Tough days are ahead for global trade and climate talks. The shock comes from developed countries and affects poor countries the most. The European Parliament approved the introduction of carbon border tax (CBT) on April 18. The CBT will become law after approval from the EU Council next month. It will allow the EU to charge a new tax on the import of steel, aluminium, cement, fertiliser, hydrogen, and electricity from January 1, 2026. However, Indian exporters must share firm-level emission data with the EU from October 1 onwards.

But the EU is not alone in taking such as decision. The UK, Canada, Japan and the US are also bracing up to levy CBT on imports. Most developed countries will introduce some form of CBT between 2026 and 2028.

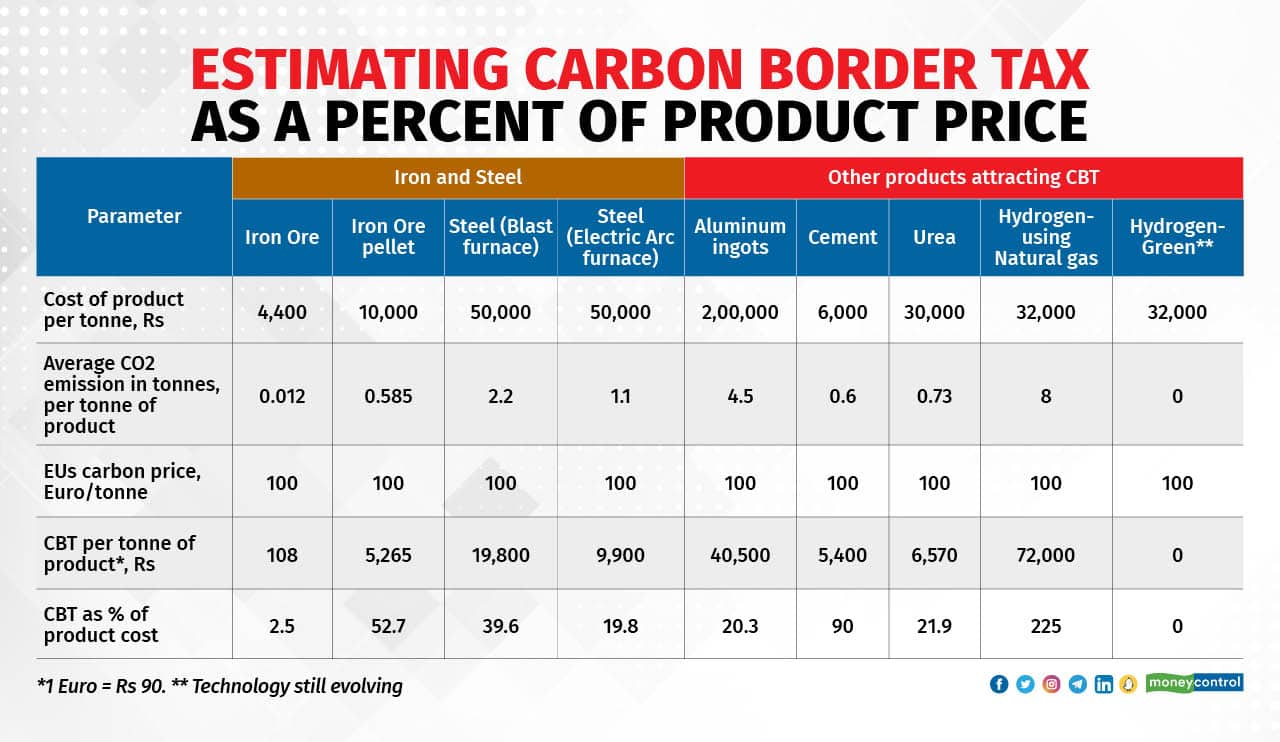

The CBT rates will vary from product and production process. The CBT rates are not fixed, they would be calculated for each consignment. The rates would depend on a product's emission intensity including embedded emissions. These could be different for different manufacturing units spread worldwide. For example, the CBT for cement could be 90 percent of the product value. For the steel made using a blast furnace, the rate may be about 20 percent of the product cost. The average rate will be 20-35 percent of the product value. The following table gives a product-wise estimate of CBT.

