ICICI Bank’s proposal to delist its subsidiary ICICI Securities has surprised the market. The broking firm is on a growth path and delisting it at the right time will give it more freedom to innovate in the highly disruptive sector, believe most market participants.

As cash market volumes took a hit after the COVID-19 lockdown, ICICI Securities was quick to diversify. It has been growing its derivatives segment steadily even as it expanded into loans and wealth management. It also remains among the top five brokerages in the country with 7 percent market share of active National Stock Exchange clients.

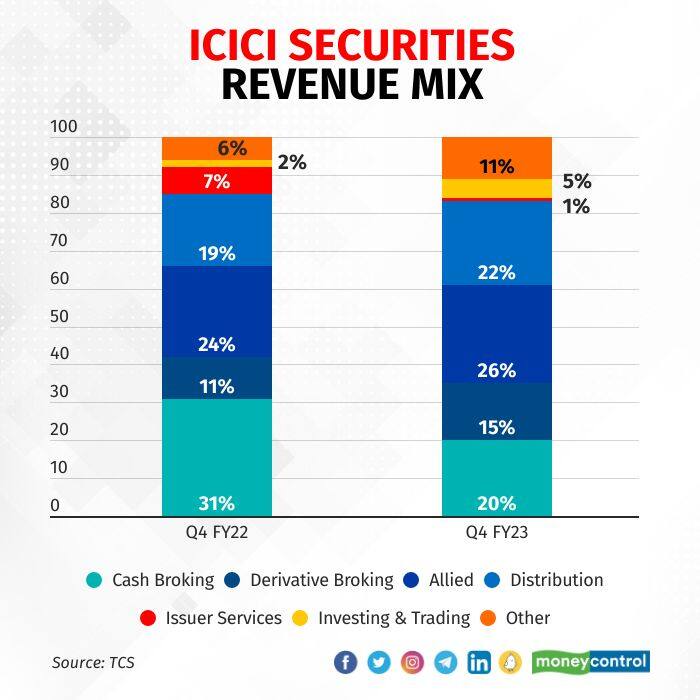

For instance, the proportion of cash equity broking in the company’s overall revenue has decreased to 20 percent from over 50 percent a few years ago. Derivative brokering revenue has now been increasing for the last seven quarters and currently stands at about 15 percent of the total revenue stack. Share of distribution business revenue has jumped from 19 percent to 22 percent in a year.

“Furthermore, the company is sitting on cash and cash equivalents of Rs 6,790 crore and is trading at a forward price-to-earnings ratio of 11x. At 42 percent, it has high return on equity compared to other listed brokers. Yet, the market is not rerating the stock. So the promoter might have decided to take matter into its own hands,” said a fund manager, on condition of anonymity.

ICICI Bank holds 74.85 percent in ICICI Securities.

Big plans awaiting?The news around the delisting comes at a point when the company is clearly gearing for a mega transition, said Nirav Karkera, head of research at financial services firm Fisdom. “ICICI Securities is improving its product mix by focusing on high-margin products,” he added. From 52 percent in FY20, the broking firm has taken its operating margins to 62 percent in FY23.

The ramp-up in the wealth management business has been a big margin driver. The firm has 78,000 customers in this segment with assets of Rs 3.2 lakh crore under management. In the quarter gone by, it also increased its market share by about 30 basis points in the derivatives segment with the launch of products such as Flash Trade, Algos, APIs, Option Plus, etc. Another such product is also in the works, said a person familiar with the development.

The third growth lever identified by the management is the distribution of loans. ICICI Securities distributed a total of about Rs 3,750 crore of loans for FY23, a 66 percent growth on an annualised basis. “We went live with our arrangement with Tata Capital for loan against shares as well as personal loans. So, we should start seeing some traction in this as well,” managing director Vijay Chandok had said in the Q4 earnings conference call.

What’s in it for the bank?In this context, it becomes easier for the promoter to delist the company and explore cross-selling opportunities.

“It is likely that the capital required for expansion can be met in-house. Moreover, the bank can leverage ISec’s capabilities as a distribution arm which would provide more freedom to innovate,” said Rikesh Parikh, principal officer at Rockstud Capital.

Notably, most bank-owned securities companies like HDFC Securities, Kotak Securities and Axis Securities are closely held. So ICICI Bank’s announcement is in line with what its peers are doing.

“ICICI Securities is valued at a discount when analysts do a sum-of-parts valuation for ICICI Bank, as is the case with most holding companies. Once ICICI Securities is integrated with the bank, the earnings will be consolidated under the bank and that part of earnings will also get the same valuation as that of the bank, mean could result in a overall pop,” said an analyst covering the sector, who did not want to be identified.

A long-drawn processContrary to expectations of a cash payout, the delisting will be done through a share swap process. This means shareholders of ICICI Securities will get shares of ICICI Bank. The swap ratio will be announced after the board meeting to be held on June 29.

“The ratio has to be closely watched. The delisting process will be successful if shareholders accept the proposal and are willing to swap, thus taking promoters stake up till 90 percent,” said Shriram Subramanian, founder of InGovern, a corporate governance research firm.

All eyes are now on the merger ratio. On June 26, ICICI Securities' stock ended at Rs 626, higher by 11 percent from previous close.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!