Dark clouds have gathered over the global economy. The inflation rate in the United States has surged to 9.1 percent, the highest in 41 years, as a result of the COVID-19 period fiscal stimulus as well as supply chain problems caused by the Ukraine war, after effects of the pandemic, and the recent lockdowns in China.

As the US Fed continues to tighten monetary policy, there are fears of a recession in the US. The US treasury yield-curve has seen its steepest inversion in 12 years, generally considered as a harbinger of recession. The head of the IMF recently warned of the rising risk of global recession in the next 12 months. Price of crude oil has fallen below $100 per barrel, and multinational corporate giants have started cutting jobs. As if the global news was not bad enough, closer home the Sri Lankan economy collapsed, triggering fears of will it be India’s turn next?

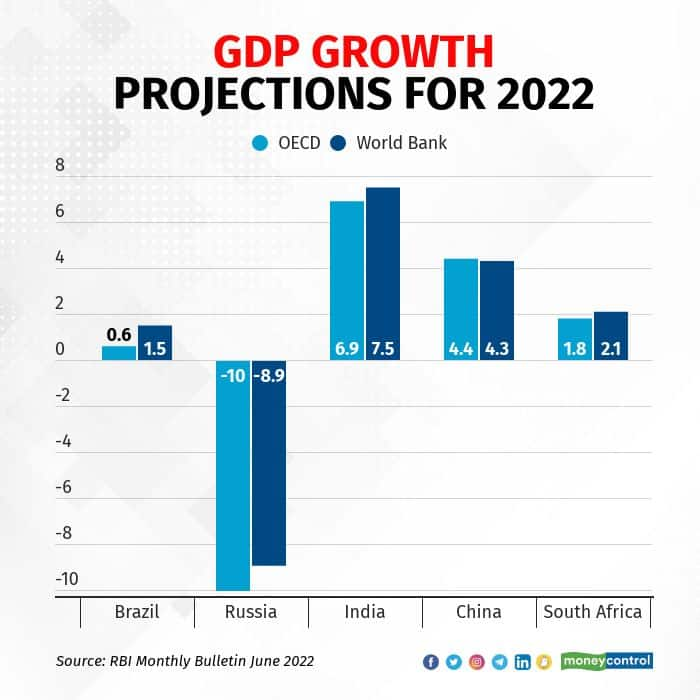

India is not insulated from the global upheavals. Growth projections have been revised downwards in the last few months as exports will take a hit. However, the status of economic stability parameters is encouraging, and the strong fundamentals of the economy can de-risk it from global shocks.

GDP growth projections for 2022 are still the highest for India (table above) compared to its emerging market peers. High frequency indicators such as passenger car sales, two-wheeler sales, electricity production, and bank credit have risen in June for the second month in a row. The unemployment rate in June (7.8 percent as per CMIE) is higher than in May, but a lot lower than it was in February (8.11 percent).

While net foreign direct investment (FDI) continues to rise (the latest figure in April was $5.03 billion, up from $2.74 billion in March), foreign portfolio investors have been pulling out. The capital outflow combined with a return of current account deficit (CAD) has led to a slight deterioration in the official forex reserves causing concerns. Here comes the role of the Reserve Bank of India (RBI).

The RBI has raised its key policy rate (the repo rate) twice in the last three months in a late bid to fight inflation. The rising trend in headline inflation ended after this monetary tightening, also helped by government policies such as a cut in excise duty on petrol and diesel, export restrictions on wheat and sugar, and waiver of import duty on raw materials for steel production. It is expected that the RBI will further increase the repo rate to tame inflation, and keep up with the Fed’s expected rate hikes. This will dampen growth momentum, but is necessary for economic stability.

Portfolio investment is one of several items on the capital account that contribute to forex flows, hence its outflow can cause the currency to depreciate. This component known as ‘hot money’ is usually volatile, and moves in the direction of higher risk-adjusted interest rates (currently US).

But the latest quarterly balance of payments (BOP) position shows that the other items on the capital account provide fair levels of comfort. Although forex reserves decreased by $16 billion in Q1 of FY22 compared to a year ago, the stable components of the BOP have increased. FDI at $13.8 billion was up by 400 percent compared with last year’s corresponding quarter. Remittances at $23.7 billion was up by 13.4 percent from a year ago.

Another reason for forex reserves falling recently is the worsening current account deficit (CAD). India’s CAD increased to $13.4 billion (1.5 percent of GDP) in Q4:2021-22 compared to $8.2 billion a year ago, but was sequentially lower than in the previous quarter. The high CAD is a result of improvement in purchasing power for foreign goods, and a rise in the value of imports on account of higher oil prices. Going forward, as oil prices come down, India will benefit from lower pass-through of oil prices to domestic inflation. Forex reserves will rise on the back of lower CAD and higher foreign investments as FDI continues to be attracted by the opportunities in the Indian economy created by structural reforms.

How serious is the risk of an external debt crisis? Bulk of the country’s short term external debt of $267.7 billion is private, and the government’s share is just $7.7 billion, so it does not reflect a sovereign obligation. The external debt can be comfortably serviced because it does not have to come out of the forex reserves held by the RBI at any point of time. The BOP is a dynamic account where forex keeps flowing in due to exports, foreign investments, and remittances. Therefore, what matters is whether there are enough forex inflows to meet the outflows. Only the mismatch (the overall BOP deficit) needs to be met from the RBI’s forex reserves. The RBI is comfortably placed to do that as the ratio of short-term debt to forex reserves is 20 percent, which is higher than last year’s 17.5 percent, but lower than in each of the previous 10 years during which the average was 25.6 percent.

Among the other sectors of the economy, banking stability has considerably improved with the gross non-performing asset (NPA) ratio falling to 5.9 percent in FY22, the lowest in six years. Corporate profits as a ratio of GDP is at a 10-year high of 4.3 percent in FY22 indicating good health of the formal corporate sector. Government finances remain an area of concern as the fiscal deficit target for FY23 is still quite high at 6.4 percent. But since the deficit is financed primarily through domestic borrowings, the risk of a default of the Sri Lanka kind, does not arise.

Rudra Sensarma is Professor of Economics, Indian Institute of Management Kozhikode. Twitter: @RudraSensarma. Views are personal, and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.