Targeting Emission Reduction

The EU seeks to achieve 55 percent lower carbon emissions by 2030 compared to 1990 levels. It wants to be carbon-neutral by 2050. It set up an Emissions Trading System (EU-ETS) in 2005 to achieve its climate goals. The EU-ETS monitors emissions from over 10,000 power stations, oil refineries, plants manufacturing iron, steel, aluminium, cement, paper and glass, and civil aviation.

The ETS system operates through European Emission Allowance (EUA). Call it a license or permit that allows one metric tonne of CO2 emission during a specific period of time. The EU-ETS sets a cap on the quantity of greenhouse gas emissions (mainly carbon dioxide) each installation can release. Each participating firm gets a limited number of annual EUAs. At the end of each compliance cycle, all EU-ETS participants must surrender enough EUAs to cover all their emissions of that cycle. The EU-ETS system reduces cap gradually to reduce emissions. Businesses are expected to achieve lower emissions by investing in better technologies, fossil fuel alternatives and energy efficiency. Thus, the EU-ETS is a cap-and-trade system that uses market forces to reduce emissions. The system allows the market to determine a carbon price, and that price drives investment decisions and spurs market innovation.

But EU-ETS allowed the most polluting sectors like steel or aluminium a free run by giving them free emissions allowances to cover all their emissions. This was done to prevent them from relocating to cheaper destinations like China or India. The phenomenon of shifting polluting sector firms from high-cost countries to low-cost countries is termed carbon leakage. Carbon leakage occurs when firms move production to countries with less stringent climate policies. Rising EU carbon prices (from 30 euros per tonne of CO2 in December 2020 to 100 euros in February 2023) make carbon leakage very likely. To reach its climate goals, the EU has now decided to gradually phase out the free allowances from most polluting sectors and simultaneously introduce CBT to prevent the relocation of industries. The CBT will apply only to a proportion of production that does not benefit from ETS-free allowances.

Trade Disruptions

As developed countries account for over half the world trade, CBT will cause significant trade disruption, weaken the World Trade Organization (WTO) and render free trade agreement (FTA) obligations and ongoing negotiations ineffective. More than 60 percent of imports enter developed countries at zero duty, and their average tariffs are less than three percent. The new 20-35 percent tariffs with the introduction of CBT will change the character of their trade regime. Exports from developing countries will suffer the most. The EU will initially impose CBT on steel, aluminium, cement, fertiliser, hydrogen, and electricity. But the tax will be extended to cover all products by 2034.

The carbon border tax regime places onerous data requirements on trading partners. Every small and big unit intending to export to the EU must capture the emission details at a granular level and share these with its EU counterpart importers. The EU-based importer will calculate the total emission of imported products and buy carbon certificates from EU authorities. The current trading rate at EU Emission Trading System is 100 euros per tonne of carbon dioxide emitted. If the data submitted is not considered satisfactory by the EU authorities, they will charge the highest default tax rate. This will assume product emissions to be the worst 10 percent of European companies.

The CBT will make FTAs with developed countries one-sided. As India negotiates FTAs with the UK, EU and Canada, it must seek clarification and the tax should be the top agenda for any discussions.

Setback For Climate Commitments

At the 15th Conference of Parties (COP15) of the United Nations Framework Convention on Climate Change (UNFCC) in Copenhagen in 2009, developed countries committed to spending $100 billion annually by 2020 to help developing countries decarbonise. This money reflected the responsibility of developed countries to help the poor countries that emit little. After all, developed countries contributed to 89 percent of all cumulative emissions resulting in global warming. The CBT turns this logic on its head - developed countries will earn money by taxing ‘dirty’ imports from poor countries. They need these products, so there are no bans but taxes.

While the US with its hard power uses technology and military to expand its influence, the EU, lacking in both hard power and tech clout is working hard to fancy itself as a green warrior. The CBT will invite retaliation, and create a trade war-like situation. It will harm the progress achieved made through Paris Agreement.

Ajay Srivastava is founder, Global Trade Research Initiative. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.