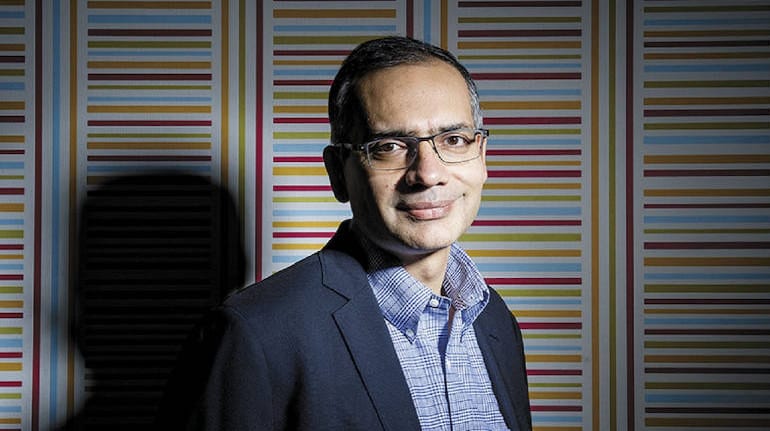

Travel aggregator MakeMyTrip is thinking about an India listing, the company's founder and chairman, Deep Kalra said while talking about the internet sector in India at Delhi on September 2.

"We are thinking of listing here. When we listed in 2010, India was not ready for internet stocks," he said at the India Internet Day conference organised by TiE Delhi-NCR.

The Nasdaq-listed company settled at $33 dollars apiece on September 1. The stock has risen 31 percent since going public over a decade ago.

Kalra said that some of the internet companies which went public last year in the country may have been misguided.

"Someone misguided them that all of them were ready to go out... You need to be at least able to say that the company can be profitable in the next 2 or 3 years. Investors (in the public market) like solid, comfortable predictions. They don't like choppiness," he explained.

According to the travel aggregator's founder, public market investors and analysts in the country ascribe a lot of importance to metrics like price-to-earnings ratio and earnings per share.

Kalra also cautioned that growth stage start-ups with 18-24 months of runway might find themselves in troubled waters if they don't focus on profitability and the market for tech stocks doesn't turn by 2024.

He also said that while the Information Technology boom of the late 1990s and early 2000s happened 'despite the government', the rise of tech startups in the country in the past few years couldn't have happened without government-backed tech innovations like the United payments interface (UPI).

"We have come a long way in 10 years. We have moved on every stat possible. There were 120 million internet users then, today we have more than 700 million," he said.

"E-commerce was at 10 million users, today that number is 350 million. We have grown 30X effectively," he added.

A slowdown in the funding of growth and late-stage technology companies was the flavour of discussions at the internet conference on Friday. While investors and entrepreneurs conceded that early-stage start-ups do not have a lot to worry about in the near term, they maintained that a path to profitability was the writing on the wall for more mature companies.

According to data by Tracxn Technologies, the average monthly Series B and Series C rounds for startups, typically called growth-stage rounds, have fallen 25 percent year in the first half of the year.

"People are talking about the funding winter, stock values and how long is this going to last. There are so many questions... The holy grail of any business is how do we cut down on costs and yet not compromise on growth," said Kalra.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.