The Goods and Service Tax (GST) Council is mulling whether to gradually increase the average GST rate to closer to the revenue-neutral rate of 15 percent, so that compensation to states does not have to be extended beyond June 2022, Moneycontrol has learnt.

At the 45th GST Council meeting last week, the centre had presented several options to states, including revenue enhancement measures. It is learnt that among the options given were increasing the average GST rate to be closer to revenue neutral rate and correcting inverted duty structures in a number of items.

"Both these moves will increase the revenue of states and hence eliminate the need to extend compensation beyond its sunset date as mandated by the extant laws,” said a senior official.

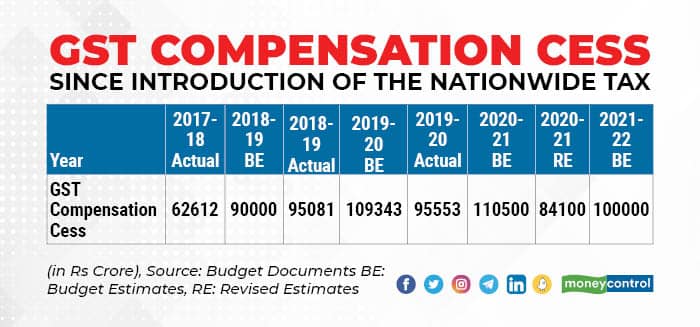

When the GST came into being, states had agreed to join the new tax regime provided they were compensated for any revenue loss in the first five years from July 1, 2017 to June 2022.

Section 18 of the Constitution (101 amendment) Act, 2016 and Section 7 of GST (Compensation to State) Act, 2017 permits that the loss of revenue will be compensated to states at the end of every two months for five years. The shortfall is calculated assuming a 14 percent annual growth in GST revenue over the base year of 2015-16.

As per the centre, the current GST average rate is around 11 percent. Increasing it closer to the revenue-neutral rate will involve hiking rates of some items in the 5 percent and 12 percent brackets.

Officials say that if the centre and states agree to such a proposal, these hikes will happen gradually so as to not cause any sort of inflationary shock.

Revenue Neutral Rate

A revenue-neutral rate is a rate in which states and centre don’t lose any revenue compared with the pre-GST tax regime. It was set at 15 percent by a panel headed by former Chief Economic Advisor Arvind Subramanian.

At the GST Council meeting on September 17 in Lucknow, Finance Minister Nirmala Sitharaman said that the GST Compensation to states will end on June 2022, though never once directly. Her take was that the current legislation allows for compensation only till June 2022 and that cess collected beyond that would be used to pay back loans in lieu of compensation shortfall.

This is starkly different to what opposition state politicians and officials from states such as Delhi, Bengal and Tamil Nadu told the media. Delhi Deputy Chief Minister Manish Sisodia and West Bengal minister Chandrima Bhattacharya, who attended the meeting on behalf of Finance Minister Amit Mitra, said that the issue of compensation extension had been referred to a group of ministers formed to look at various GST-related matters.

Sitharaman and Revenue Secretary Tarun Bajaj said that while compensation cess will be collected till March 2026, it will be to pay back the interest and principal of the Rs 2.69 lakh crore total that the centre borrowed and will borrow in 2020-21 and 2021-22, and transferred to states.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.