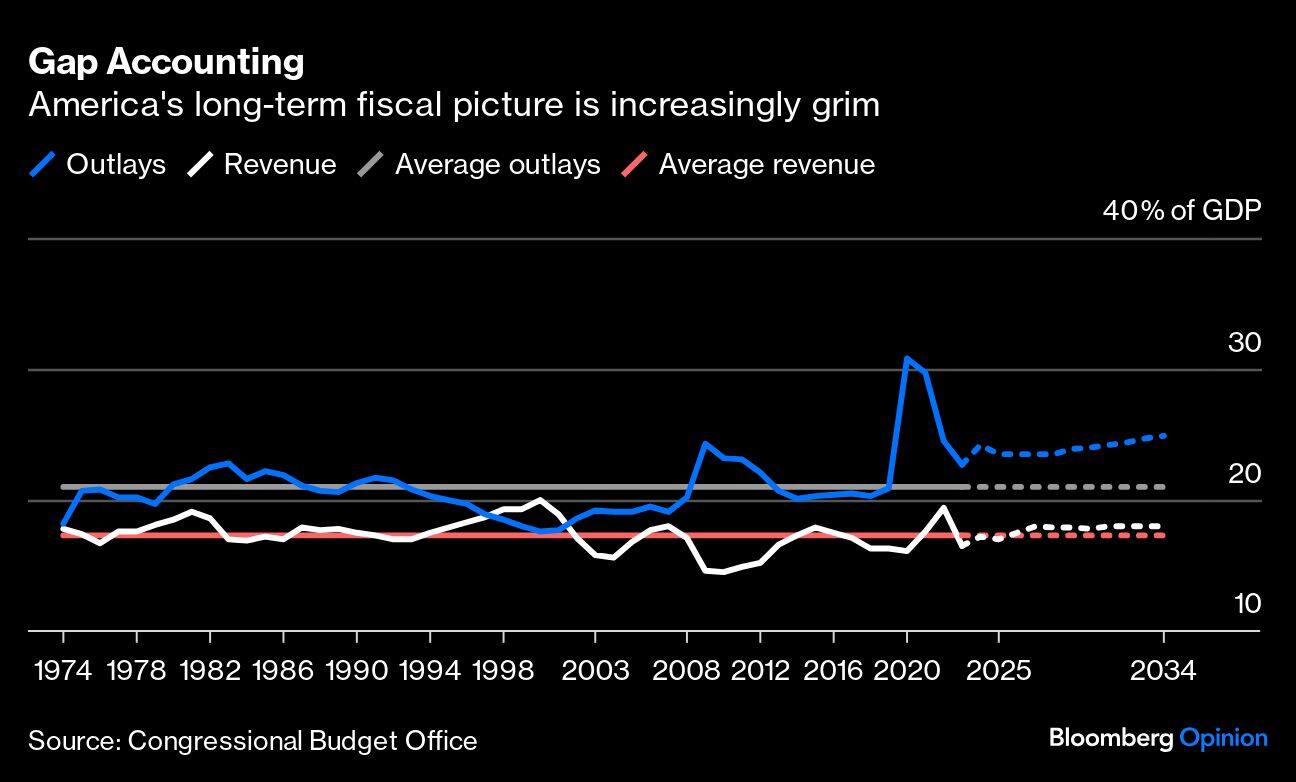

Somewhat lost in this turbulent election season, America’s bipartisan experiment in budgetary fantasy is racing ahead. Both 2024 presidential candidates seem content to carry on with the charade.

Restraint is not among Donald Trump’s virtues, and when it came to government spending, he never even tried. After pledging to eliminate the national debt over eight years, he instead bargained and blundered his way into an additional $8.4 trillion in net 10-year borrowing. By the end of his term, projected deficits (over the decade from 2017) had increased by $3.9 trillion, debt exceeded 100% of gross domestic product for the first time since World War II, and the trust funds that support Medicare and Social Security were speeding toward insolvency.

A second term would be unlikely to improve on this picture. One of Trump’s few concrete policy proposals would be to extend the expiring provisions of the Tax Cuts and Jobs Act of 2017. That would cost more than $5 trillion over 10 years and increase debt by 14% of GDP. Reducing the corporate rate to 20% from 21% (as Trump recently mooted) would add billions more. Then there’s his proposed “Trump middle-class, upper-class, lower-class, business-class, big tax cut,” cost unknowable.

Lately, Trump has also toyed with the idea of replacing the income tax with revenue from much higher tariffs. This would be a quintuply bad idea. It would (like all such barriers) raise consumer prices, invite retaliation, reduce employment and impede economic growth. But it would also worsen the fiscal picture egregiously: Even under hugely favorable assumptions, tariff income could make up only about 40% of current income-tax revenue, with the rest presumably made up by borrowing. Scaling the tax cut to match tariff income might mitigate this effect, but the disproportionate impact on low-income households and needless economic disruption would remain.

In fairness, Trump has hinted that he might consider entitlement reform. (“There’s tremendous amounts of things and numbers of things you can do.”) But he has also said, in a campaign video, “Under no circumstances should Republicans vote to cut a single penny from Medicare or Social Security.” A serious effort to make either program financially sound will require the kind of foresight, prudence and political shrewdness that was nowhere in evidence during Trump’s first term. Add in a Republican-backed plan to boost defense spending, likely to cost $6 trillion, and a second term looks potentially ruinous.

President Joe Biden — who insists he is remaining in the race — hasn’t fared much better on this score. He reached a $1.5 trillion deficit-reduction deal with Republicans last year, and he has talked about raising taxes on businesses and the wealthy. Yet his plans also add costly new credits and complexities, and what savings they might accrue could well be negated by his pledge to extend the 2017 tax cuts for households making less than $400,000 a year, a policy that would imply some $1.4 trillion in additional borrowing. All told, these measures simply aren’t commensurate to the task.

The splurge the US undertook during the pandemic was mostly justified. It’s one reason the economy is doing as well as it is. Problem is, such profligacy has become the new normal. As a recent report from the Congressional Budget Office shows, the nation’s debt will soon exceed 106% of GDP, yet another record. Neither candidate seems willing to state the obvious: America’s current fiscal path leads to disaster.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.