Top 10 Category III AIFs in 2024; A9 Finsight and Swyom Advisors take the lead

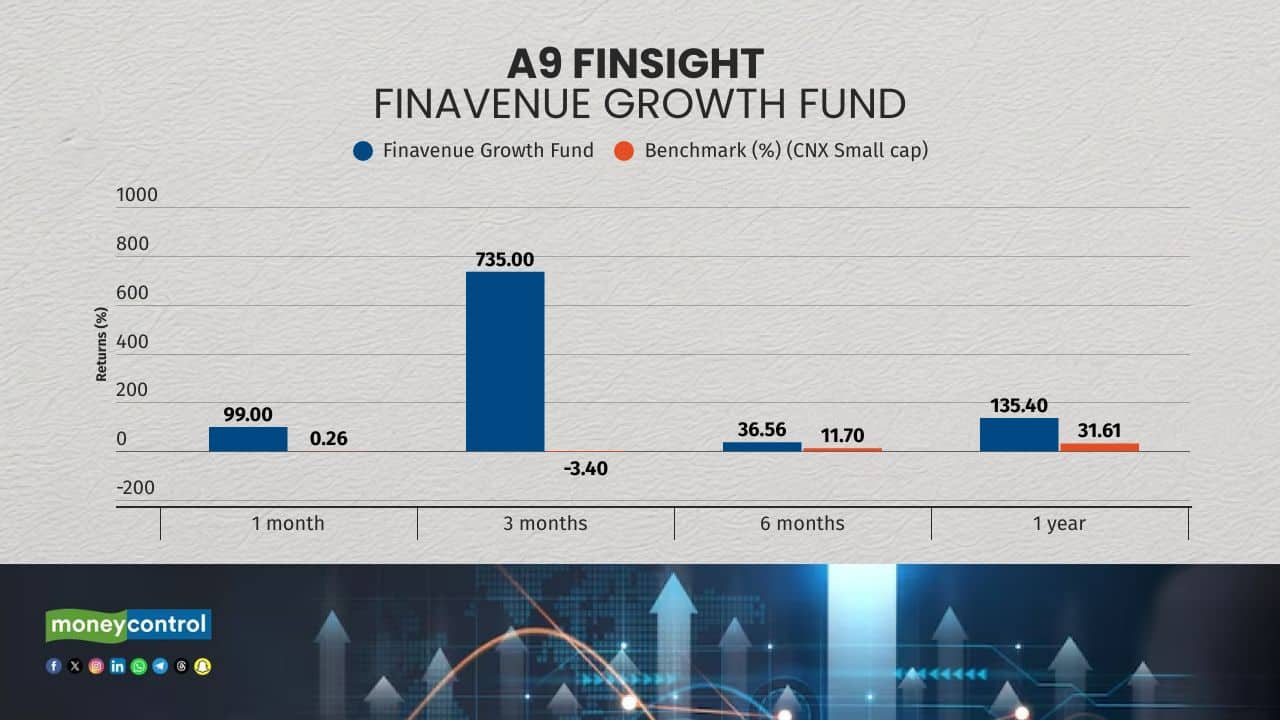

A9 Finsight's Finavenue Growth Fund delivered 135.40% 1-year returns, while Swyom Advisors' India Alpha Fund has generated 58.41% returns over the same period

1/11

The top ten Category III Alternative Investment Funds (AIFs) in 2024 have delivered returns between 135 percent and 40 percent in 2024. Among the top ones are A9 Finsight's Finavenue Growth fund, which has given returns of 135 percent in 2024. It is followed by Swyom Advisors' India Alpha Fund, which delivered returns of 58 percent to investors in the same period.

2/11

1. A9 Finsight Pvt Ltd's Finavenue Growth Fund was launched on July 19, 2023, and is managed by Abhishek Jaiswal. With a focus on identifying and investing in 30-35 high-conviction stocks across market capitalisations, the fund seeks to capitalize on sectors poised for long-term growth driven by macro trends like improving quality of life. Their investment approach emphasises companies with strong competitive advantages and attractive valuation prospects along while taking care of long-term sponsor contributions. Their AUM currently stands at Rs 313 crore.

