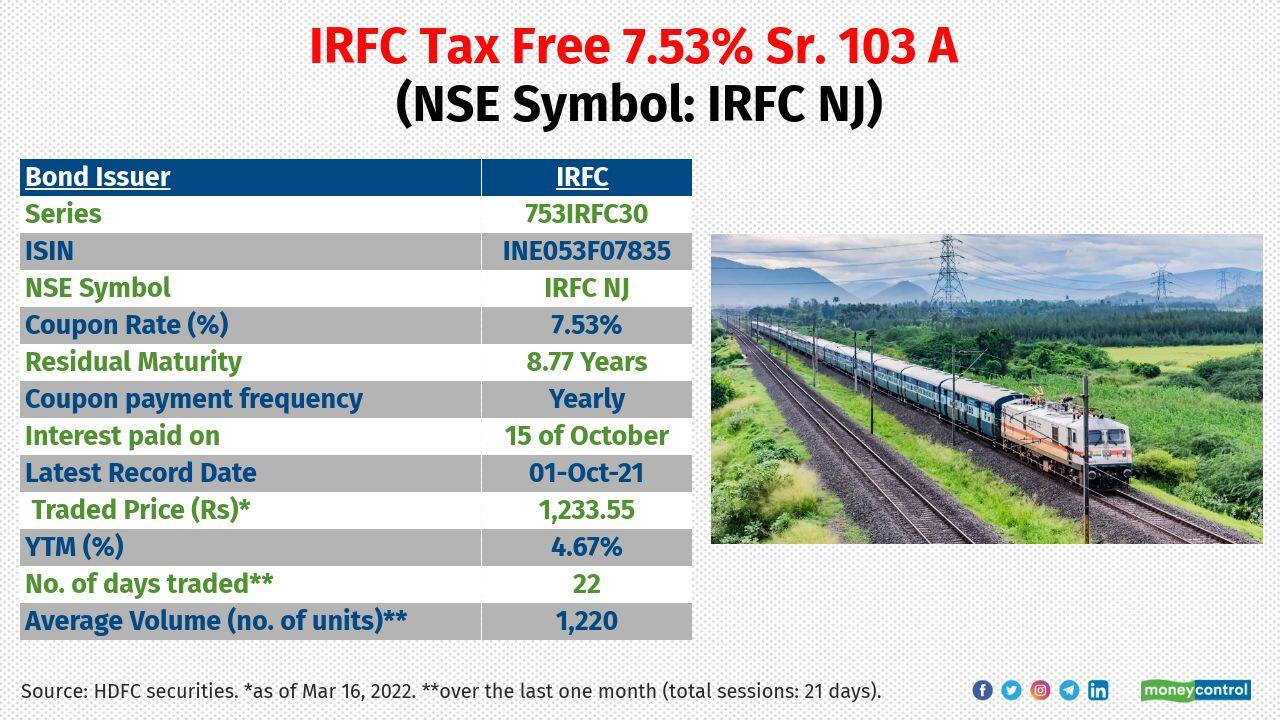

5/10

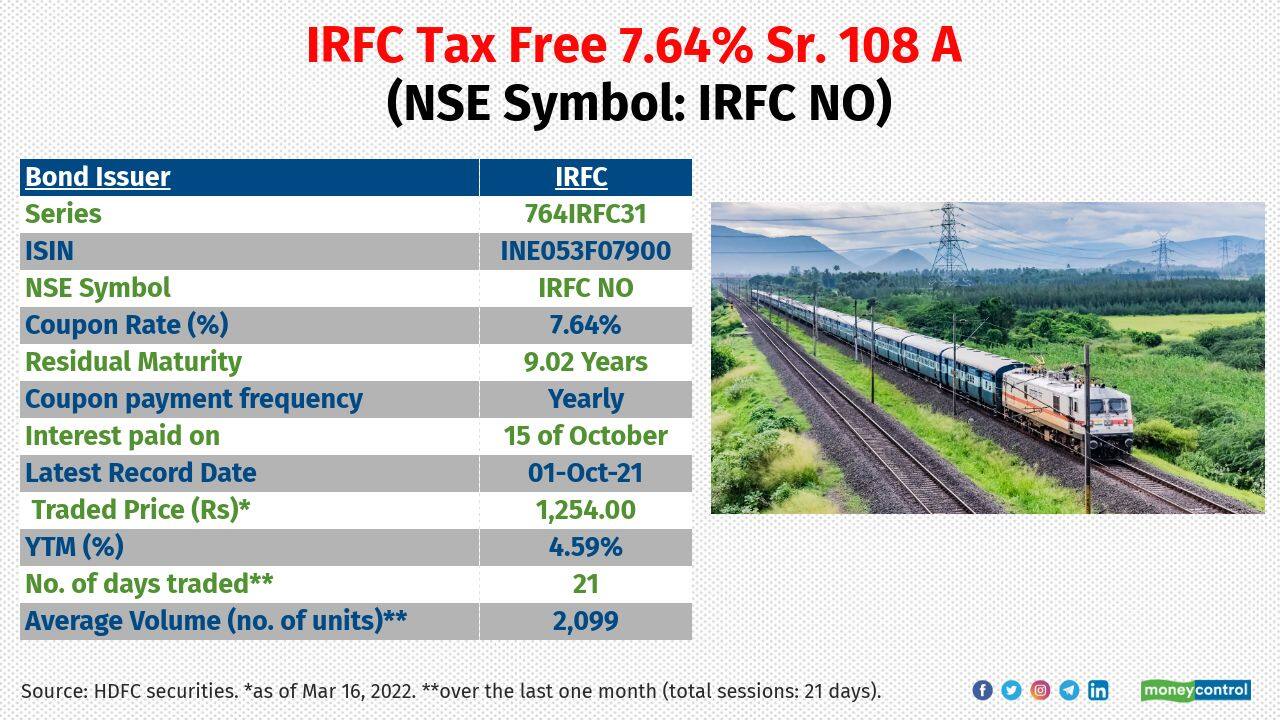

Indian Railway Finance Corporation Ltd (IRFC) is the dedicated market borrowing arm of the Indian Railways. With majority of the stake are owned by the government, IRFC is a Schedule ‘A’ public sector enterprise. According to the CARE ratings, it has a demonstrated history of receiving timely and regular parent support in the form of regular capital infusions to ensure comfortable capital structure. IRFC has maintained the highest credit ratings of AAA from CRISIL, ICRA and CARE.

6/10

There are 23 series of tax-free bonds issued by Indian Railway Finance Corporation Ltd (IRFC) traded in the exchanges. IRFC is the dedicated market borrowing arm of the Indian Railways. With majority of the stake are owned by the government, IRFC is a Schedule ‘A’ PSU. The favourable lease agreement with MoR protects IRFC against any exchange rate volatility, interest rate fluctuations and liquidity risk. IRFC has maintained the highest credit ratings of AAA from CRISIL, ICRA and CARE.

