Electricity exchanges are seeing renewed growth but uncertainty around plans for market coupling remains, says a new report from ICICI Securities.

Market coupling involves pooling all buy and sell bids to arrive at a uniform market price. In FY24, trading volumes on power exchanges grew almost 16 percent on an annualised basis to around 120 billion units (BU) . This increase, according to the report, comes on the back of a 2 percent growth in FY23.

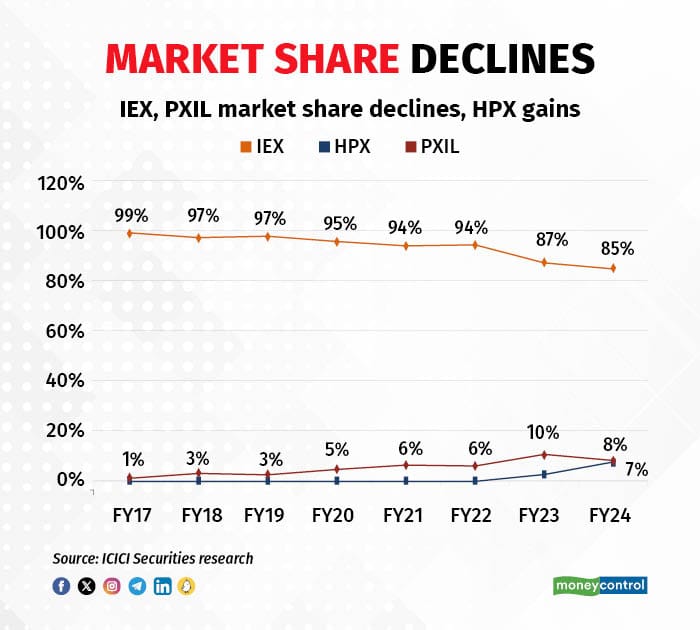

India currently has three energy exchanges : IEX (India Energy Exchange), PXIL (Power Energy Exchange) and HPX (Hindustan Power Exchange). IEX is the only listed one among them.

Also read: Initial simulations by CERC suggests market coupling will not have any significant benefit: IEX CMD

Shares of IEX have fallen around 4 percent over the last one year but gained around 11 percent over the last six months. As on April 9, the stock was trading at Rs 146.70.

According to the report, IEX's market share dropped to 85 percent in FY24 against 87 percent in FY23, while PXIL's market share dropped to 8 percent from 10 percent. On the other hand, HPX gained to 7 percent from 3 percent in FY23.

In Q3FY24, IEX reported an 18.9 percent year-on-year increase in net profit to Rs 91.8 crore. Revenue from operations for the period grew 15 percent to Rs 115.3 crore from Rs 100.27 crore in Q3FY23. EBITDA (earnings before interest, taxes, depreciation and amortisation) for the reporting quarter rose to Rs 124.7 crore in the quarter ended December 2023.

Volumes at IEX grew 13 percent over the previous year to 102 BU in FY24. According to the report, volumes at PXIL dropped 10 percent annually to 9.4BU. HPX volumes for the same period grew more than 3 times to 8.6BU.

Also read: MC Explains: What is market coupling and why is it in the news?

Uncertainty amidst power market couplingMarket coupling in simple terms is a model where the buying and selling of electricity from all power exchanges in the country are aggregated and matched to discover a uniform market clearing price (MCP). Currently, each of these exchanges collects buy bids and sell offers on their own and comes up with its own MCP.

In a February 6 order, the Central Electricity Regulatory Commission (CERC) ordered for a "shadow pilot" on market coupling of India's power exchanges. As per the order, national load dispatcher Grid-India will develop the necessary software over the next two months to run this shadow pilot.

Some analysts have previously expressed concerns that market coupling could result in a decline in market share for all three exchanges and could specifically be of concern to IEX. ICICI Securities analysts added that in the current market, as the last word is yet to be said on market coupling, uncertainty will continue to plague the sector.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.