3/11

2. Swyom India Alpha Fund Ltd, managed by Radha Raman Agarwal Swyom Advisors' leading investment product, Swyom India Alpha Fund, is a Category III Long-Short open-ended fund. It was launched on September 8, 2023 and is a multi-strategy alternative investment scheme. The fund seeks to generate alpha by strategically allocating capital across various asset classes and investment styles, combining value investing principles with the identification and exploitation of active investment opportunities.

4/11

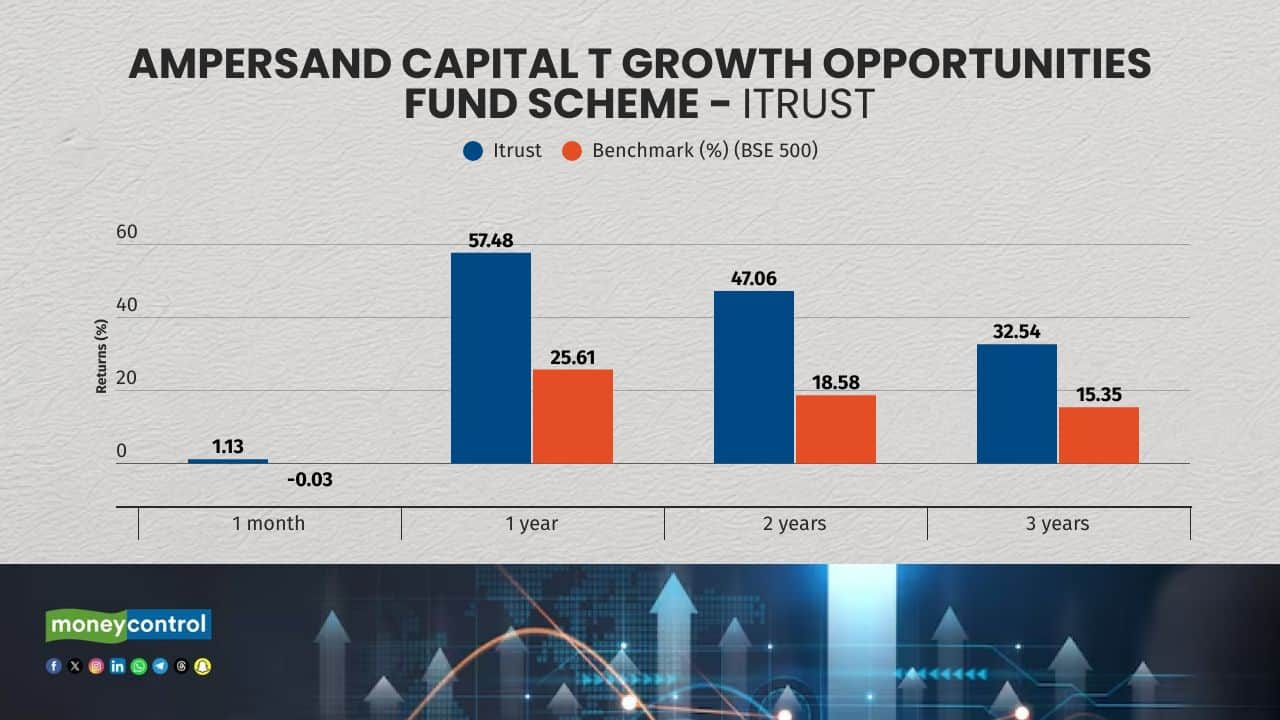

3. Ampersand Capital Trust: Growth Opportunities Fund Scheme - I, led by Arun Subramanyam since September 24, 2017, with an AUM of Rs 837.20 crore, seeks to deliver outsized returns for investors. The fund focuses on identifying high-growth companies across sectors, leveraging its research and a concentrated portfolio approach (30-35 stocks) to capture long-term opportunities. The fund prioritises businesses with strong competitive advantages and attractive valuations, underpinned by significant sponsor support.

5/11

4. Carnelian Structural Shift Fund, launched in April 14, 2022, is a long-only, multi-cap thematic fund managed by Manoj Bahety. The fund focuses on capturing growth opportunities arising from two key structural shifts: the resurgence of Indian manufacturing and the rapid evolution of Indian technology. The fund invests in both listed and unlisted companies across these sectors.

