South Asia, which had been seemingly on its way to prosperity, is battling an economic crisis. Sri Lanka is not the only economy in crisis; Pakistan and Nepal are on the verge of a precipice as well. If we include Afghanistan and Myanmar in South Asia too, the list of regional economies in crisis only gets bigger.

In 1997, South-East Asian economies also faced a huge economic crisis. Twenty-five years later, we are seeing economies in another region of Asia – South Asia – embroiled in crisis.

The South-East Asian crisis started in Thailand, but soon engulfed all economies in the region -- Malaysia, Indonesia, the Philippines and Singapore -- before spreading to Hong Kong and South Korea.

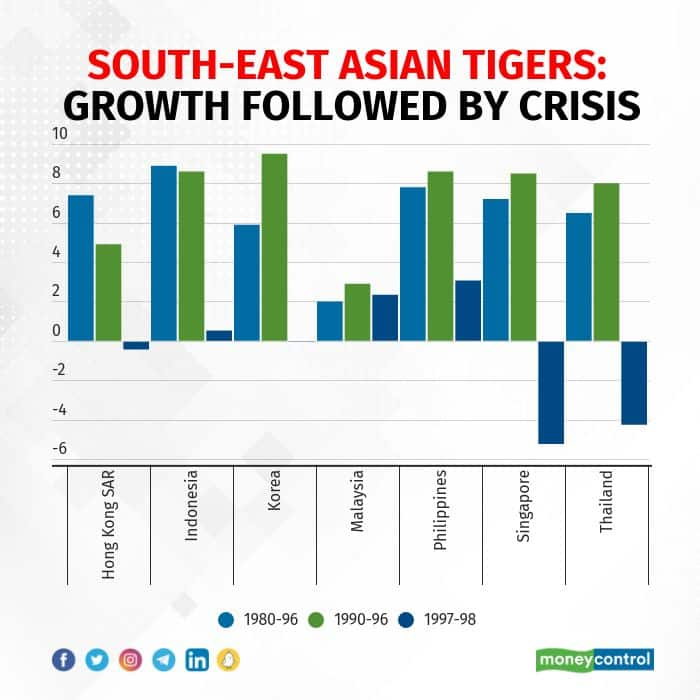

Regional economies were generating high growth in the early 1990s, even earning the moniker of Asian Tigers (see figure). In 1997, growth collapsed across the region barring in the Philippines, which expanded at a slow pace.

What led to this rise and fall?

Virtuous cycle turns viciousThe South-East Asian region suffered a typical boom-bust cycle. The economies generated positive growth leading to high capital inflows and high external debt. These economies also had fixed exchange rate systems that remained unchanged despite changing economic fundamentals, giving them a false sense of security.

As growth slowed, the virtuous cycle reversed into a vicious one with soaring inflation, spiralling debt, depreciating currencies and devastating public protests. The International Monetary Fund (IMF) provided financial support worth $36 billion to the three worst-hit countries—Indonesia, Thailand and South Korea.

Their political leaders criticized IMF, saying the institution demanded reforms that only worsened the crisis. The IMF responded saying the initial hesitation of the countries in accepting the bailouts had worsened the crisis.

How does the South Asian region compare to South-East Asia? If we compare average five-year growth rates between 2010-15 and 2016-19 (pre-pandemic), we can see that growth has slowed in all the countries barring Bangladesh and Pakistan.

A crisis in the makingUnlike South-East Asian countries, which suddenly plunged into a crisis, their South Asian counterparts have slowly been moving towards a crisis. The pandemic only accelerated the pace of the decline in growth.

Economies such as Sri Lanka, the Maldives and Nepal are highly dependent on tourism and remittances that dried up because of the pandemic. As the pandemic eased, the Russian invasion of Ukraine has caused a spike in oil and commodity prices. Apart from low growth, troubled South Asian economies are now facing multiple problems: accelerating inflation, widening current account and budget deficits. These economies are also running out of foreign exchange reserves to meet oil bills.

In these South Asian economies, a crisis is not limited to economics alone but extends to politics too. As explained above, the crisis had been brewing in some of these economies for a while now. However, rather than focus on containing the economic crisis, the governments fostered political instability in many of these countries. When governments are unable to contain the crisis, the blame is passed to the central bank. While the Governor of the Central Bank of Sri Lanka resigned recently, the Governor of the Central Bank of Nepal was fired. One could expect fireworks in other South Asian central banks too.

The South-East Asian crisis led to several lessons. How do these lessons apply to South Asia? First, the countries need to adhere to macroeconomic stability and act when the economy is showing signs of overheating. This lesson does not apply to South Asian economies as they have actually been underperforming.

Second, avoid borrowing in foreign currency. Unfortunately, most South Asian economies have high external debt. Third, prolonged fixed/pegged exchange rates at unsustainable levels fuel crises. Barring Bhutan and the Maldives, other South Asian economies do not follow fixed exchange rate systems.

Fourth, seek quick assistance from IMF and reform your economies. (IMF assistance is not new to South Asian countries. It is just that these economies have not really cared to reform themselves.) Fifth, the crisis gets magnified if the crisis-ridden economies are interconnected with each other’s fortunes and misfortunes. South Asian economies are interconnected, but not to the extent of their South-East Asian counterparts.

Implications for India and the worldWhat does the impending South Asian crisis mean for India and global economies?

The crisis will impact India’s external trade because nearly 7% of India’s exports goes to South Asia. We have already seen Nepal banning luxury imports, which is likely to hit India the hardest.

India will also be called to provide financial aid to these crisis-driven economies. The economic crisis will once again test the foreign policy of India vis-a-vis these countries.

Globally, the impact of a South Asian crisis is likely to be limited. Unlike South-East Asian economies, South Asian economies have not really integrated themselves with the world economy both in terms of trade and financial flows. Foreign lenders and investors who lent to and invested aggressively in South-East Asian economies have shown limited excitement towards South Asia because of the slow pace of growth.

To sum up, there was a time when the South-East Asian crisis was discussed prominently by world economists. The global financial crisis of 2008 led to the South-East Asian crisis fading from public memory. On the 25th anniversary of the South-East crisis and with a looming crisis in South Asia, it is time to revisit lessons from the former to help the latter.

Amol Agrawal is faculty at Ahmedabad University.Views are personal and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.