In May this year, Z (name changed), a provider of co-living spaces for professionals, approached one of India’s biggest late-stage startup investors for a new funding round. The company was eyeing a $150 million fundraise at a substantial upside to its soonicorn valuation.

Backed by marquee investors including Sequoia (now Peak XV Partners), Z had raised more than $100 million in equity in the two pandemic years, projecting robust growth to investors.

Flush with funds, Z had hired aggressively to expand and match the expectations it had projected. The company’s revenue growth did not match expectations in FY21-22 and FY22-23. But Z was unable to bring down its burn, prompting it to raise funds.

However, with investors looking at investment metrics differently, Z’s offer was passed on by the global investor mentioned above. The company, since then, has been struggling to find takers for the valuation it is demanding.

“It’s one of those pandemic companies. Is it really a tech company? I don’t think so, it’s more of a real estate company, and so the multiples need to be different,” said the investor mentioned above (added).

“The kind of multiple it commanded in 2021, it won’t be able to get that in 2023. They were commanding a tech multiple then, but not anymore. No one will pay 25-30 X multiple for a real estate company with a bit of tech,” the person added.

Fund-raising challengesAnother person who’s aware of Z’s affairs said the company will have to reprice itself and settle for a down round. A down round is when a company raises funds at a valuation lower than its previous round.

“Z needs funds for growth. So they will have to settle for a down round, especially in this environment. If not, the existing investors may pool in more capital, which will provide the company with a 12-18 month runway. But that will be survival, not growth,” the person added.

It’s not just Z. In a meeting on July 19, Google and Reliance-backed quick commerce and hyper-local delivery startup Dunzo’s co-founder and CTO Mukund Jha admitted to employees that the company had kept fundraising talks going for a while, as it wanted a healthier valuation even as it needed capital to continue operations.

“One of the reasons to delay an equity raise has been to ensure we’re valued correctly,” he said.

Z and Dunzo are among several growth and late-stage startups facing challenges in raising new funds. Founders are unwilling to lower their company's valuations, and investors are hesitant to invest at 2021 levels.

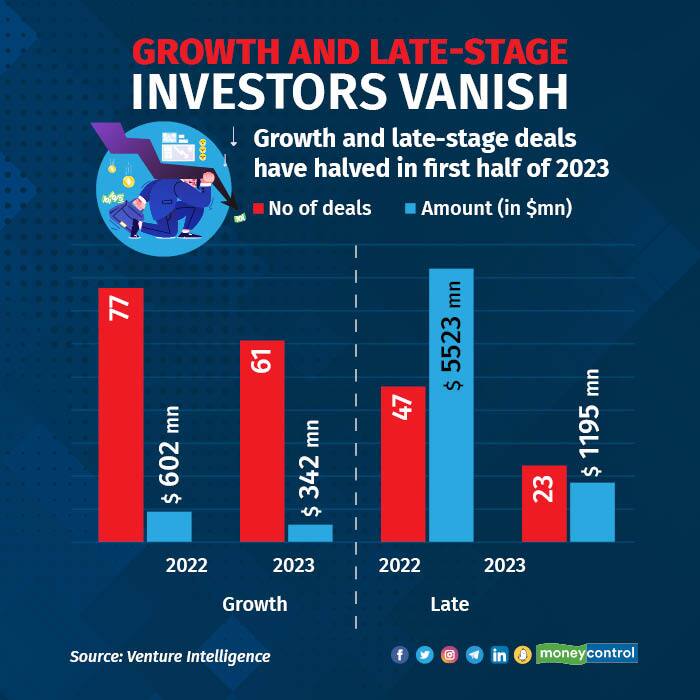

Over the past 18 months, numerous instances similar to the two cases mentioned have come to light, highlighting how late-stage investors have been altering their investment criteria. As a result, late-stage deals have experienced a significant decline this year.

According to data compiled by Venture Intelligence, during the first six months of 2023, there were only 23 late-stage deals amounting to a total capital of $1.2 billion. This is in stark contrast to the year-ago period, which saw 47 deals worth $5.5 billion. Industry insiders have observed differences in how investors are looking differently at valuations.

“For instance, 4-5 years back, GMV (gross merchandise value) was the north star of e-commerce metrics and an important determinant for valuation. Today, investors focus less on GMV and more on profits,” said Neeraj Shrimali, Managing Director and Co-head, Digital and Technology Investment Banking, Avendus Capital.

“Now investors want certainty around profitability. PE investors or late-stage VCs want to see profitability in 6-18 months. This is real profitability that is not adjusted against any costs. Investors are still keen on companies that aren’t profitable, as long as they have the right unit economics in place. Otherwise, it will be difficult to raise funds,” Shrimali added.

Late-stage investors in India have avoided most deals this year as they are still grappling with the aftermath of the bubbly and exuberant Indian startup party, which resulted in inflated valuations.

SoftBank, Alpha Wave Global, Insight Partners, DST Global, and Sofina among other late-stage venture capital investors, who were very actively investing in the pandemic years between March 2020 and March 2022, have cut very few cheques since then, data compiled by Moneycontrol showed.

In fact, these investors have not participated in a single deal in 2023 yet. These investors were behind a majority of growth and late-stage deals between 2020 and 2022.

“The entry points (price) of most of these startups are not attractive currently. This is not just the soonicorns (a startup that’s expected to soon hit a billion Dollar valuation), but even the unicorns (firms valued above a billion Dollars). Companies haven’t grown into their valuations and that’s a big problem some of the late-stage guys are witnessing,” said a veteran late-stage investor, whose investment firm has backed more than 60 startups in India, including 12 unicorns.

“The Covid period was the era of cheap capital, there was excitement all over. India’s internet market was booming and so on and so forth. All these things led to inflated valuations. For me, and for a few peers, (late-stage) opportunities in India are a problem, more than funds or any macro headwinds,” the investor added.

Even SoftBank’s Rajeev Misra, in an interview with Moneycontrol earlier this month, said that capital isn’t a constraint for the Japanese investor when it comes to investing in India, but opportunities are. SoftBank, through its Vision Funds, typically makes investments in hundreds of million Dollars.

“In India, only the top players have sizeable revenues. Not beyond that. Unlike the US, where even the third-largest player would have a very large revenue pool,” Shrimali said.

“Investors are becoming more particular about these things before investing. When it comes to valuations, there is a correction for most players from multiple perspectives. Even market leaders have taken a hit in their valuation multiples,” he added.

With late-stage investors refraining from taking part in investments, India has not witnessed a new unicorn in the last 10 months, in what is the largest unicorn drought for the world’s third-largest unicorn ecosystem in five years. Moneycontrol has previously reported how there seems to be no unicorns in the pipeline as well.

Shrimali, however, said that the pace of deal-making in the late stages has picked up. But as deal closures are taking longer compared to 2021, we might see late-stage deals getting announced only over the next two quarters.

“I think you will see several unicorns and late-stage deals later this year. Four-five years back, there were 15 companies which were of interest to late-stage investors, now there are almost 50. The market is getting deeper and so you will see more unicorns and more $5-7 billion companies,” Shrimali explained.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.