6/11

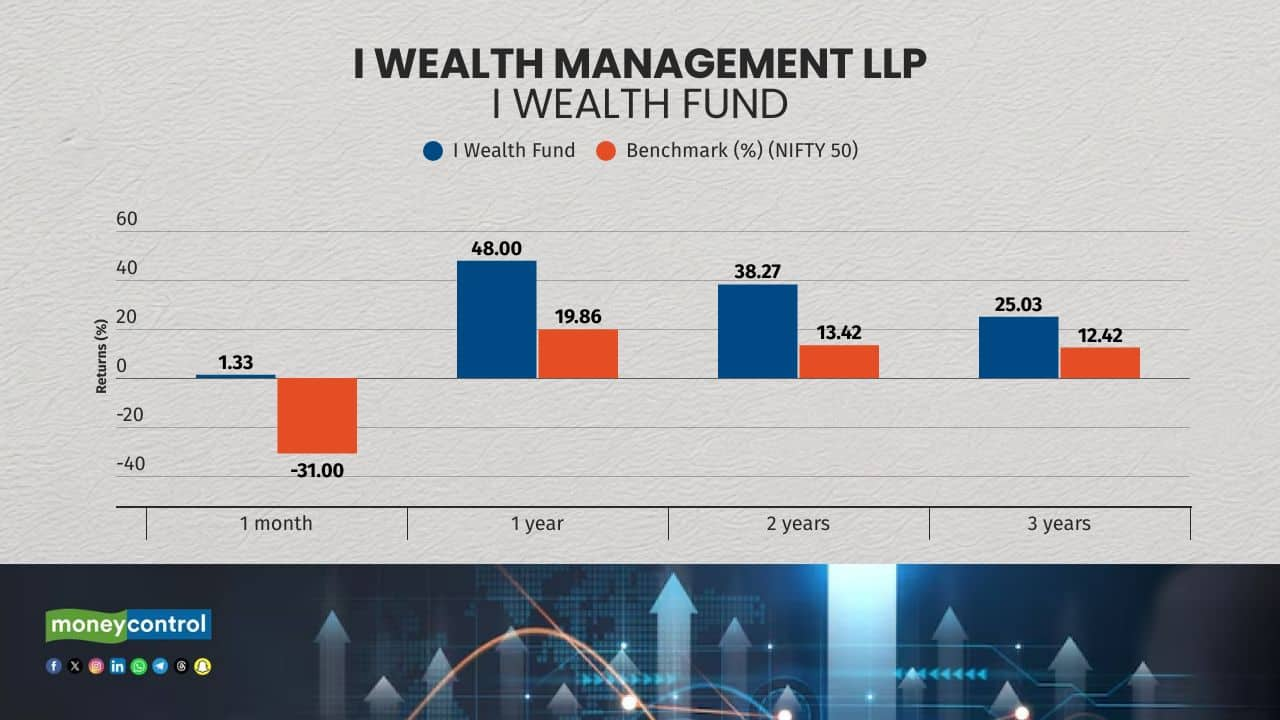

5. i-Wealth Fund, launched in 2018, is an absolute return-oriented fund managed by Bharat Jain. The fund aims to generate capital appreciation while prioritizing capital preservation. The portfolio, typically comprising 20-25 stocks, employs an active cash management strategy, utilizing proprietary models to identify attractive risk-adjusted opportunities.

