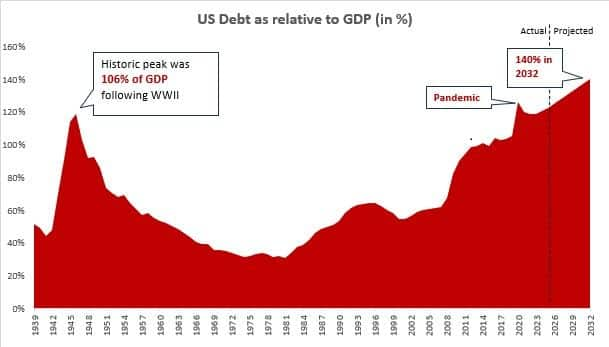

Per the US Office of Management and Budget, the country's national debt has soared to a jaw-dropping $36 trillion, or 124 percent of GDP, a level unseen since the aftermath of World War II. America is now paying $1 trillion every year – more than what it spends on defence – just as interest on that debt. This isn’t just a financial crisis. It’s a ticking global time bomb. And yes, India lies well within the blast radius.

Debt spiral

Interest rates are rising sharply as the Fed tries to choke inflation. But rising rates crush bond demand. Giants like China and Japan are dumping US bonds, which forces America to borrow at higher rates. This leads to more debt and even higher interest payments. It’s a vicious cycle.

This isn’t just bad math, it’s bad policy. Decades of unchecked spending, tax cuts, and populist politics have bloated the US balance sheet. President Donald Trump's “big, beautiful (tax cut) bill” has become a costly affair. Now, the US Treasury's tightrope walk between growth and inflation has become a whole lot tougher and its illusion of control is fading, replaced by the cold arithmetic of compounding chaos. Each misstep now isn’t a stumble, it’s a crack in the global financial edifice.

The 30-year US Treasury yield has now hit a multi-decade high and every time that happens, we in the emerging markets feel the heat as capital runs straight to the US.

India is wired into the global system through trade, capital flows, and financial sentiment. In 2008, during the 2013 Taper Tantrum, and again in 2022, we saw how quickly FIIs (foreign institutional investors) pull out. When the Dollar strengthens, the Rupee weakens, Indian bond yields rise, and equity markets tremble. Per analytics firm GuruFocus, India’s market cap-to-GDP ratio is flashing amber again.

Yes, our fundamentals are stronger today: we have a disciplined central bank, healthy reserves, and a resilient consumption engine. But we mustn't mistake resilience for immunity.

In 2008, the markets fell off a cliff, then levitated artificially through quantitative easing. But this time, that trick won’t fly. The US doesn’t have the room to print its way out anymore. The monster it fed has grown teeth.

If you’re an investor, this is not the time to gamble. It is time to reposition.

Here's what smart money is doing:

• Investing in gold and silver — silver especially remains undervalued and historically outperforms in hard money regimes.

• Rotating towards high-quality largecaps with pricing power and clean balance sheets.

• Using dynamic asset allocation funds to manage risk with intelligence, not impulse.

• And most importantly: cutting leverage.

Just as important as what you buy is what you avoid:

> Chasing high-beta, speculative stocks — they crash first when markets panic.

> Overexposure to smallcaps or leveraged positions — they magnify risk.

> Blindly following momentum without fundamentals — that’s not strategy, that’s gambling.

The fuse is lit

Debt is a silent thief, stealing from the future to pay for the present. And the empire of debt is collapsing – not today, not tomorrow, but the fuse is definitely burning.

Through decades of market cycles, one has learnt that markets don’t punish those who are cautious. They punish those who are late. Timing is everything. If you wait for the headlines, it’s already too late. Smart money moves early. It doesn’t panic, it prepares.

So, stay ahead, stay sharp, and most importantly, stay invested, not exposed.

The author is the Founder and CEO, Samco.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.