With the stock indices touching a new high, the earnings growth for Nifty 50 index constituents will taper to 21.2 percent in FY24 from 22.9 percent expected for FY23, according to Bloomberg consensus expectations. The decline is mainly due to an expanded base and slowing of export revenue amid fears of a recession that could affect demand.

However, the performance of the energy sector, which is closely linked to crude oil prices, will hold the key, said Mayuresh Joshi, head of equity research at William O’Neil & Co.

Controlled inflation, a peaked out bad-loan cycle and good agricultural output will lend some support to the Nifty 50, said G Chokkalingam, founder of Equinomics Research.

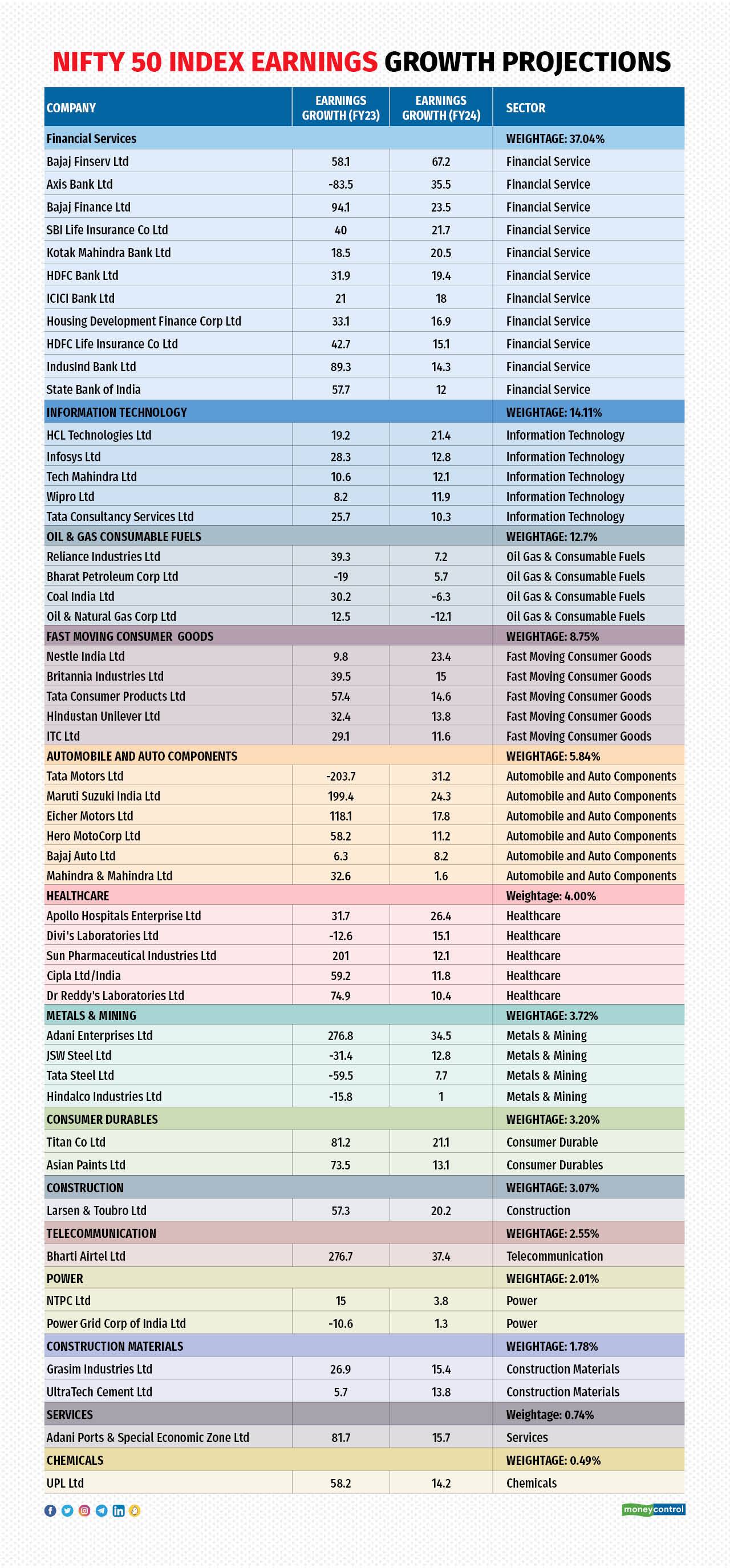

Bajaj Finserv, Bharti Airtel, Axis Bank, Adani Enterprises and Tata Motors are likely to be the biggest contributors to EPS growth in the Nifty 50 index in FY24, according to a Moneycontrol analysis.

A real turnaround in EPS growth is expected in Axis Bank and Tata Motors, according to Bloomberg data. On the other hand, EPS growth is narrowing for Bharti Airtel and Adani Enterprises.

How the valuations stack up:

According to Bloomberg, the Nifty Index’s PE is expected to contract to 19.2 times in FY24 from 22.9 times in FY23 mainly on account of higher earnings for the next financial year.

According to Gautam Duggad, head of research – institutional equities at Motilal Oswal Financial Services, the Nifty price to earnings for the next 12 months at 20x is well within the 10-year average of 19.6 times because earnings have caught up while the markets were little changed for the past 12 months.

According to Gautam Duggad, head of research – institutional equities at Motilal Oswal Financial Services, the Nifty price to earnings for the next 12 months at 20x is well within the 10-year average of 19.6 times because earnings have caught up while the markets were little changed for the past 12 months.

With earnings growth of 16-17 percent for FY24, the markets should, by and large, reflect underlying earnings without much de-rating/re-rating. On a granular basis, Axis Bank and Adani Enterprises are trading at higher valuations than their 10-year average, while Bharti Airtel, ONGC and Tata Motors are trading at steeper discounts.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.