7/11

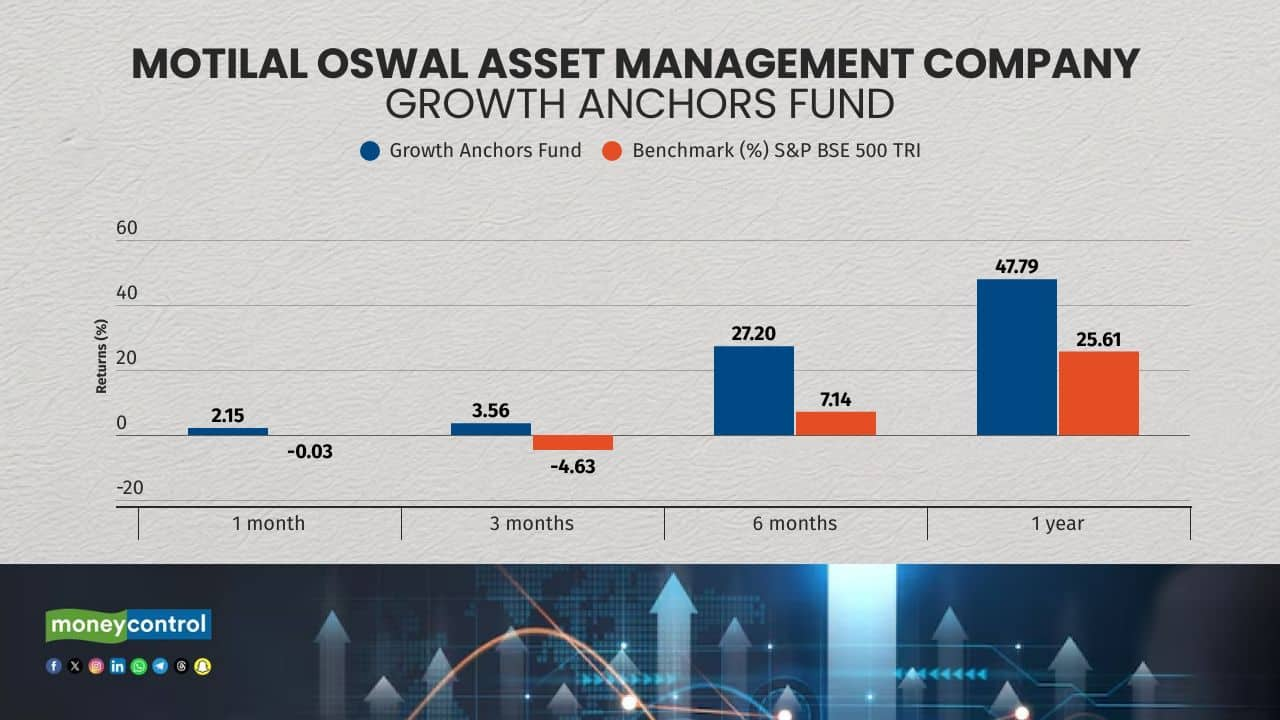

6. Motilal Oswal Growth Anchors Fund is a Category III, Close Ended AIF, that seeks long-term capital appreciation by investing in equities and equity-related instruments. Managed by Vaibhav Agrawal, the fund focuses on businesses with high-quality management, sustainable and scalable models, and significant promoter/ESOP holdings (over 26 percent). With a sector-agnostic approach, the fund has an AUM of Rs 2,059.53 crore and the flexibility to invest up to 30 percent in unlisted securities. Launched on February 1, 2023, the fund has an indicative tenure of 6 years with a 2-year extension option.

