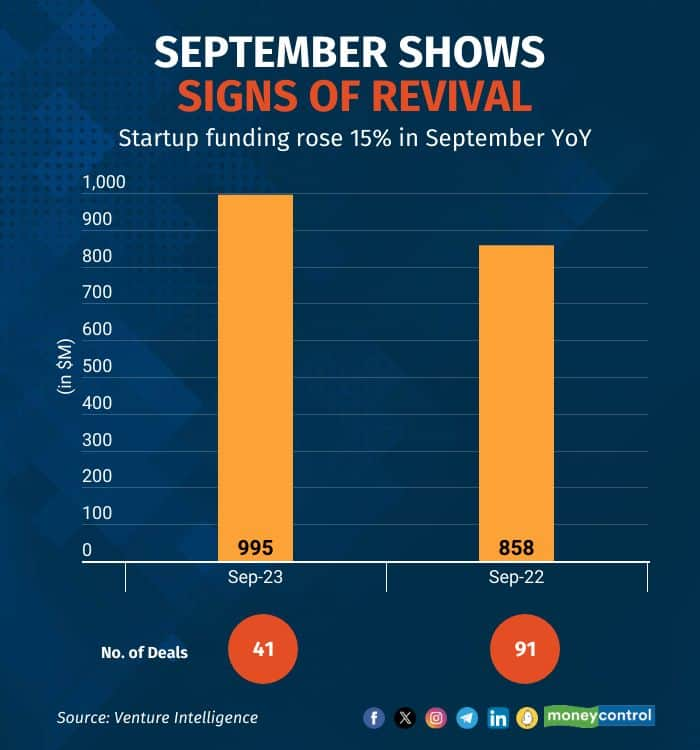

Funding to India’s startups was up 15 percent in September from a year earlier as late-stage deals staged a comeback, indicating signs of some green shoots ahead in what would bring some cheer to the world’s third-largest startup ecosystem.

Startups raised close to a billion dollars in September this year across 41 deals, up from $858 million raised across 91 deals in the same month of last year, data compiled by Venture Intelligence showed. The month also saw three deals of more than $100 million each, which propelled the deal amount to close to $1 billion.

Perfios Software, a Business-to-Business (B2B) software provider for financial institutions raised $229 million in its Series D funding round from private equity firm Kedaara Capital through a combination of a primary fund raise and a secondary sale, in what was September’s largest funding round.

Perfios was followed by two electric two-wheeler startups – Ola Electric and Ather – which raised $140 and $108 million respectively.

Notably, the three rounds were also among the largest rounds raised by startups this year, with Lenskart leading the pack with its $500 million fundraise.

“India digital is a large opportunity and VCs today are sitting on a lot of money. So while the current pace of investment is slow, it is not because of lack of funds or opportunity. It’s a matter of performance and pricing. Once that aligns, we should see the pace pick up,” said Navjot Kaur, Partner at Epiq Capital, a late-stage investor in unicorns like Lenskart and Pristyn Care.

“It all boils down to performance, growth, and cash runway. If a company is high growth with good margins, it should be able to justify its valuation or grow into its valuation. Companies with high performance or enough cash runway or both will not face repricing pressure,” she added.

With three large deals happening during the month, the average ticket size also doubled to $24 million in September this year from a little under $10 million in September 2022.

However, while late-stage deals made a comeback, early-stage deals remained low in September, according to the data. To be sure, about 9 startups have raised $10-35 million in funding rounds in the past two weeks.

However, VI data suggested that startups in early-stage (Seed to Series A) raised $75 million across 19 deals this month compared to $191 million raised across 59 deals in September 2022. While early-stage deals were higher compared to the previous month, the value was much lower than in June and July 2023, data by Venture Intelligence showed.

“It (lower funding at even early stages despite many VC early-stage firms sitting on a lot of dry powder) has got a lot to do with sentiment. Right now, the overall sentiment is down, so naturally you see the investments being down,” said Apoorva Ranjan Sharma, Co-founder and President of Venture Catalysts, an investor in four edtech startups, including Tiger Global-backed unicorn Vedantu.

“Secondly, some other asset classes are doing well. The stock market is at an all-time high, real estate is doing well so some larger investors are choosing these sectors over startups. Some good startups will still get funds, but these need to have either a strong bottom line or a hockey-stick-like growth trajectory,” he added.

Moreover, the overall funding, in the first nine months of 2023 too remained much lower than the previous year. Between January and September 2023, startups in India raised $5.9 billion across 434 deals compared to $21.4 billion raised last year across 1,037 deals in the same period.

On a global scale, factors such as rising interest rates and more stringent monetary policies led venture capital and private equity investors to exercise caution in their selection of companies for investment.

In India, many investors expressed concerns about the overvaluation of startups; this sentiment was echoed by industry observers including Sameer Nigam from PhonePe, Nithin Kamath from Zerodha, and Rajeev Misra from SoftBank, who all voiced their opinions on the potential overestimation of India's market.

“Valuations are not hyped by founders. It is hyped because there is competition among VCs to take a deal. When there’s a lot of demand for a good startup, automatically, by giving a higher valuation, VCs enter,” said Sharma.

“So that’s the reason we have seen unrealistic valuations at times. But when downtimes like these come, startups should focus on resilience and should rationalise costs, and also take money, if required at lower valuations. Companies like Flipkart, in the past, have done this because they realised how crucial it was for them to raise funds at rational valuations,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.