Krishna Karwa Moneycontrol Research

TCNS Clothing is one of India’s largest women-centric branded apparel retailers with a portfolio of nearly 1,600 products. The company, by virtue of its 37 designers, possesses strong design capabilities to achieve product differentiation. Its manufacturing processes are entirely outsourced. As on 31st March 2018, it collaborated with 78 job workers and sourced raw material (fabric) from 181 suppliers.

What works in favour of TCNS?

Demand scope: As per a Technopak report, the retail market for women’s apparel in India is valued at $19.3 billion and is considerably underpenetrated vis-a-vis developed nations such as the US, the UK, and China. Higher spends on clothing, an increase in the number of working women and growing preference for branded garments provide TCNS a plethora of opportunities to bolster its revenues.

Distribution strength: TCNS is among the largest retail players in India, with about 3,456 points of sale (465 exclusive brand outlets, 1,469 large format stores, 1,522 multi-brand outlets) spread across the country. The company also sells its products through Indian e-commerce portals and 6 exclusive brand outlets in other nations (Nepal, Mauritius, Sri Lanka).

The path ahead

Keeping the low base and fast growth potential in the Indian womenswear segment in mind, the management is looking at expanding its online omnichannels and offline store network (mainly large format stores in India and Middle East). It is evaluating plans to strengthen its positioning by offering women's accessories such as footwear, jewellery and fragrances.

To keep asset turn high and business model asset light, 80 percent of the 75-85 new stores proposed to be opened in FY19 and FY20 will be under the franchise-run route. To reduce overheads, TCNS targets diversifying its manufacturing activities in states that offer cost benefits and other incentives. These measures could lead to an uptick in margins.

Increased brand recognition is a critical sales driver in the women’s apparel industry. TCNS, therefore, will prioritise introducing seasonal cum thematic collections periodically, apart from undertaking distinctive promotional and customer engagement initiatives. This may help the company attract more footfalls and garner higher sales.

The risks

With more options now available to buyers, customer loyalty is declining fast. As a result, garment retailing businesses, which more often than not deal in commoditised products, face stiff competition from other brands and unorganised players.

Fashion trends are subject to frequent changes, which could lead to inventory losses or write-offs. Extended ‘end of season sale’ periods and an inability to pass on raw material price hikes to consumers may also dent margins.

Should you subscribe?

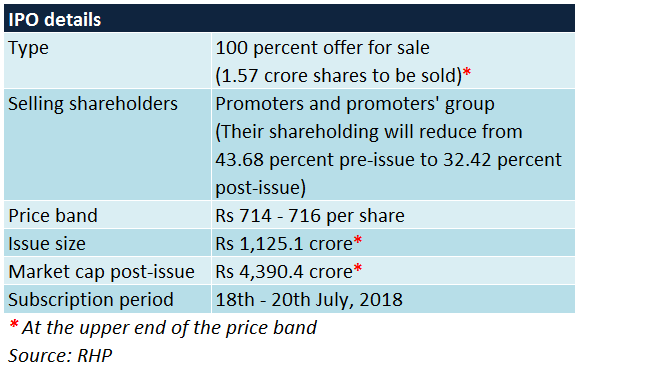

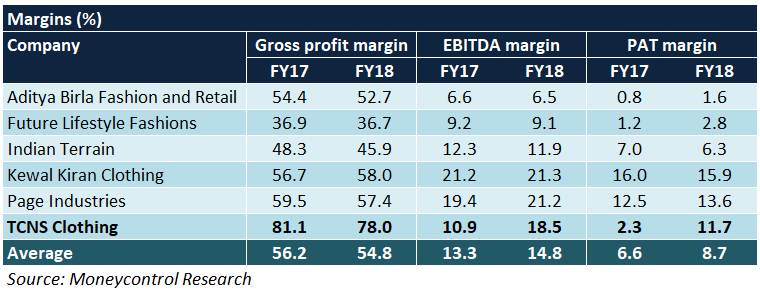

TCNS’ fundamentals improved noticeably year-on-year (YoY) in FY18 on all fronts, as seen in the exhibits below:-

Should TCNS succeed in delivering results better than the industry average in the upcoming fiscals (like it did in FY18), the stock may witness a sharp re-rating in due course.

At 46.6 times trailing 12-month earnings, the stock seems fully priced, notwithstanding the fact that it is still valued at a discount to the industry average. This leaves little on the table for new investors, especially when the market sentiment is expected to remain bearish in the near-term. We advise buying this stock on dips in the secondary market (post-listing).

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.