Market rose more than a percent amid volatility as investors were cautious ahead of Fed outcome, renewed tension between China & US and fear of rising Delta variant cases across the world.

Indian benchmark indices, Sensex and Nifty, touched their fresh record high levels of 56,198.13 (on August 25) and 16,722.05 (on August 27), respectively. However. For the week BSE Sensex added 795.4 points (1.43 percent) to close at 56124.72, while the Nifty50 rose 254.7 points (1.54 percent) to end at 16705.2 levels.

The broader indices outperform the main indices with BSE Mid-cap and Small-cap indices adding 2-2.5 percent.

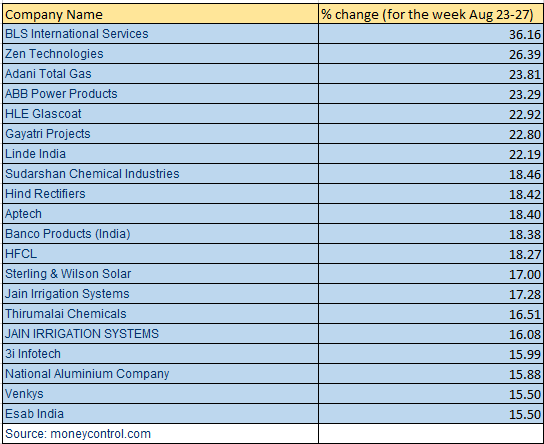

Among smallcaps, more than 50 stocks gained between 10-36 percent. These include names like BLS International Services, Zen Technologies, Adani Total Gas, ABB Power Products, HLE Glascoat, Gayatri Projects, Linde India and Sudarshan Chemical Industries.

On the other side, Capacite Infraprojects, Karda Construction, NELCO, Sadbhav Engineering, Wockhardt, Ujjivan Financial Services and Inox Wind fell 10-23 percent.

“Mid and small cap stocks were in focus this week as value-buying led to a recovery in the sector leading to its outperformance,” said Vinod Nair, Head of Research at Geojit Financial Services.

“In the coming week, the market expects the release of key economic data such as Q1 GDP growth rate and Manufacturing & Service PMI. The Q1 GDP is expected to show a sharp growth owing to a low base and recovery in economic activities towards the end of the quarter," Nair added.

The BSE 500 index rose nearly 2 percent supported by Adani Transmission, New India Assurance Company, Adani Total Gas, ABB Power , Products, Hindustan Aeronautics, Linde India and Sudarshan Chemical Industries.

“The market suggests 16500 will be an important support level in the short-term perspective. If the market breaches the level of 16720-16740 and is able to sustain above this level, the market expects to gain momentum, leading to an upside projection of 16950-17000 levels,” said Ashis Biswas, Head of Technical Research at CapitalVia Global Research.

“The momentum indicators like RSI and MACD to stay positive and market breadth to improve, further strengthening the short-term bullish outlook,” he added.

Where is Nifty50 headed?Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak SecuritiesGoing forward, Indian Markets would keep an eye on signals from the Fed, commodity prices, the pace of vaccination process in India, unlock measures by various states, GST collections, monsoon development Pan India, progress on Asset Monetisation Programme (AMP), and other reforms from the Central Government.

FPI inflows have not been very exciting despite the general market bullishness and a spate of IPOs. We expect FPI flows to be volatile in the near terms, given the indication of the likelihood of tapering of assets, which could have a major impact on global equity markets. In addition, the impact of the third wave of COVID-19 in developed economies would also impact the overall flow.

Joseph Thomas, Head of Research, Emkay Wealth ManagementThe global markets are looking forward to the Jackson Hole Speech by the US Fed Chairman , for more specific hints on the tapering that is likely to be set in motion, may be later this year, or early next year. The sense that Fed Chairman’s speech makes, in the context of the details of the US economic performance, may have some impact on the thinking of the markets in the coming weeks.

Samco ResearchIndian bourses are expected to face whipsaws post Fed’s Jackson Hole meeting outcome. Participants are eager to understand the timelines for gradual tapering of bond purchases to judge the mood on the Street.

Markets could also be impacted by an eventful economic calendar which begins with quarterly GDP growth rate numbers, followed by auto sales numbers and manufacturing PMI data. Profit booking may occur in certain overpriced stocks, however investing in high quality companies in stages would be a smart strategy.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.