The board of government-owned natural gas explorer and distributor GAIL India is going to decide on issuing bonus shares on Wednesday, July 27. In anticipation, the stock's movement has intensified.

On July 23, GAIL India climbed nearly 4 percent after a decline of about 2 percent in the previous sessions as analysts believe a short covering has begun in the counter ahead of a major corporate event. This will likely continue.

GAIL India Futures are likely to outperform on the long side on Tuesday (July 26), options and chart data shows. On Monday (July 25), the price traded above volume-weighted average price (VWAP) and options chain data showed strong unwinding of calls in strike prices above the current price.

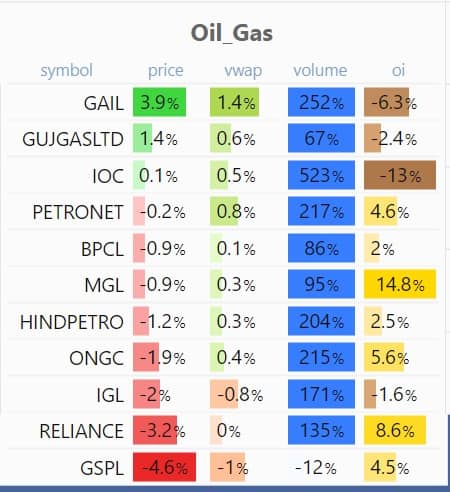

In the oil & gas segment, GAIL India was the biggest gainer on July 25 with volumes over three times the average. The stock has performed well in recent months amid rising natural gas prices in the international market. In last one month, it is up 9 percent and year-to-date it has risen 12 percent.

Thanks to its recent rally, the stock also closed above the 200-day moving average (DMA) line that is emerging as a very strong support. The 200-DMA line is often considered the dividing line between a bull and a bear phase.

As of July 25, the 200-DMA stands at Rs 145.80, while GAIL India closed at Rs 147.

Options chain data shows unwinding in call options above GAIL's July futures' closing price of Rs 147.55. This means that bears are likely to be seen exiting the counter.

July futures contract is scheduled to expire on Thursday (July 28).

At the same time, very strong support is being seen in Rs 140-142.5-145 put strikes on the right side of the chain. Overall, bulls are seen on the front foot as the total put Open Interest (OI) change is positive compared with a fall in call OI change.

Disclaimer: Futures and options are extremely risky. This is just a view based on closing price and options data. Please consult your own financial advisor before taking a position.Options chains statistics are subject to differing interpretations based on the trader's own perspective of where the underlying stock is headed. Mostly, an unwinding in calls coupled with strength in put writing is considered to be a bullish scenario by options traders.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.