7/10

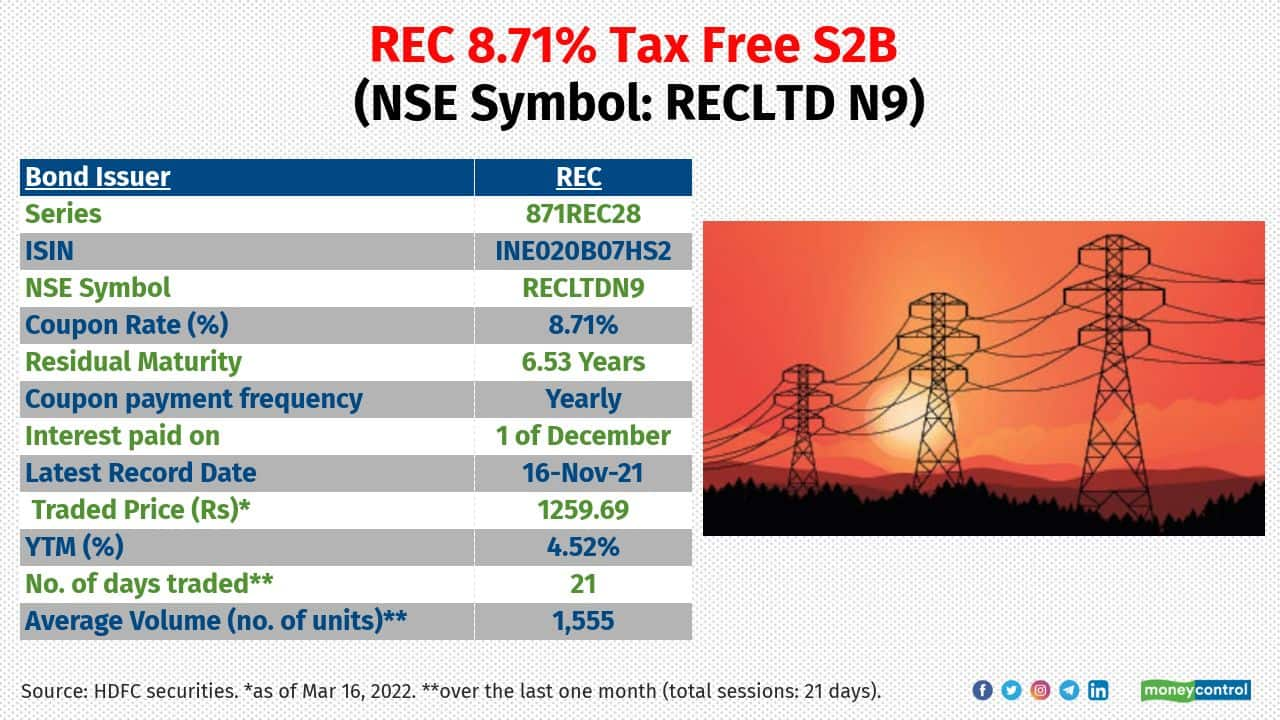

REC is a Navratna company under the Ministry of Power. REC is strategically important to the government as it plays an important role in the power sector, not only by providing finance but also by implementing the government's power sector policies. Its net NPA was 2 percent as on December 31, 2020. CRISIL, ICRA and CARE ratings have reaffirmed the highest rating of AAA to the long-term market borrowing of REC ltd.

8/10

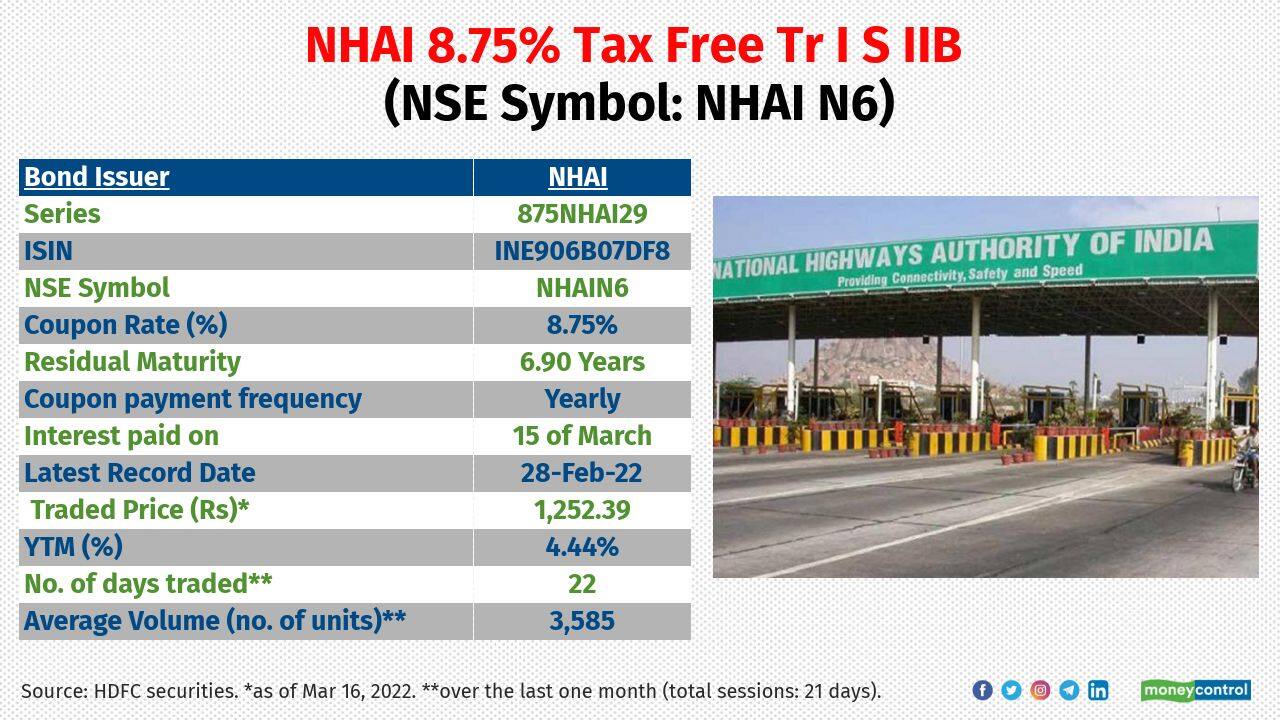

NHAI has strong financial flexibility because of continuous support from the Government of India for its projects. Rating agencies CRISIL, CARE and Brickwork have assigned the highest rating of AAA.

