Ruchi Agrawal

Moneycontrol Research

Amid several challenges such as rising crude prices, uncertainty on revenue collections post GST, upcoming elections, desire to revive the GDP growth and an endeavor to double farm incomes, the government presented a moderately balanced budget. The focused budgetary measures directed at rural India aim to realize the 2022 goal, and give the desired push in an election year –thereby killing two birds in one shot.

In line with our expectation and views, the budget focused on addressing the post-harvest issue to provide relief and bargaining power to the farmer, improve farm incomes and rejuvenate rural demand. Though a lot would depend on the implementation of the schemes, the current allocation indicate a boost to rural incomes which would ripple through to farm inputs and rural consumption.

Background

Despite an improvement in production, income in the hands of the farmers has remained substantially subdued over the past decades. The budget introduced several measure focused on improving the income and demand in rural India which we believe would benefit several companies.

Major announcements aiming towards Agricultural reforms

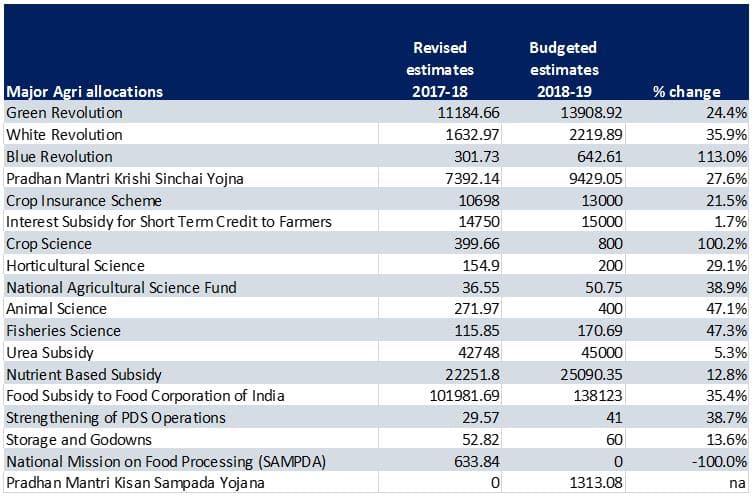

Linking MSP to production cost – Finance Minister (FM) announced 1.5x input cost MSP (Minimum Support Prices) prices for Kharif crop to farmers. Given that many product prices have been forced below MSP in recent times, the budget reiterates the need for effective implementation of MSP and directed Niti Aayog to introduce a mechanism to ensure farmers get adequate price for their produce. The budget has enhanced the food subsidy to FCI by almost 35 percent.

Agri Market Development – The government announced full implementation of eNAM system (online agriculture marketplace) by March 2018, which would empower the farmers with ample bargaining power to fetch justified prices. In order to facilitate the small farmer’s access to these online platforms the government has announced plans and allocated Rs 2000 crore to upgrade rural haats or Gramin Agricultural Markets which would be linked to eNAM.

Crop insurance – The 21 percent increased allocation towards Crop insurance schemes, at Rs 13000 crores, will help in stabilizing and stabilizing farmer incomes and protecting farmers from anomalies of weather, crop damage and market dynamics.

Irrigation reforms - The government has allocated Rs 2600 crore towards irrigation reforms and announced incentives for rapid development and penetrations of farm irrigations systems. This would help to reduce dependency on weather and monsoons.

Institutional credit to farmers –The allocation for rural institutional credit has been enhanced to Rs 11 lakh crores which would increase the volume and penetration of institutional credit. Moreover, the budget has suggested suitable mechanism to enable access of lessee cultivators to credit without compromising the rights of the land owners.

Push for allied activities and value added products – The budget emphasized the need to improve farm income by incentivizing allied farm activities and rural non farming incomes, a move we had reiterated time and again. Separate provisions have been announced for the development of aquaculture and animal husbandry with increasing the allocation to these segments.

Push to Food processing – The budget has doubled the allocation under the Krishi Sampada Yojana in order to push the Food processing industry which would eventually be the major off takers of farm produce.

Increasing the subsidy for Fertilizers – The budget has substantially enhanced the amount allocated towards fertilizer subsidies, both urea and nutrient bases subsidies by almost 8 percent to Rs 70000 crore, which would provide relief to Urea and Non urea fertilizer companies. Moreover this would also help lubricate the pan India DBT implementation.

Liberalization of Agri exports - FM has announced the liberalization of the Agri export policy and enhancement of the testing facilities for exports. This would help in boosting the exports to intended potential and improve incomes for farmers.

Deduction to farm producer companies - The budget has proposed to extend the benefit of 100 percent tax deduction on profits to Farm producer Companies with net turnover below Rs 100 crores. This move would help promote small Agri companies and enhance rural incomes.

Trading of agricultural commodity derivatives – The budget amends the provisions of commodity transaction tax for derivative transactions on agricultural commodity and now defines them as non-speculative transaction income. This would boost agri-commodity transactions in the derivative market.

Outlook

Overall we see the budget to be a balance between fiscal and economic prudence and populism and we believe that Agri reforms introduced will work towards improvement of rural incomes. Companies in the Agri input, seeds, crop protection, Agri feed, logistics, cold storages, food processing, Aqua culture and Agri equipment segment stand to benefit directly in the near term.

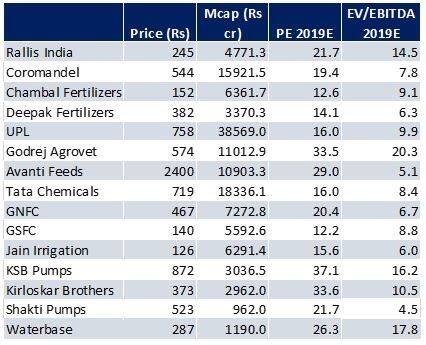

Enhanced farm incomes would improve the ability of farmers to spend towards farm inputs which will be beneficial for companies like UPL, Coromandel International, Rallis India, Chambal Fertilizers, Godrej Agrovet, Deepak Fertilizers, GNFC, GSFC and Tata Chemicals. Emphasis on irrigation and reforms would boost companies like Jain Irrigations, Kirloskar Brother, KSB pumps, Shakti pump. Increased allocation for allied farm activities, animal husbandry and aquaculture would boost companies like Avanti feeds, Godrej Agrovet, Waterbase and Apex frozen foods.

For more research articles, visit our Moneycontrol Research Page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.