EaseMy Trip (EMT, CMP: Rs 46.95, Market Cap: Rs 8,161crore) has reported a mixed set of numbers for the final quarter of FY23. Industry tailwinds were reflected in the strong uptick in gross booking revenue, and stable market share and commission (take rates), though slightly elevated costs due to competitive intensity suppressed margins. The progress on non-airline revenue continues to be unimpressive and the negative cash flow on account of high trade receivables and advances given to airlines and hotels need attention. While the company will continue to reap the benefits of a structural shift in travel demand, expensive valuation caps the room for re-rating. However, thanks to the boom in the travel industry, the earnings trajectory should remain strong and investors could expect stock returns to closely mimic earnings.

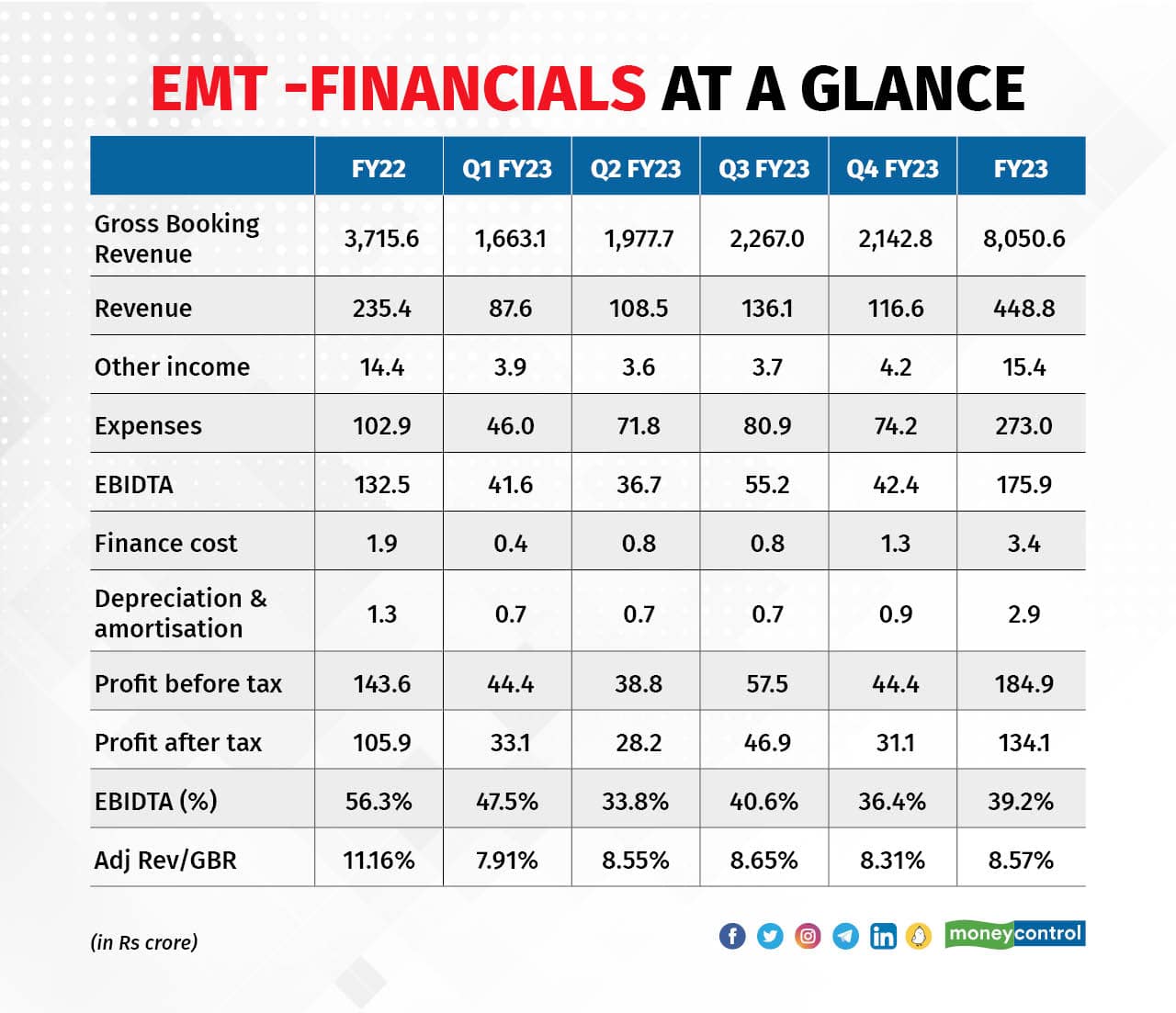

Q4 FY23 – strong show in gross bookingsThe gross booking revenue (GBR) was up 83 percent year on year (YoY) for Q4 and 117 percent for the year; thanks to the overall buoyancy in the industry. The larger peer too has reported a similar growth traction in gross booking revenue.

Adjusted revenue as a percentage of the GBR saw a sequential decline but was still at a respectable 8.3 percent. For FY23, adjusted revenue as a percentage of GBR was 8.6 percent and the company is confident of maintaining it at this level, going forward.

Source: Company

Brand promotion expenses elevated as competitive intensity remains highEaseMy Trip associated its name and brand with multiple sports properties to fortify its brand image amid heightened competitive intensity. Consequently, advertising and brand promotion expenses as a percentage of GBR was close to 1.1 percent and the overall costs as a percentage of GBR was close to 3.5 percent. While this continues to be one of the best in the industry, the company sees headroom for improvement as employee addition peaks out and payment gateway charges get reduced because of the higher adoption of the UPI.

Source: Company

Source: Company

Easy Trip has international presence in Dubai, the UK, Singapore, the Philippines, Thailand, and the US. It plans to replicate the low-cost model in other geographies, where the local competitors typically charge a high commission and hence the “no convenience fees” model can be a game changer. The Middle East operations have got off to a great start, with the GBR in Dubai crossing Rs 118 crore in the first year.

The company started its first franchise store in Patna, Bihar, aiming to offer customers an in-store retail experience that is especially expected to boost the high-margin tourism business.

The company has been making steady efforts to diversify revenue stream with a slew of acquisitions like Spree Hospitality, Yolobus, Nutana Aviation, and cheQin. However, while it has big plans in the high-margin hotels space, the traction so far is not meaningful.

The balance sheet quality has worsened with higher receivables, thanks to the rising share of the B2B business and other current assets due to advances given to airlines and hotels. The company like many other players in the industry has a substantial receivable (to the tune of Rs 69 crore) from Go Air that warrants a close monitoring.

Structural shift – rerating ruled outWith the travel and tourism segment booming, competition is heating up. But there is also a structural shift in demand with travel increasingly grabbing a larger share of household budgets. Despite the strong show by most of the players, the stock market performance has been lacklustre except for the leading Chinese player Trip.com.

Source: Yahoo Finance

Source: Yahoo Finance

Even post the lacklustre show, EMT remains the costliest stock.

Source: Yahoo Finance

Source: Yahoo Finance

While we rule out valuation re-rating, after the significant underperformance of the stock, investors can look to gradually add the stock to ride the strong earnings growth expected in the future.

Source: Company, Moneycontrol Research

Source: Company, Moneycontrol Research

Key risks: Severe slowdown due to any external event/economic slowdown and heightened competition impacting growth and profitability

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.