Some 30 years ago, the “office lady,” with her Burberry scarf and Gucci bag, was a regular sight on the Japanese subway system. Commuting to work, she epitomized Asia’s leading luxury market, making up about one-third of global top-end sales.

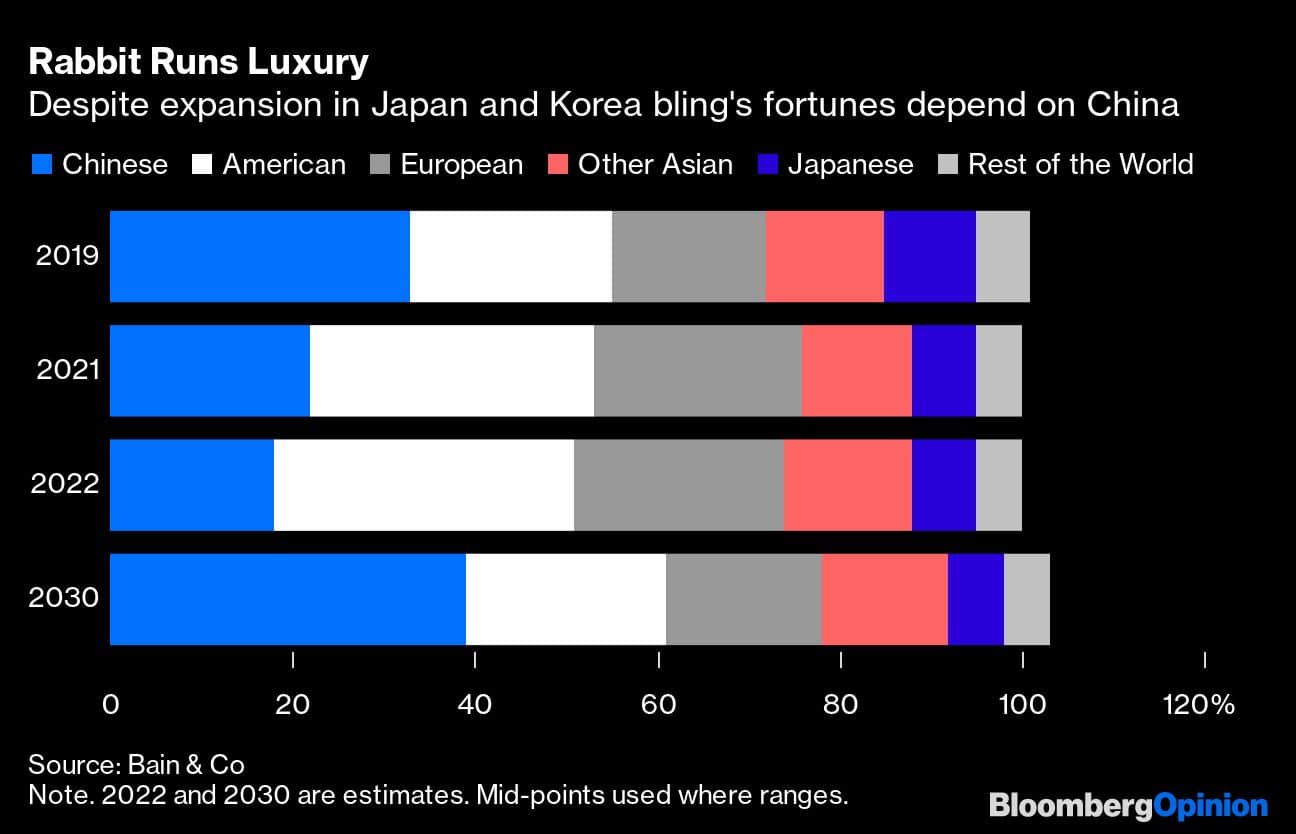

Fast forward to 2019, and it was China reigning supreme for the bling behemoths, with the country’s consumers accounting for 33% of the luxury goods market, according to Bain & Co. Japanese shoppers were just 10%.

