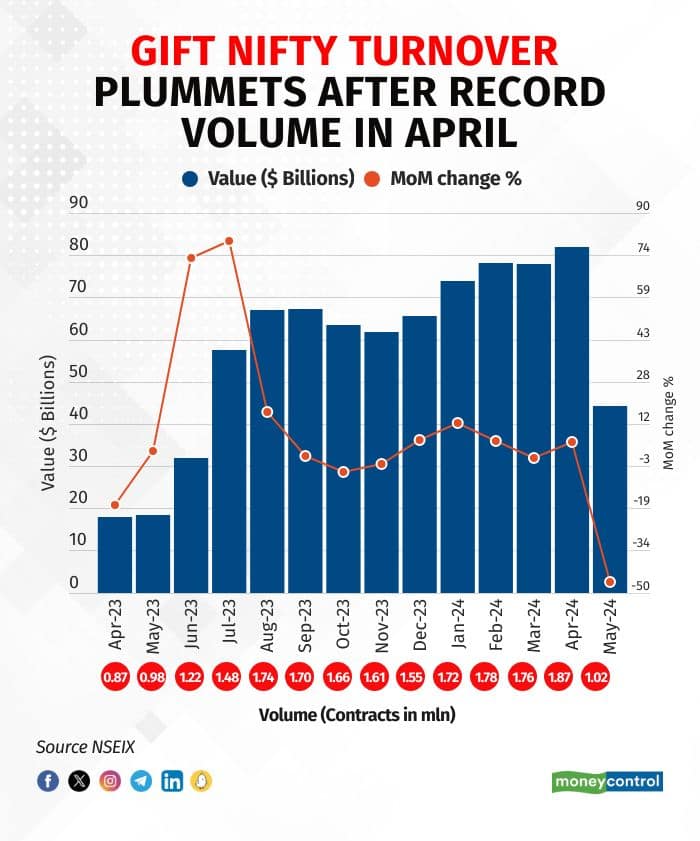

The hugely popular GIFT Nifty derivative contracts, traded on the NSE International Exchange at GIFT City, Gandhinagar, have seen their volume plunge in the current month.

The turnover has fallen by almost 46 percent in May from the record turnover of $82 billion registered in April. In May till date, the turnover has been pegged at $44.24 billion.

Market experts attribute this trend to foreign investors as the volume in the International Financial Services Centre (IFSC) is solely driven by overseas investors. The experts highlight the huge selling by FPIs in the domestic cash market as well.

Data shows that FPIs have been net sellers of Indian shares worth nearly $2.7 billion in the current month as of May 24.

Uncertainty around election results is being looked upon as the prime reason for such selling and most market experts believe that foreign investors are currently in wait-and-watch mode, leading to lower volumes in GIFT Nifty contracts.

“Market sentiment oscillates between extreme pessimism and optimism, reflected in significant swings in the VIX. Volatility has led FIIs to remain cautious, impacting market volumes, said Kranthi Bathini, Director of Equity Strategy at WealthMills Securities.

Since the launch of GIFT Nifty contracts on July 3 last year, trading turnover on the NSE IX has consistently risen.

In the current calendar year, turnover has consistently exceeded $70 billion, reaching a record high of $82 billion in April.

From July to December 2023, GIFT Nifty turnover ranged between $58-65 billion, showcasing significant investor interest. As of April, it accumulated around 16.9 million contracts and a total turnover of $694 billion, as reported by GIFT IFSC.

Interestingly, while GIFT Nifty volumes have dropped, the open interest has largely remained unchanged.

Deepak Jasani, head of retail research at HDFC Securities, said several factors may explain this decline in intraday volume: foreign and other participants are trading less intraday, the GIFT Nifty is exhibiting higher volatility, and the lower depth compared to the domestic Nifty.

Additionally, since late April, the contract size of the domestic Nifty has halved, leading to reduced contract value and some volume diversion from the GIFT Nifty. Consequently, the price difference between the GIFT Nifty and domestic Nifty has doubled, making the GIFT Nifty comparatively more expensive.

