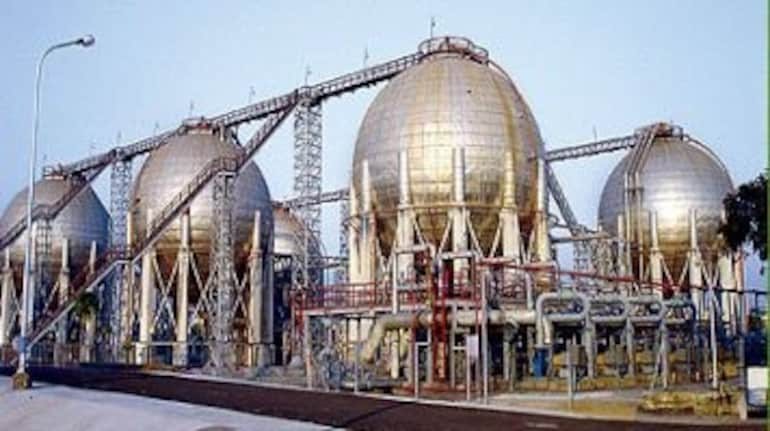

KRChoksey's report on GAIL IndiaGAIL’s under-recovery sharing was nil for 1QFY16 (vs Rs 5bn YoY, nil QoQ). We expect no subsidy sharing going forward.Revised agreement with Ras Gas on LT RLNG and upward revision in pipeline tariffs could act as positive triggers.The company owns 11,000 kms of natural gas pipelines. GAIL has also forward integrated itself by putting a LPG-separation plant, a 440 KTPA of ethylene gas-based cracker and further downstream Polyethylene. The firm dominates the city gas distribution business as it either has stakes in the CGD entities or runs the same through its 100% subsidiary Gail Gas Ltd. GAIL is also involved in natural gas trading, where it sources gas from domestic producers and also imports LNG and sells it to domestic customers. It has recently commissioned a 5 mtpa LNG terminal at Dabhol.Valuation"We believe the long term prospects of the stock to be positive with new gas supplies however there are no near term triggers. Government has initiated to supply LNG to stranded power plants which will eventually increase transmission volumes and profitability despite decline in tariff’s and margins. Petchem and LPG margin outlook remains weak in near term. We believe that although the transmission volumes have bottomed out and will pick up by mid of FY16 with the ramp up of Dhabol terminal, expansion of the Dahej terminal and ramp up of the volumes of Kochi terminal. There are certain overhangs on the stock which will keep the performance of the stock under pressure namely higher input cost (internal consumption gas cost) due to nearly nil KG D6 volumes, higher APM price (marginal impact), further fall in the domestic gas volumes and lack of clarity about the subsidy burden for FY16. Currently GAIL is trading at 8.5x FY17 EPS of Rs. 32.4. We believe the recent price correction has increased the attractiveness of the stock and therefore we recommend BUY on the stock with a price of Rs. 350/share based on SOTP methodology", says KRChoksey research report.For all recommendations, click hereDisclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.