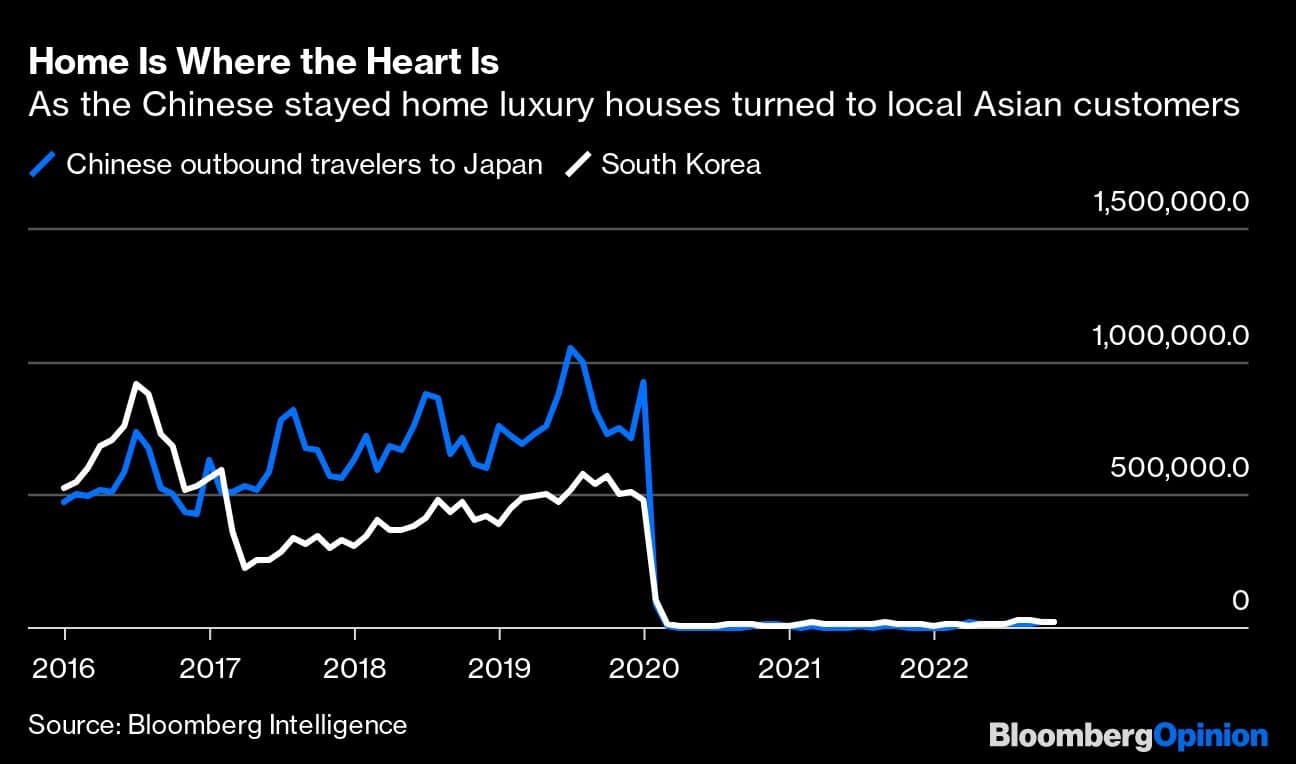

The pandemic upended things once more. The reliable and deep-pocketed Chinese buyer all but disappeared, while Americans have filled the void for the past two years. But signs suggest their appetite is cooling too.

To hedge against uncertainty in China and buy time to understand how consumers have evolved, luxury giants have once again turned to Japan and South Korea.

High-end sellers are wise to broaden their horizons. Even with China’s sudden reopening, the market is set to remain volatile: Other countries have issued visa restrictions on Chinese travellers, and luxury executives are still reading the tea leaves around spending habits and the government’s drive for “common prosperity.”