Moreover, there were expectations of the rupee appreciating post the election results. Traders, anticipating a stronger rupee, are reducing open positions in the GIFT Nifty to avoid potential losses when converting dollar margins into rupees. This precaution is partly warranted, given the rupee's recent appreciation against the dollar.

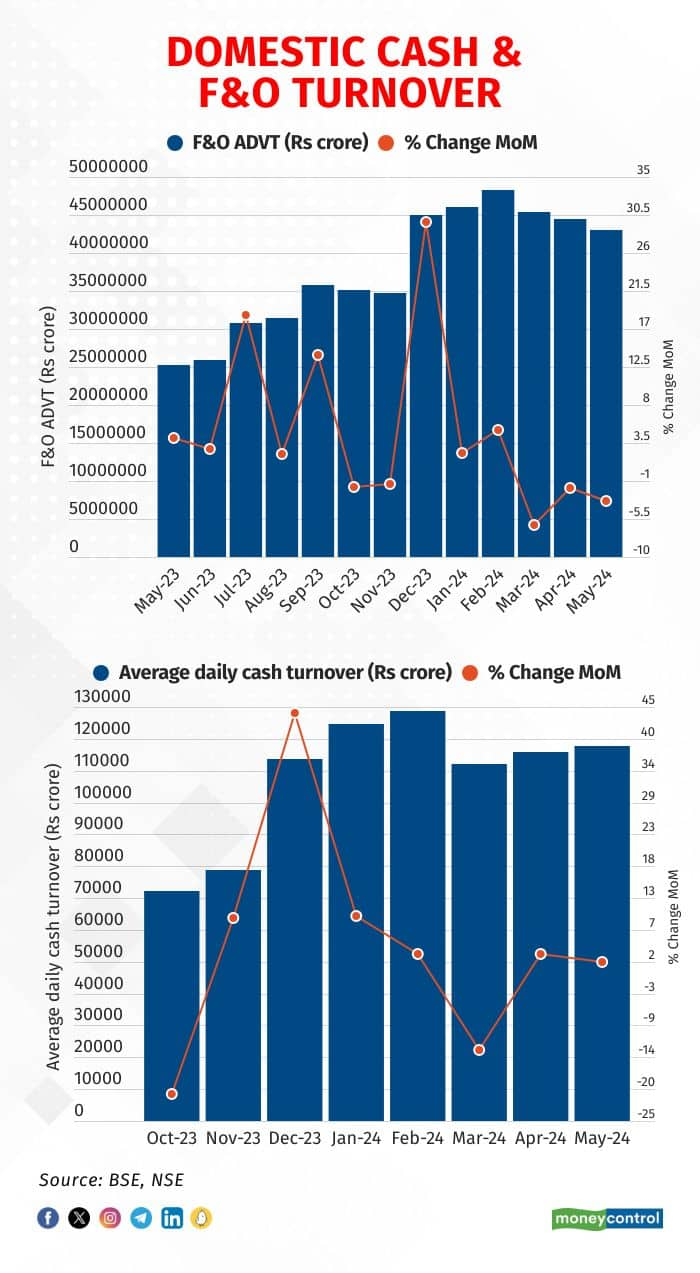

Domestic cash and F&O Turnover

Cash and derivative volumes in the Indian equity markets on both the BSE and NSE exchanges stayed stagnant for the fifth straight month since the start of 2024.

The combined F&O average daily turnover for both the BSE and NSE hit a six-month low of Rs 430 lakh crore in May, down 3.4 percent from a month ago. This is the third straight month of declines.

Meanwhile, the combined average daily trading volume in the cash segment of both exchanges in May rose just 1.8 percent to Rs 1.18 lakh crore from Rs 1.16 lakh crore in April.

"On Dalal Street, there's an old saying: "Sell in May and go away…," Traditionally, May is seen as a month where volumes are generally weaker owing to the summer holidays in India. The US markets have seen buoyancy and scaled new heights over the last few weeks; that too is another reason for momentary waning interest in Indian Indices," said Alok Churiwala, MD, Churiwala Securities.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.