8/11

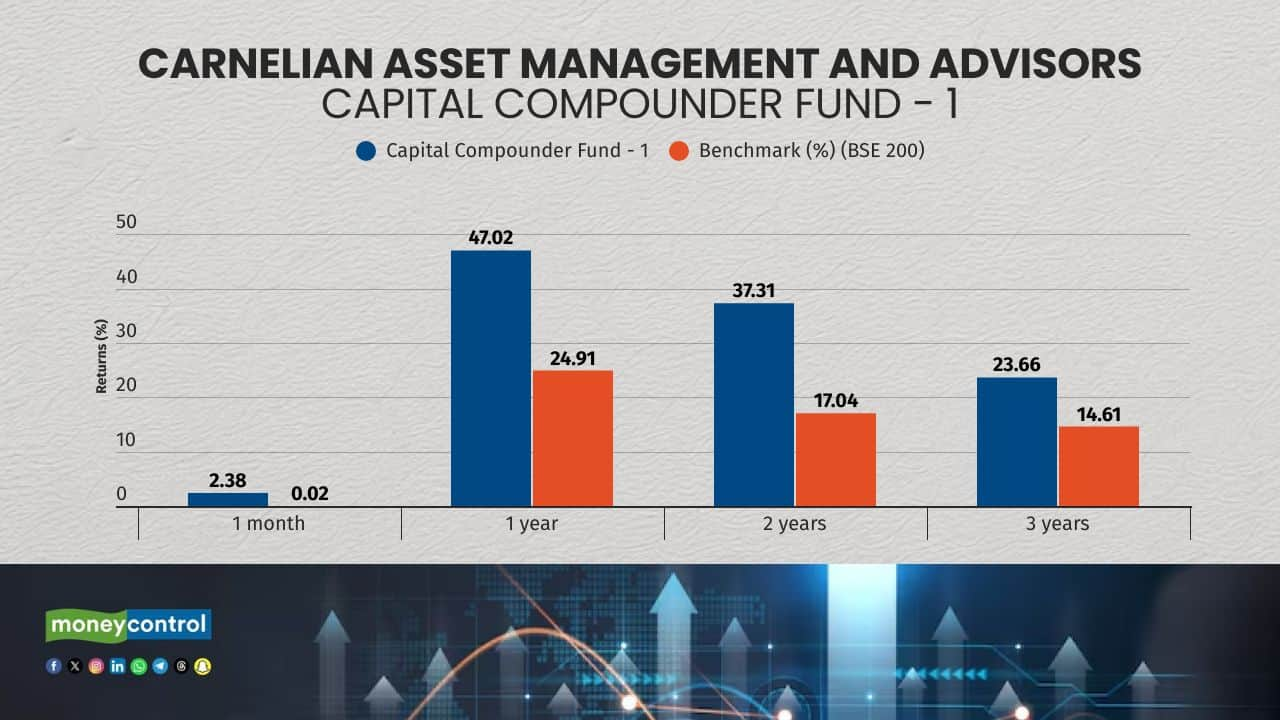

7. Carnelian Capital Compounder Fund-1, a long-only, multi-cap fund managed by Manoj Bahety, was launched in May 31, 2019. The fund aims to generate superior returns across market cycles by investing in businesses with strong fundamentals and growth potential. The fund leverages Carnelian's proprietary MCO (Magic, Compounder, and Opportunistic) framework and CLEAR (Competition, Leadership, Economics, Accounting, and Regulations) risk assessment system to identify and invest in high-conviction opportunities.

9/11

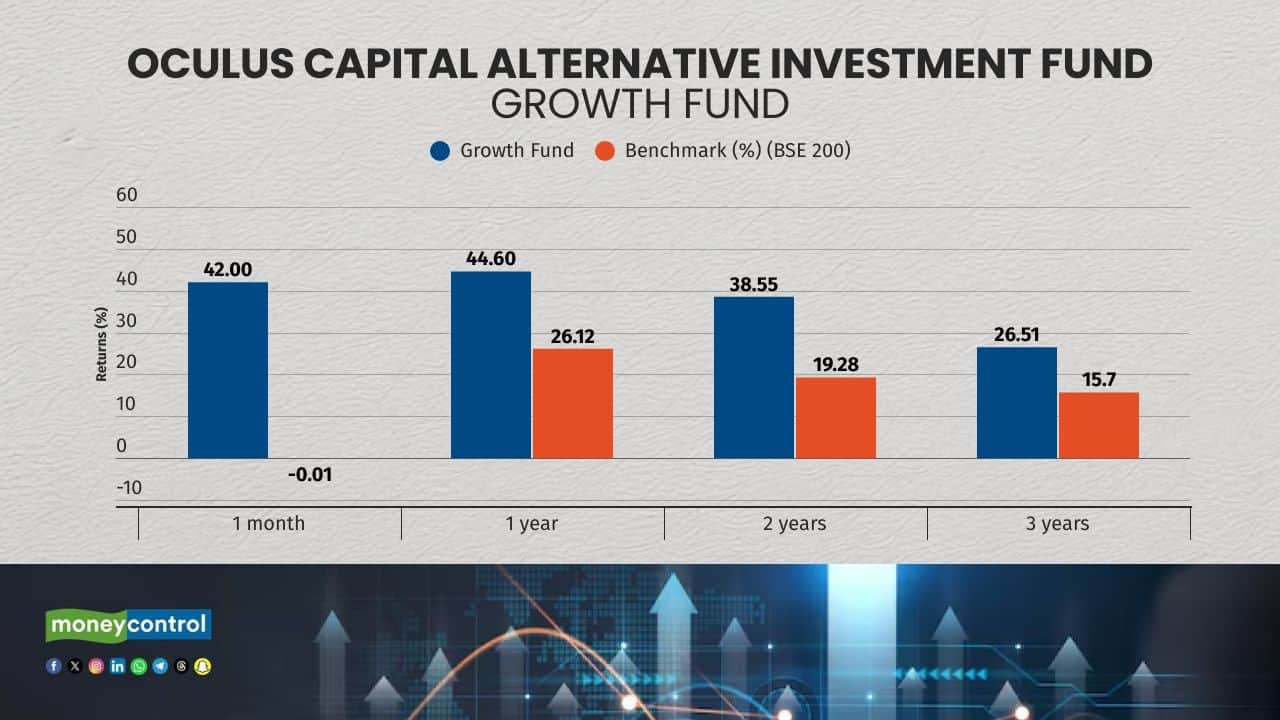

8. Oculus Capital Alternative Investment Fund: Growth Fund, launched in July 1, 2021, is managed by Mayank Bajaj. The firm actively understands new developments such as regulatory changes, emerging technologies, and evolving business dynamics in the economic cycle.

