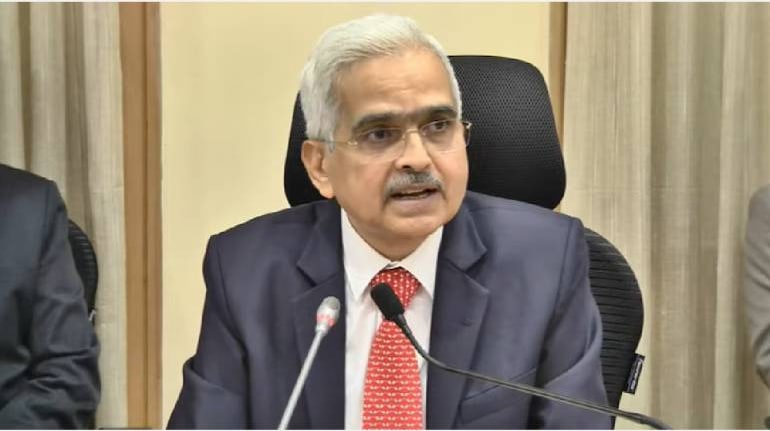

The nature and timing of today’s interest rate hike is surprising. So far, the Reserve Bank of India (RBI) Governor Shaktikanta Das had guided the markets that he doesn’t believe in surprise moves. Yet, today’s rate action came as a big shocker.

True, there were clear hints of an approaching rate hike in the last policy statement. Moneycontrol had highlighted this in an earlier column. Everyone knew a rate hike is on the cards when Das put inflation ahead of growth in his post policy presser on April 8.

But why did the RBI announce the sudden rate hike—an unusual 40 bps hike in repo rate and another 50 bps increase in CRR in an off-cycle meeting that too amid one of the biggest share sales, fully knowing the action will impact sentiments?

What has happened between the last policy review and now? Logically, there are reasons such as the ongoing Russian war and the US Fed rate moves but these aren’t sudden triggers.

The only possible, immediate reason for the RBI to announce a twin-shocker during an off-cycle meeting would be that it would have got data to assess that inflation may be going out of hand. And that the RBI needed to act tough now, before it is too late. Price stability is central bank’s primary mandate.

The central bank, which highlighted inflation as primary concern in the last policy review, could have hiked the repo rate in last policy itself in a smaller dose, followed by similar hikes. Instead, it chose to shock markets with a bigger quantum hike.

A senior economist told this writer that in a way, today’s rate hike is an admission by the central bank that it ignored the inflation concerns for too long and if it doesn’t act now, inflation can grow as an untamable animal.

At 17-month high, the inflation data for March itself was a shocker. It came at close to 7% (6.95% to be precise) from 6.07% in February. This is the third consecutive month in which inflation has come in above the 6 percent upper bound of the RBI mandate, averaging 6.3 percent in January-March.

As such, 6 percent-plus inflation in April-June and July-September will see the MPC failing to meet its mandate. The RBI's latest forecast pegs average CPI inflation at 6.3 percent in April-June and 5.8 percent in July-September. If MPC fails to meet its mandate, it owes an explanation to the Parliament.

The government too will want inflation to come under control at the earliest. High inflation is hurting the common man more. Prices of essential items, including food and vegetables have shot up significantly raising questions on timely action from the Government and the central bank.

Remember, the sharp increase in CPI inflation in March was driven by an increase in prices across all but one of the major groups of the basket, including food items.

The MPC probably believes it is on its way to breach the mandate for the second consecutive quarter and if it doesn’t act now, it can very well fall behind. This fear, in fact, was highlighted by MPC member Jayanth R Varma in the last policy minutes. Varma mentioned that the MPC may be warranted to act by the data that becomes available in the coming weeks.

“With inflation projected to breach the upper tolerance limit for several months, it is imperative for the MPC to communicate its resolve to ensure that inflation remains within the target going forward,” Varma said.

In this backdrop, today’s unexpected, sharp twin hike can be seen as a pre-emptive action from the MPC to save itself from the embarrassment of failing in its inflation mandate.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.