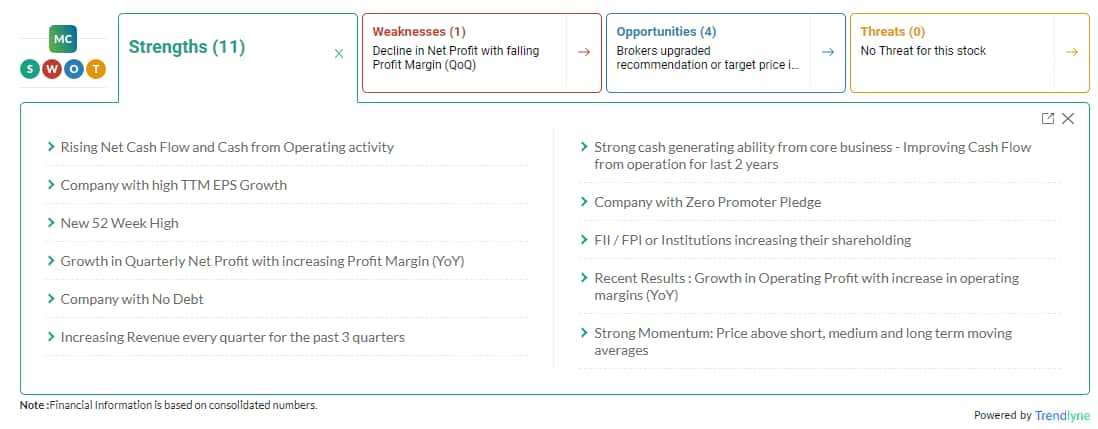

IT stocks remained in focus today with the Nifty IT index adding over 1 percent. Mindtree is the top gainer of the bunch. The stock was up over 5 percent at hit a fresh 52-week high of Rs 2,342.60. It has rallied 163 percent in the last 12 months.

The company reported a 2.8 percent sequential decline in consolidated profit to Rs 317.3 crore for the quarter ended March 2021.

Consolidated revenue grew by 4.2 percent quarter-on-quarter to Rs 2,109.3 crore and the dollar revenue at $288.2 million was up by 5.2 percent from the previous quarter.

The management’s increased focus on annuity revenue and tail account rationalization is already reflected in its revenue and client mix, said broking house Motilal Oswal.

A stable outlook for the top account, decent deal signings, and the ability to sustain improved margin are key positives. Consistent margin expansion and a positive outlook on the same are key positives. Higher exposure to the Travel, Transport, and Hospitality segments remain a drag on overall recovery, it added.

The stock has been one of the best performers in the IT sector in the last one-year. The key positives are already captured, and we see limited upside hereafter. Our target price stands at Rs 2,180/share. Maintain neutral, Motilal Oswal added.

The company in the last week announced that it will acquire the NxTDigital Business, the cloud-based IoT and AI platform of L&T Group.

The acquisition is subject to customary closing conditions.

Research house Emkay is having sell rating on the stock with a target price of Rs 1,650 at 20x FY23E EPS, considering the rich valuation, dependency on top client and limited success in broadening revenue growth, and anticipated pressure on margins over the medium term.

At 11:55 hrs, Mindtree was quoting at Rs 2,320.35, up Rs 112.20, or 5.08 percent on the BSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.