9/10

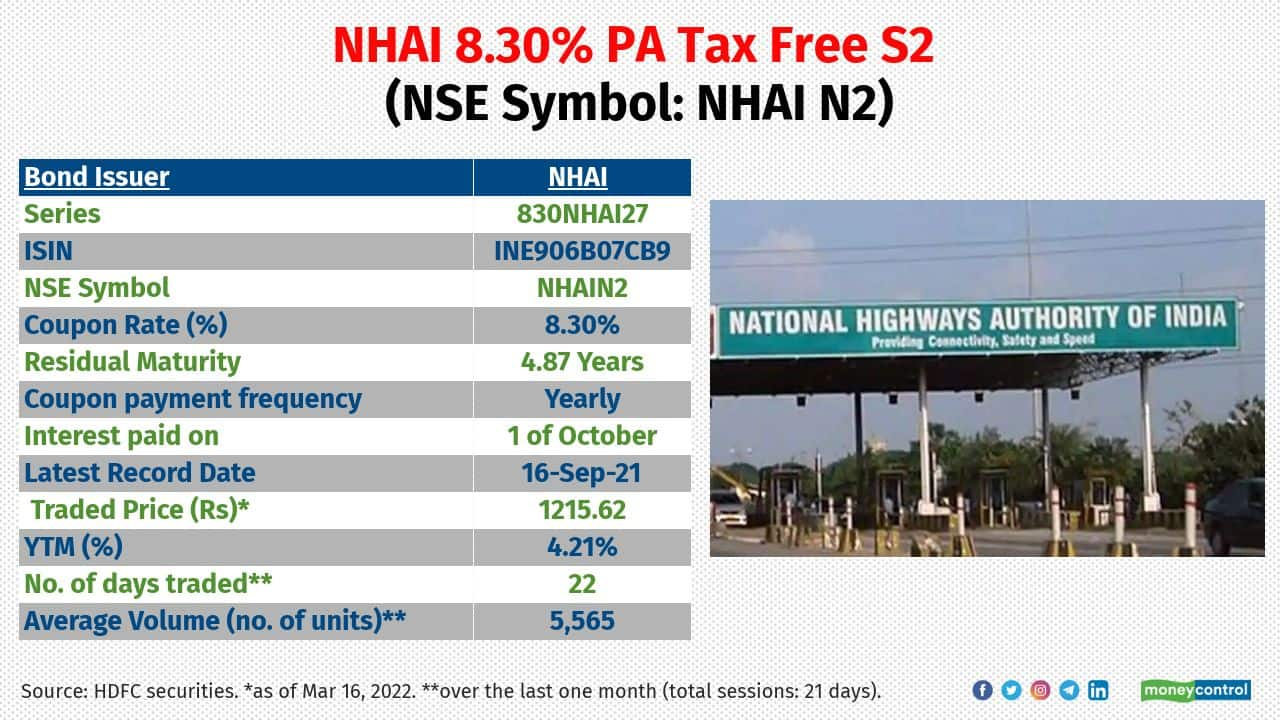

NHAI has strong financial flexibility because of continuous support from Government of India. Unlike the series of bonds mentioned in the above slides, this is the tax-free bond series issued by the NHAI without the step-down clause. In those bonds, if your investment (based on face value) exceeds Rs 10 lakh, then there will be a reduction of 25/30 bps in coupon rate. But in this series (INE906B07CB9), the coupon rate remains same irrespective of any amount invested. The YTM mentioned here is too for the investment made without any limit.

10/10

The interest paid by tax-free bonds are exempt from income tax. Keep in mind that selling tax-free bonds in the secondary market attracts capital gains tax. If you sell them within 12 months from the date of purchase, you will have to pay tax on the gains as per your slab. If you sell after 12 months, tax has to be paid on the gain at flat rate of 10 percent. There is no indexation benefit available. Check with your tax consultant while making investment decision.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!