Mahindra Logistics and Future Supply Chain Solutions, two of the largest third-party logistics players in the country, recently reported their earnings for the March quarter. Both companies saw a healthy growth in revenue and performed well on an operational basis. However, their stocks are expensive at their current prices, even if we consider the exciting prospects for the sector. So which way should investors go at this point?

Mahindra Logistics reported a year-on-year rise of 23.5 percent in its revenue for the March quarter, while its EBITDA surged 75 percent over the same period. Similarly, Future Supply Chain reported an year-on-year growth of 50 percent in its revenue for the reporting quarter and its EBITDA improved 32.9 percent.

Third party logistics remains an exciting space and investors should keep a close watch on companies from the sector as the growth momentum is likely to sustain for a few years.

Mahindra LogisticsFor FY18, Mahindra Logistics reported a growth of 28 percent in its revenue to Rs 3,416 crore. Its operating profit jumped 46 percent to Rs 126 crore. Strong performance in the supply chain management business across both Mahindra and non-Mahindra verticals drove the revenue growth. The company continued to diversify its revenue base and increased the share of non-Mahindra revenues to around 35 percent.

Mahindra Logistics recently leased a 2.80 lakh sq. ft. warehousing facility in Chakan near Pune, which is an automotive hub. The company is yet to take possession of this facility and aims to benefit from its existing customer relationships and volumes. Also, 85 percent of its warehousing facility in Gurugram is currently occupied and the management expects it to reach full utilisation by the end of the June quarter.

The company follows an asset-light business model and designs logistical solutions for several industries like automotive, engineering, consumer goods, pharmaceuticals, and e-commerce. While the non-auto business is expanding at a rapid pace, it has an established track record in the automotive segment (Mahindra & Mahindra) and is expected to benefit from the uptick in the segment. Going forward, the management aims to focus on large-revenue clients by providing integrated, end-to-end solutions and leverage technology to generate operating efficiencies.

Future Supply Chain SolutionsFuture Supply Chain Solutions ended FY18 with a standalone revenue of Rs 775 crore, 38 percent higher year on year. Its gross profit and EBITDA margins also improved to 34.5 percent and 15.6 percent, respectively. The rise in revenue was on the back of strong performance by its contract logistics segment, which contributes 70-75 percent of its total revenues. Revenue from contract logistics surged to Rs 582 crore in FY18, from Rs 407 crore in FY17. Besides, revenue also rose on account of consolidation of the financials of Vulcan Express, a logistics subsidiary of Snapdeal, which the company acquired in February.

Overall, the company’s margins expanded this time around as the increase in segment revenue helped the company achieve operational efficiencies across its three business verticals. Also, the temperature-controlled logistics segment reported a positive gross profit of Rs 1 crore, compared to a loss of around the same amount last year.

In the fiscal year gone by, Future Supply Chain Solutions added 6 lakh sq. ft. of warehousing space. It has also signed agreements to set up an 18 lakh sq. ft. facility, which will house seven distribution centers. Revenue visibility appears robust given the fact that the company has sales of Rs 400-500 crore in the pipeline (majorly from non-anchor customers) that are at various stages of discussion.

Over the years, the company has capitalised on its expertise of handling Future Group operations and has leveraged its experience and capabilities to add non-Future Group clients to its portfolio. Its pan-India presence across 29 states and 5 union territories gives it a competitive advantage as it allows customers access to multiple destinations for booking and delivery of goods across India, thereby helping the company in attracting higher volumes at lower costs.

Future Supply Chain Solutions covers the entire value chain of logistics services and aims to grow revenues and enhance margins by cross-selling services to its existing and new clientele.

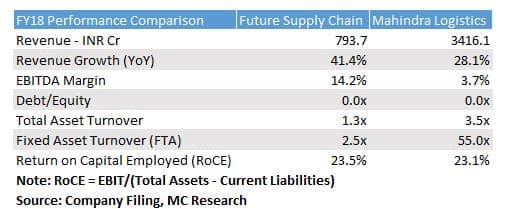

Performance ComparisonFuture Supply Chain Solutions outperforms Mahindra Logistics on the margins front, despite being only a fifth of the latter’s size in terms of revenue. Future Supply Chain Solutions' consolidated EBITDA margin is considerably higher at 14.2 percent. But the return on capital employed (RoCE) ratio for both companies is around the same level, as Mahindra Logistics has a significantly-higher asset turnover ratio. Both companies have strong balance sheets and maintain a zero debt-equity ratio.

These companies have asset-light business models and therefore, do not need much money for capital expenditure. This results in healthy free cash flow and return ratios for investors.

Outlook and RecommendationIndustry tailwinds, pan-India presence, and strong customer relationships should help these third party logistics players report secular growth of 20-25 percent going forward and also gain market share from unorganised players, whose share currently stands at around 95 percent.

Future Supply Chain Solutions has a concrete relationship with Future Group companies and therefore, remains well-positioned to grow through strong presence in fast-growing consumption sectors. On the other hand, Mahindra Logistics aims to leverage on the experience gained through its association with the Mahindra Group to add new clients.

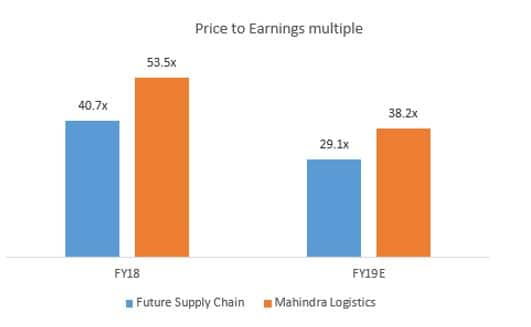

Both stocks are trading expensive at the moment after a run up in the price on the back of recent tailwinds like GST, E-way Bill and the sector being granted infrastructure status. On a one year forward basis, Future Supply Chain Solutions (Market Cap: Rs 2,737 crore) trades at a price-to-earnings multiple of 29.1 times, compared to Mahindra Logistics (Market Cap: Rs 3,496 Crore), which trades at a multiple of 38.2 times.

Despite being smaller in size than Mahindra Logistics, Future Supply Chain Solutions performs well on an operational basis and trades at a significant discount to the former. We remain confident of the growth prospects of the company and expect margins to improve and return ratios to rise as the assets are milked more effectively. In our view, long-term investors should look to accumulate Future Supply Chain Solutions whenever the stock corrects.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.