With realignment of products and focus, ABB India is emerging as an even stronger player in the domestic engineering market. The company today has competence in some of the futuristic and competitive products with help from its global parent company, ABB Global.

Just to give an example, ABB global has, for long, been present in products and services for charging electric vehicles, with a strong position in the European markets. Some of these products are already well-tested and recognised in the markets where electric vehicle (EV) charging has already taken shape. Leveraging this expertise, the company has started talks with OEMs (original equipment manufacturers) in India to help them understand and design the products.

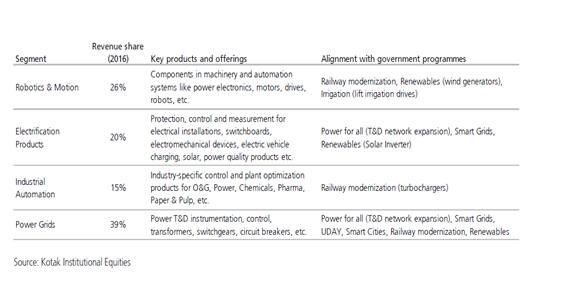

While EV charging is just one example, and is still in a nascent stage, the company has been able to take a lead in other upcoming segments as well like robotics, solar, smart grid and metro projects. These segments are now compensating for the opportunity lost in the traditional segments. ABB’s products are now more strategically placed in the segments that are actually witnessing traction.

"With a comprehensive product portfolio now in place, we believe, the company could potentially post numbers close to the previous cycle given an improving product mix, which we believe is rare in our current industrial coverage universe," Said Amit Mahawar who tracks the company at Edelweiss Securities.

Deviation from the past

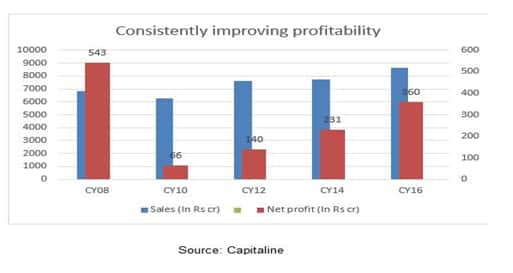

Back in the year 2009-10, ABB had a huge task to realign its products as business suffered a huge setback with the problems in the power sector, and subdued demand in the industrial segment. As against a net profit of Rs 543 crore in the calendar year 2008, profits had hit a low of Rs 66 crore by end of calendar 2010. The performance took a toll on the stock price that fell by 75 percent by end of March 2009 to around Rs 350 levels as against a peak of Rs 1,800 made at the end of 2007.

ABB Global, which is the parent company of ABB India, is an established player in the engineering space with its leadership across the value chain. Knowing there was a merit to be in India in the long term, the company came out to buy back shares in 2010 at around Rs 900 a share, which was at about 31 percent premium to its prevailing share price.

This was also a time when Bazmi Husain, the Global Head of smart grid industry segment of ABB, joined as Country Manager and MD of ABB India. The company took several restructuring initiatives starting with ABB India exiting from rural electrification business which was a drag on its financials. That apart, the company started focusing on futuristic products back in 2011. It focused on energy-efficient products on the back of climate change talks. It decided to leverage its global presence and products in smart grid, robotics in the industrial segment. Solar was also identified as a big trend in India early. All these should now be paying good dividends.

No wonder, while speaking to analysts in a conference call, the management reiterated the view that on the Indian operation this is just the beginning.

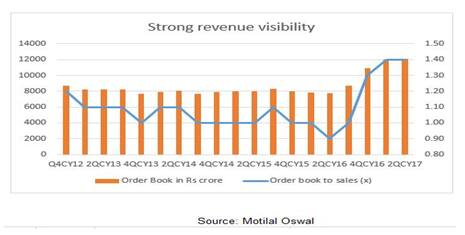

Despite the impact of demonetisation, GST, and muted demand from the industrial segment, the company was able to report order inflows of close to Rs 2,300 crore, taking its order backlog to Rs 12,100 crore or 1.4 times its trailing four-quarter revenue. This is the highest revenue visibility it reported in the recent past.

Moreover, more orders came in as a result of clients opting for technology upgradations such as robotics in industrial, smart grid products etc. That apart, efforts in building product portfolio in the metro, solar, railways, among others, is now yielding results and is expected to gain further traction with the government’s investments in these segments.

While ABB is best placed within the engineering space, the other marked improvement would be in profitability led by higher margins because of the product mix and efforts to curtail costs.

"Gross margin at 35.9 percent improved 160 basis points (bps) YoY, driven by initiatives undertaken over the past 3-4 years toward increasing localisation, rationalisation of supply chain, improving efficiency, better project management capabilities, and lower raw material prices," said Ankur Sharma who tracks the company at Motilal Oswal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.