Birlasoft, a digital and information technology consulting company, can rise another 22 percent in the next four to six months on top of its 175 percent gain in the past year, technical analysis shows.

It has outperformed the Nifty50 that rose 43 percent and the S&P BSE 500 index that gained about 50 percent in the year.

On a year-to-date (YTD) basis, it rose 64 percent compared to nearly the 16 percent gain in the Nifty50 and nearly 20 percent upside in the S&P BSE 500 index.

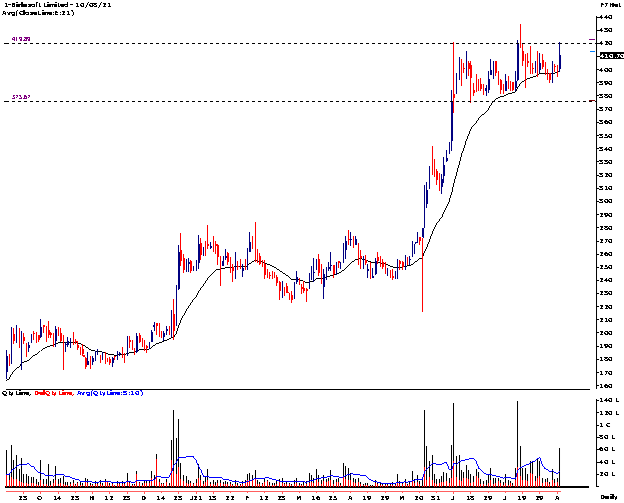

Birlasoft, part of the multibillion-dollar diversified CK Birla Group with a market capitalisation of over 11,000 crore, rose to a fresh 52-week high of 434.40 on the BSE on July 16, 2021, but has seen some consolidation after that.

But technically, it has been consolidating for the last couple of months in a tight range of 375-420. A break above Rs 420 will open doors for the stock to hit Rs 500 levels which translates into an upside of nearly 22 percent from the August 10 closing price of Rs 410, experts said.

On the fundamental side, Birlasoft is aiming to achieve revenue of $1 billion in the next four years, implying a CAGR of 20 percent. It aims to achieve this with both organic and inorganic revenues.

The company has Rs 128 crore of debt and Rs 1,043 crore cash in books. The company consistently delivered ROCE between 15-20 percent over the last five years, including 22 percent in FY21.

The stock is trading well above the short and long-term moving averages such as 5, 10, 20, 50 and 200-DMA. Technically, it is in an uptrend forming a higher top and higher bottom than the previous ones. “The stock is in an uptrend. Volumes on the up move have been high while on declines below average indicating buying participation on up move. After a strong up move stock has been consolidating its gains for the last couple of months sideways between 420 and 375 levels to form a base for next leg of rally,” Ashish Chaturmohta, Director Research, Sanctum Wealth Management, said. “Price has taken support from 21-day exponential moving average and bounced back. Crossing and sustaining above 420 levels stock will see a resumption of the uptrend,” he said. Chaturmohta recommends investors to buy the stock at current levels on dips to 389 with a stop loss of 375 for the target of 500 in the coming 4-6 months. Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

The stock is trading well above the short and long-term moving averages such as 5, 10, 20, 50 and 200-DMA. Technically, it is in an uptrend forming a higher top and higher bottom than the previous ones. “The stock is in an uptrend. Volumes on the up move have been high while on declines below average indicating buying participation on up move. After a strong up move stock has been consolidating its gains for the last couple of months sideways between 420 and 375 levels to form a base for next leg of rally,” Ashish Chaturmohta, Director Research, Sanctum Wealth Management, said. “Price has taken support from 21-day exponential moving average and bounced back. Crossing and sustaining above 420 levels stock will see a resumption of the uptrend,” he said. Chaturmohta recommends investors to buy the stock at current levels on dips to 389 with a stop loss of 375 for the target of 500 in the coming 4-6 months. Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.