Global brokerages turned cautions on Yes Bank as they maintain either sell, hold or neutral rating, a day after the private sector lender reported a divergence in gross bad loans of Rs 6,355 crore for FY17.

Reacting to the results, shares of Yes Bank plunged nearly 10 percent in opening trade on Friday. It hit a low of Rs 298.55. At 09:20 am, Yes Bank was trading 8 percent lower at Rs 304.

Yes Bank reported a 25 percent jump in net profit for the second quarter ended September 2017. It increased to Rs 1,002 crore from Rs 802 crore a year earlier, but the bank had to set aside Rs 447 crore as provisions which were one-and-a-half times higher than the Rs 162 crore reported a year earlier, said a report.

As on March-end, 2017, Yes Bank had reported gross NPAs of Rs 2,018.6 crore as against RBI’s assessment of Rs 8,373.8 crore in the same period.

Similarly, for net NPAs, the difference in divergences was to the tune of Rs 4,819.4 crore, when RBI’s report suggested net NPA figure of Rs 5,891.6 crore.

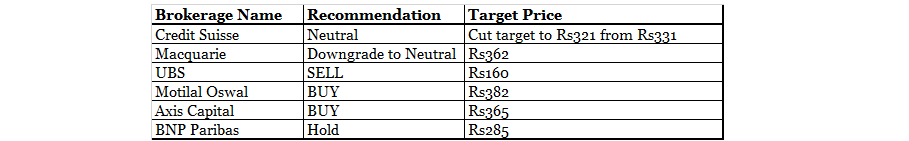

Here’s what global brokerages said post Q2 results:

Credit Suisse maintains neutral| Cuts target price to Rs321 from Rs331

Credit Suisse maintains a neutral rating on Yes Bank post-September quarter results and slashed its 12-month target price to Rs321 from Rs331 earlier.

The previous quarter performance was overshadowed by large NPA divergence. Earnings per share and price target cut is likely to build in higher credit costs.

The loan growth remains strong but asset quality worsened sharply, said the Credit Suisse note. Given large divergence in NPA trading multiples are likely to remain capped, it said.

Macquarie downgrades to Neutral from Outperform: Target Rs362

Macquarie downgraded Yes Bank to neutral from outperform but maintained its target price to Rs362. Growing trust deficit will be a big overhang on the stock which resulted in the downgrade.

It is difficult for the stock to re-rate further from here. The management says it has no exposure to Jindal Steel and Power Ltd. and has sufficient real estate collateral against accounts sold to assets reconstruction companies.

UBS maintains SELL| Target Rs160

UBS maintains its sell rating on Yes Bank with a target price of Rs160. The non-performing loan risks are not fully reflected and continue to expect credit cost of 165 basis points and 145 basis points during the current financial year and next financial year respectively.

Indian Accounting Standards would pose additional challenges due to change in fee income recognition rules. It expects a sharp increase in the gross non-performing loans which remains a key factor for Sell view.

BNP Paribas maintains hold| Target Rs285

BNP Paribas maintains a hold rating on Yes Bank and maintains a target price of Rs285.

The global investment bank is of the view that as the divergence issue persists, investor focus will return to asset quality. It believes that potential de-rating will start discounting growth multiple for the bank.

The growth momentum is strong, and focus on retail continues. The liability profile is changing, and the CASA ratio grows to 37 percent. The asset quality concerns limit upside in our view and we maintain hold rating on the stock with a target at Rs285/share, said the note.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.