Anubhav Sahu Moneycontrol research

Arrow Greentech’s recent quarterly result was disappointing on both the levers of topline - royalty income and manufactured sales. While an extensive patent pool keeps the prospects alive for its monetisation and a superior earnings growth, near-term growth visibility has got shaken due to challenges at the clientele’s end.

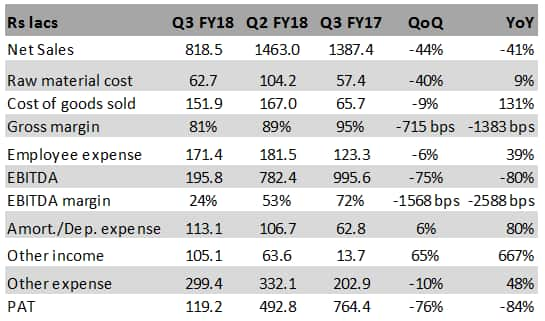

Q3 2018 results: Sharp drop in royalty income

Table: Consolidated financial statement

Consolidated Q3FY18 results were weighed by the slowdown in the business of a key client impacting their royalty income. Steep decline in raw material costs (-40 percent YoY) also suggests that there has been a scale back in utilization of new capacity. As a result, gross margins have shrunk and net profits have been impacted due to the elevated cost of operations post new capacity enhancement.

Company’s presentation indicates that while legacy capacity is utilized optimally (150 MT), utilization of new capacity (300 MT) would depend upon the trial runs and customer approvals of new grade of film. Management expects streamlining on new capacity by the end of FY18, with incremental utilization FY19 onwards.

Valuation and recommendation

Based on the event flows - Both royalty business and water soluble business - and the financial result, we have made downward revisions in our estimates. We are hopeful that new capacity addition can reach about 40 percent utilization rate in FY19, though acknowledge that it is contingent on client approvals of new film grade/s. Revival of royalty income is difficult to predict at this moment but our base case is for an incremental improvement (10% of earlier run rate for the client) as the contract remains intact.

At the same time upside risk to our projections come from faster monetization of patent pool (only 3 out 38 patents monetized), accelerated adoption of Klenz pro (hygiene chemicals) and faster client approvals for newer grades of Water Soluble films.

Having said that, the stock is currently trading at 18.0x FY19e earnings and reflects the current business conditions. Hence, we would prefer to wait for signs for better earnings visibility before getting constructive on the stock.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.