As Chinese citizens begin traveling overseas again, Japan will top their list. Among the considerations when choosing a destination, safety and hygiene (a product of post-COVID paranoia) remain the most important, closely followed by where to get the best deal on a Bottega Veneta clutch or Cartier watch. Japan fits the bill on both counts with citizens wearing masks and following pandemic policies, and a weak yen making luxury cheaper than at home and elsewhere.

So European luxury groups are ramping up initiatives in the country.

Louis Vuitton is going big on its collaboration with Japanese artist Yayoi Kusama and launched products first in Japan and China before rolling them out worldwide. Parent LVMH Moet Hennessy Louis Vuitton SE has also brought its “Christian Dior: Designer of Dreams” exhibition to Tokyo, with many new exhibits. In recent years, the firm’s brands have also worked with Japanese designer Nigo (now creative director of its Kenzo house) and brand Sacai.

The conglomerate is not alone. Chanel SA will repeat its Metiers d’Art fashion show — first staged in Dakar, Senegal, in early December — in Tokyo in June. Kering SA, meanwhile, has embarked on a range of marketing initiatives after having opened stores apace across Asia over the past few years, including new Gucci flagships in Tokyo and Seoul. Both cities also boast its “Gucci Osteria by Massimo Bottura” restaurant concept.

Burberry Group Plc is putting particular emphasis on Japan. Until 2015, its business in the country was operated by Sanyo Shokai Ltd. It’s seizing the opportunity to develop its relatively small presence, including opening new stores and emphasizing its British heritage.

Across the luxury landscape, these efforts are resonating with Japanese buyers. As the first Asian country to embrace European fashion houses, consumers are well-versed in top-end goods. But the dominant mega-brands — Louis Vuitton, Chanel and Hermes — will need to lure younger buyers who are increasingly veering toward more cutting-edge names.

With Japan’s relatively late exit from COVID curbs, there’s still room to run. Cie Financiere Richemont SA said in November that the Japanese market was enjoying above-normal growth rates. H. Moser & Cie, the independent family-owned Swiss watchmaker, has also seen an increase in demand in Japan since restrictions eased.

