Open, a neobanking platform for Small and Medium Enterprises (SME), has raised $50 million at a valuation of $1 billion, sources revealed to Moneycontrol. This makes it the 100th unicorn to emerge from India, marking a seminal moment for the Indian startup ecosystem.

The Series D round was led by IIFL and also saw participation from existing investors Temasek, Tiger Global and 3one4 Capital. The round was majorly a primary raise, with a small secondary component. The company is also the 16th unicorn of 2022.

The round comes just six months after Open raised $100 million led by Google, Temasek, Visa, and Japan’s SoftBank Investments. The compay's valuation post the last round was $500 million, and the valuation has doubled with this round. Moneycontrol was the first to report that Open will soon look at a follow on round to reach the $1 billion valuation.

Also Read | Startups and Unicorns: We have met the enemy and they are us

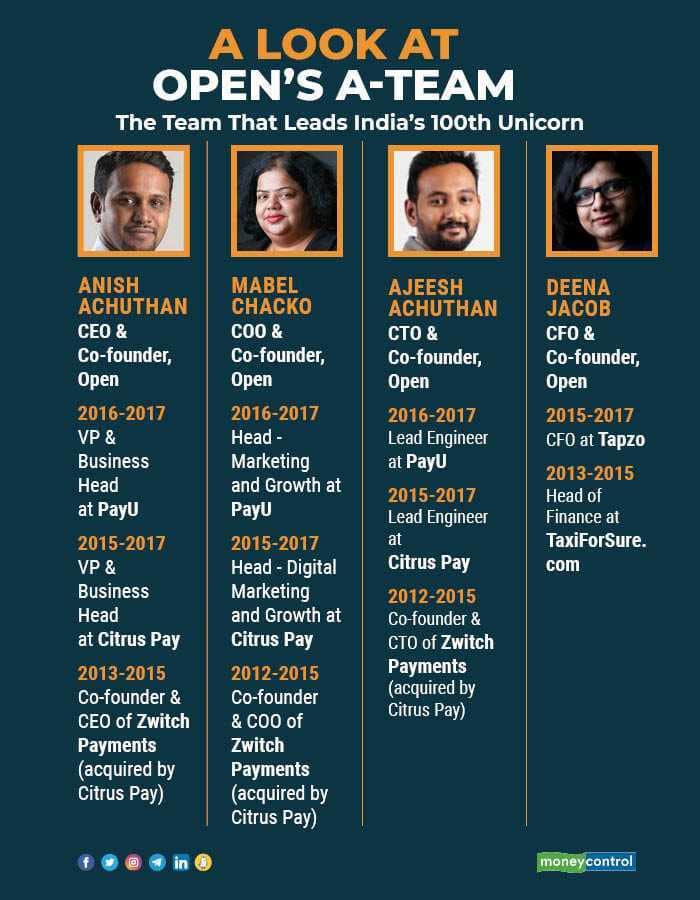

Founded in 2017 by former PayU and Citrus Pay executives Anish Achuthan, Mabel Chacko and Ajeesh Achuthan, along with Deena Jacob, Open focuses on small and medium-sized businesses by offering them a business current account. The account includes services like digital banking, payments, invoicing, and automated bookkeeping services.

Anish Achuthan, Mabel Chacko and Ajeesh Achuthan are second-time founders and became a part of Citrus Pay and later PayU after their first startup Zwitch Payments was acquired by Citrus Pay in 2015. Open is also one of the rare unicorns with two women co-founders.

Open’s fundraise underscores investor confidence in India’s startup ecosystem, which recently got recognized as the world’s third-largest. So far in 2022, India has seen 16 new unicorns.

This is on the back of a blockbuster 2021, when the country saw as many as 44 unicorns getting minted with investors pouring billions of dollars.

The platform is gearing up for the launch of three new products aimed at enhancing the capital needs of SMEs apart from its existing SME credit card offerings. The new products include Open Flo – an innovative revenue-based financing product for ecommerce businesses, Open Settl – early settlement credit offering and Open Capital – working capital lending offering for SMEs. Open is targeting to disburse $1 billion in lending through the new suite of products on the platform in the next 12 months.

While a few unicorns have struggled to raise funds in 2022, especially at late stages owing to their high cash-burn model, corporate governance lapses, among other issues, venture capital firms like Sequoia and Accel have raised or are in the process of raising large funds to invest in startups in India, indicating their bullishness on India’s startup ecosystem.

Moneycontrol had earlier reported that Accel has raised a $650 million fund, its seventh focusing on India, while Sequoia Capital India was in talks with its parent in the US and investors to raise $2.8 billion in funds for Indian and Southeast Asian startups.

Minister of Science and Technology Dr Jitendra Singh recently said that the country was now at number three in the world in terms of unicorns and that there are 99 unicorns in the country.

Inc42's unicorn tracker too shows 99 unicorns. Trackers by CB insights and Venture Intelligence show 96 and 95 respectively.

Also Read | India is moving towards making the 'century of unicorns' in a very short time: PM Modi in Lok Sabha

For Open, this is also a strategic partnership with IIFL as it works towards launching its lending vertical for SMEs. The startup will be able to leverage IIFL's Rs 2,000 crore loan book, sources added.

The company is also working on accelerating its new product lines – Zwitch, its embedded finance platform and BankingStack, the cloud-native SME banking platform for financial institutions which is currently deployed at over 15 Banks in India.

Over the next year, Open will expand its base to five million SMEs and expand to global markets like South East Asia, Europe and the US.

Moneycontrol reported on January 7 that TVS Capital Funds was likely to lead the Series D round, however according to multiple sources, the talks did not go through.

One of the sources told Moneycontrol on the condition of anonymity, "Open was in talks with a number of investors and discussions with TVS Capital Funds were at an advanced stage. But both parties mutually decided to not go ahead with it. Moreover, IIFL is more of a strategic partner for their lending plans."

The startup’s other investors include BEENEXT, Speedinvest, AngelList, Tanglin Venture Partners, Unicorn India Ventures and Recruit.

While the neobanking space has a large number of players including Jupiter, Freo, Niyo, EpiFi etc., Open directly competes with RazorpayX which is also an SME-facing neobank. The other players provide banking solutions for individuals.

As per the startup’s latest financial filings for the financial year 2021 (FY20), the company had reported a loss of Rs 65.7 crore, with total revenues at Rs 15.7 crore, according to a report by Inc42.

With inputs from Nikhil Patwardhan.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!