10/11

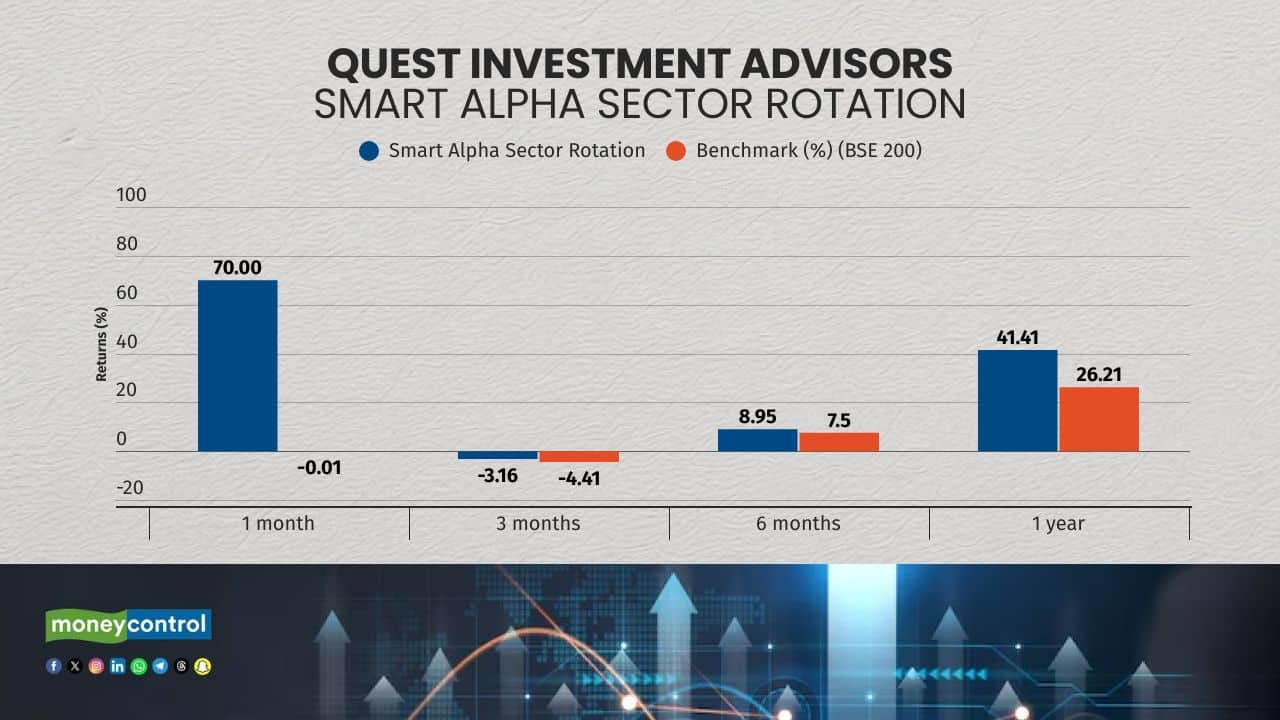

9. Quest Investment Advisors: Smart Alpha Sector Rotation Fund, managed by Aniruddh Sarkar and Rakesh Vyas, was launched on May 10, 2022. The fund employs an active sector rotation strategy, identifying and capitalizing on sector tailwinds and headwinds. The investment approach emphasizes disciplined portfolio management, including valuation awareness, active cash management, and a focus on 20-25 stocks across 3-5 key themes, including 1-2 emerging themes. The fund aims to generate alpha by adapting to changing market dynamics and policy shifts.

11/11

10. Launched on September 10, 2023, the Negan Undiscovered Value Fund is managed by Neil Madan Bahal. With an AUM of Rs 448.52 crore, it focuses on generating attractive risk-adjusted returns by identifying undervalued investment opportunities. The fund's strategy encompasses Special Situation Investments, Pre-IPOs, Anchor book investments, and value investing, leveraging catalysts such as corporate actions, long-term industry trends, and regulatory changes.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!