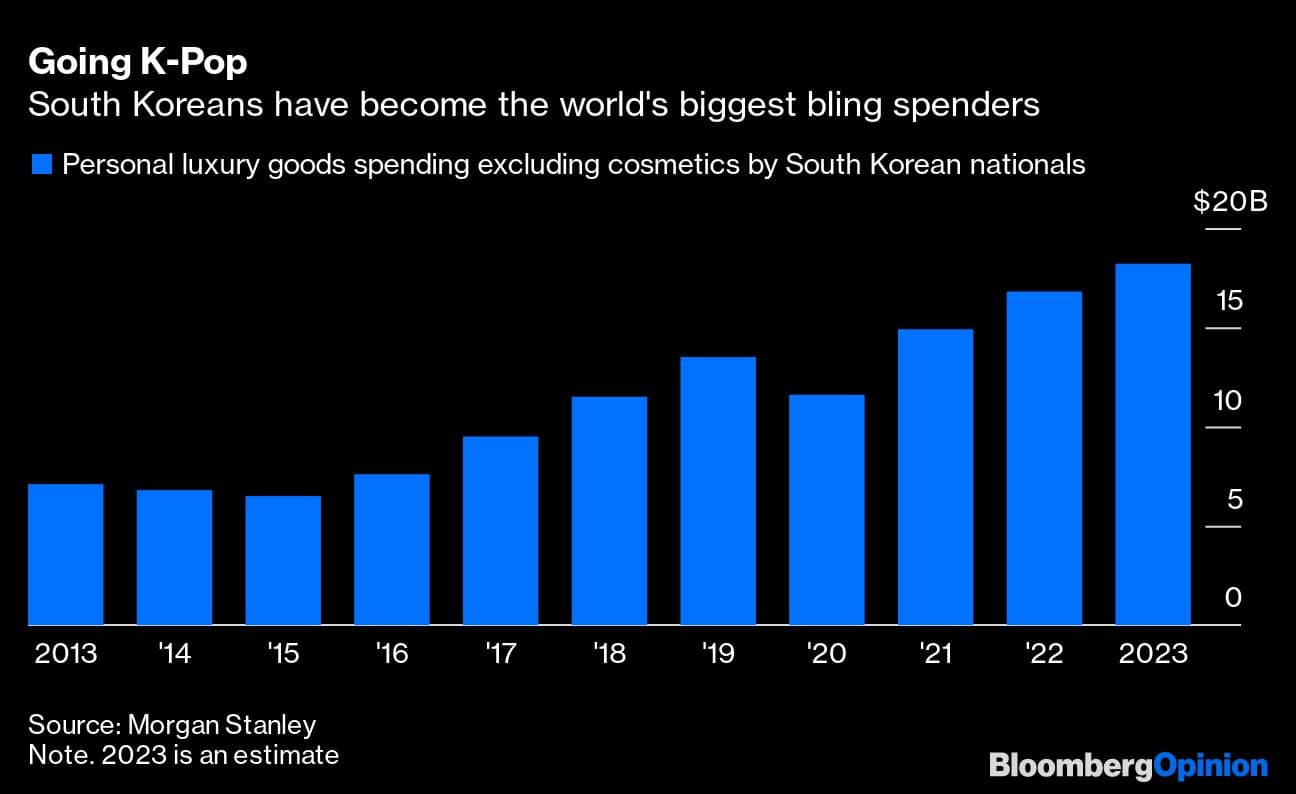

Meanwhile, South Korean consumers are Asia’s trendsetters. They prioritize appearance and financial success, according to analysts at Morgan Stanley, two elements that encourage carrying the latest bags and wearing this season’s edgiest designs. The country now leads on luxury spending, which grew 24% last year to $325 per capita, according to Morgan Stanley. That’s compared to $55 per capita in China and $280 in the US.

Prior to the pandemic, South Korea was a magnet for Chinese tourists, with a big duty-free business. Since then, brands have pivoted their marketing efforts to local shoppers. This appears to be working: South Korea was the fastest-growing luxury market between 2019 and 2022, eclipsing even the US, according to analysts at Citigroup Inc.

Still, the industry’s fortunes remain inextricably linked with China. As the Lunar New Year arrives, brands have been marketing their Year of the Rabbit capsules in the country to tap into the 6 trillion yuan ($895 billion) of household savings built up during the pandemic. Surveys show consumers want to spend on clothing, footwear and cosmetics along with healthcare. Luxury goods are a top item, too.

The key question on executives’ minds is, will they get the big, first-quarter Chinese New Year earnings pop? If not, will their investments elsewhere in Asia help offset the luxury malaise in China?

The maisons will need to decipher how consumer psychology has evolved over COVID, especially as the property market, long a store of Chinese wealth, attempts a comeback. They’ll need to pay attention to whether shoppers buy more understated goods given President Xi Jinping’s Common Prosperity drive that’s still apparent in reopening rhetoric. Lifestyle and outlook changes will affect whether the Chinese shopper turns to Gucci boots or Arc’teryx and Lululemon Athletica Inc. gear.

But if reopening is accompanied by both unrestricted travel within Asia and a return of revenge spending, then luxury’s investments in Japan and Korea should pay off.

Andrea Felsted is a Bloomberg Opinion columnist covering consumer goods and the retail industry.Anjani Trivedi is a Bloomberg Opinion columnist. She covers industrials including policies and firms in the machinery, automobile, electric vehicle and battery sectors across Asia Pacific.Views are personal and do not represent the stand of this publication.Credit: BloombergDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.