Jitendra Kumar Gupta

Moneycontrol Research

For many state-owned companies, despite having huge cash in their books, a dominant position in the industry and attractive valuations, investors often keep a distance for fear that lack of growth will keep these stocks perennially under pressure.

One such company, Balmer Lawrie, could actually break this conventional thinking as it is working to bring growth. Balmer, which is sitting on huge land bank and a cash equivalent of about Rs 530 crore, close to 20 percent of its market capitalisation, is revisiting its growth strategies.

Sitting on Hard Assets

Today, close to 50 percent of its capital is employed in cash, which is deposited with banks and other low-yielding instruments. This is in addition to the land bank, which is sitting on the books at a historical cost. If redeployed in productive activities, both the cash and excess land bank could actually unlock huge value.

Transformation Initiatives

The company has initiated the right steps in recent times. It has appointed the consulting firm PwC to prepare a long term plan so that it can optimise capital allocation and focus on segments that holds growth potential.

Profit Drivers

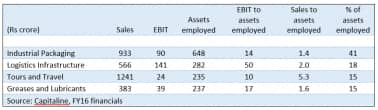

To put the numbers in perspective, close to 32 percent of the capital is deployed in logistics and lubricants business, which makes close to 33 percent return on assets employed in these businesses. Contrary to this, industrial packaging and travels businesses account for 56 percent of the capital and generate an average 12 percent return on capital.

Focusing on the Value Drivers - Logistics

In a bid to grow and improve return ratios, the company has planned to step up investments in logistics, particularly developing two cold storage chains to meet the growing demand in the cold storage space. To start with, each of these warehouses will have 3800 tonnes of storage capacity with its own air-conditioned vehicles. That apart, it will also invest about Rs 210 crore in seven climate-controlled warehouses and a multi-modal logistics park. Within logistics, it will also strengthen its presence in container freight stations. The company, currently, has operations in Kolkata, Mumbai and Chennai and intends to enter ports like Paradip, Mundra, Kandla and Dharma port in Odisha. Spending on the logistic vertical will not only deepen its competitive advantage but will also provide high-growth visibility. The logistics sector is likely to be a big beneficiary on account of GST implementation.

Today, logistics accounts for a mere 18 percent of the capital and makes 50 percent return on assets. Incremental allocation to this vertical will be earnings accretive and lead to higher return ratios and should have a positive rub-off effect on valuation.

Industrial Recovery to Aid Performance

Growth is expected to remain fairly good in all its segments with the ones linked to industry recovery now showing some recovery.

The company’s other two verticals, namely industrial packaging and travels business, make relatively low returns. But, in recent times, they have seen an uptick in demand.

In Q4 FY17, the company reported 205 percent growth in profits led by 23 percent growth in sales. Particularly the industrial packaging, which includes drums, is doing well because of lower crude oil prices. Industrial packaging grew by 12 percent followed by strong 21 percent growth in the travel business. Similarly, because of the operating leverage in the business, travel business reported 110 percent growth in profit before tax and interest.

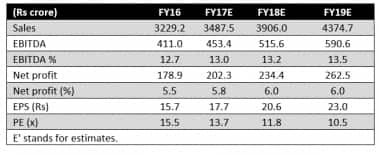

After adjusting for cash (Rs 48 per share) in the books, at the current price, the company is available at 10 times its FY19 estimated earnings of Rs 19 per share. Valuations are quite reasonable from the perspective of cash in the books, high return on equity and possibly higher growth in the coming years as a result of business re-structuring undertaken by the company. The 150-year-old company has got land parcels in various cities. There is a fair possibility (government effective stake merely 37 percent) that the government might divest its stake in the company in order to unlock value and monetize assets.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.