Jitendra Kumar Gupta Moneycontrol Research

IRB Infrastructure has survived most of the past downcycles and taken initiatives (like launch of infrastructure investment trust) well ahead of others in order to safeguard against catastrophes that most construction companies faced.

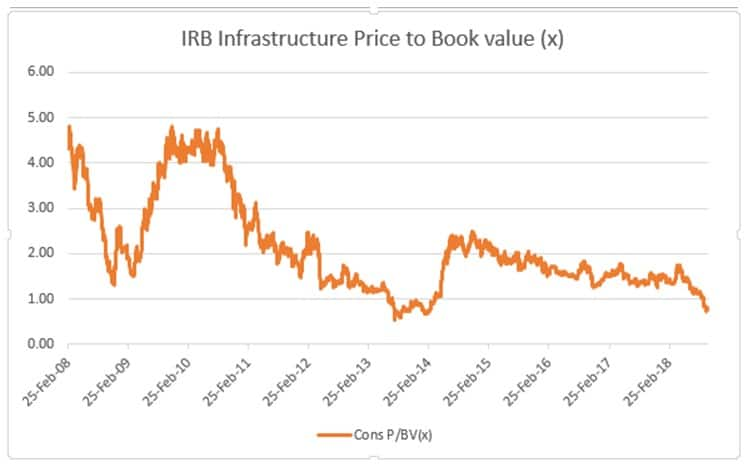

Over the past 10 years, IRB too had its share of problems and its market capitalisation shrank below its net worth, or equity capital invested in the business, on many occasions, but the stock often bounced back as the market took cue from growth in its earnings and assets.

Source: Moneycontrol Research

Source: Moneycontrol Research

Hard assets backing the company Its business is backed by hard road assets. Equity capital invested in these hard assets cannot be reduced to zero. The biggest crash in its stock price took place at the time when murder allegations were raised against the promoter in 2012.

This was also a period characterised by infrastructure slowdown and a policy paralysis as most projects were delayed due to lack of clearance. This was also a time when IRB withdrew from the bidding process of the prestigious Rs 14,000 crore Sewri-Nhava Sheva Trans Harbour project citing government's apathy and unfriendly attitude towards developers of capital-intensive infrastructure projects. Mid-2013, its stock touched a low of about Rs 55 a share, or about half of its book value.

Deep value? That was possibly the worst period in its history. Today, nothing of that magnitude has happened, but the stock has again fallen below its book value (around 0.75 times). One possible reason is overall pressure in midcap stocks, particularly infrastructure, but the magnitude of the correction seems to be unjustified.

The company has cleaned up its balance sheet, has ample liquidity, is sitting on a huge order book and its projects are well funded. Since FY14, its net worth has increased from Rs 3,560 crore to Rs 5,667 crore in FY18 at an annual growth rate of 12.3 percent.

Despite that, the company’s shares are trading at levels last seen prior to the 2014 general elections. It is currently commanding a market capitalisation of Rs 4,428 crore, which is less than its FY18 net worth of Rs 5,667 crore. At the current market price, it is offering a dividend yield of close to 4 percent making it even more attractive.

Stable business; scope for improvement On the business front, traffic has been growing steadily after demonetisation and implementation of the Goods & Service Tax. On the construction side, it is sitting on an order book of close to Rs 14,000 crore, which is about four times its sales and provides strong revenue visibility.

Moreover, with divestment of few build, operate and transfer (BOT) assets through InvIT it has garnered strong cash, which along with internal accruals can help it pare down its debt further and deploy it in the business to fund projects. These projects are divested at an internal rate of return of about 12 percent and the money raised could now be deployed for projects or acquiring assets, which can yield 18-20 percent annually.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.