Anubhav Sahu Moneycontrol Research

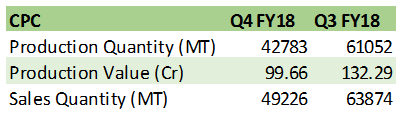

Goa Carbon, the second largest manufacturer of CPC (Calcined petroleum coke) in the country kicked off Q4 earnings for the chemical companies, wherein comfort from the improved product realisations was the key takeaway. However, decline in sales volumes, mainly due to plant shutdowns marred the topline growth numbers, sequentially.

Improvement in pricing more than offset by decline in volumes

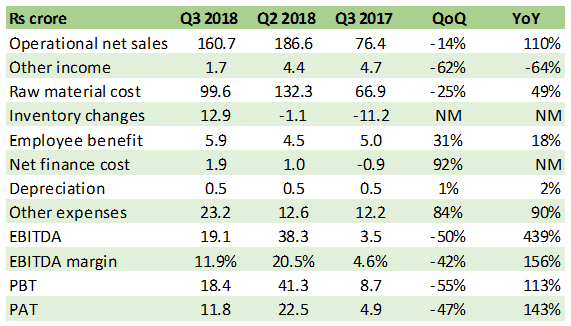

It reported net sales of Rs 161 crore in Q4, FY18 reflecting YoY (year on year) growth of 110%. However, sequentially, topline numbers dropped by 14% on account of plant shutdowns in Goa (37 days) and Paradeep (17 days) facilities resulting in sales volume contracting by 23% QoQ (quarter on quarter). Product pricing realisation, however, continues to remain firm and up about ~10% QoQ. Company’s gross profit had a similar trajectory (-13% QoQ, 133% YoY) where reduction in raw material cost was offset by the higher inventories.

EBITDA numbers slumped by 50% QoQ on account of higher employee cost (+31% QoQ) and other expenses (+84%).

Long-term drivers intact

Strong demand from the aluminum sector and the CPC supply curtailment from China has been the key factor behind the volume pick up and pricing of CPC. The company is currently manufacturing at optimum capacity (Intsalled capacity: 2,40,000 MT) and, hence, expected to gain from elevated pricing.

In fact, China’s supply side reform continues to be key structural factor behind surge in CPC prices. CPC pricing is aided by curtailment of Chinese Aluminum and CPC production (reflected in lowered Chinese exports) and improving global demand for aluminum coupled with higher capacity utilization/restarts in existing aluminum plants in North America.

Higher input cost

Almost in sync with CPC prices, raw material prices (Green coke) have also surged. However, company appears to have been able to pass on the higher input prices to end customers.

Rain industries to benefit

Though Goa Carbon’s operational result were weaker but improved product pricing trend augurs well for our coverage company, Rain Industries, which is also a leading producer for CPC in the country. It’s noteworthy that Rain industries CPC expansion is on track and a plant with capacity of 370 kT (SEZ, Vizag) is expected to commission by Q1 2019.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.