With schools, colleges, and physical tuition centres reopening, India's edtech startups have struggled to raise funds from investors this year. To make matters worse, the much-discussed funding winter has made it difficult for edtech startups to raise funds.

Despite this, a niche category of online learning - higher edtech and upskilling - appears to have found favour with investors due to continued growth in demand for their offerings.

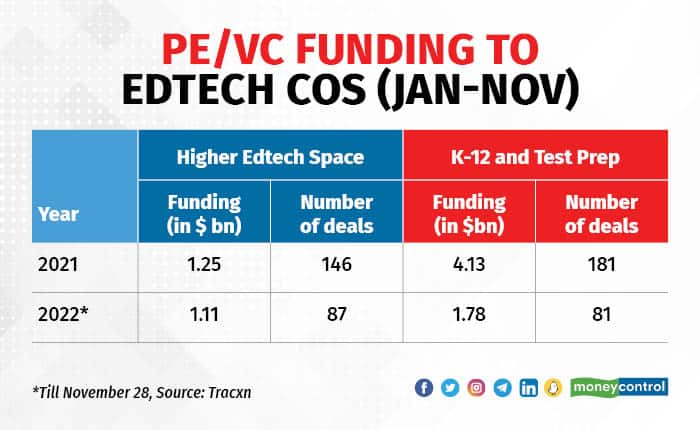

Higher education and upskilling startups have raised $1.1 billion in private equity and venture capital funding so far this year, slightly less than the $1.25 billion raised in the first 11 months of 2021, according to data by Tracxn Technologies.

K-12 (kindergarten through class 12) and test preparation platforms, on the other hand, have seen a 60 percent decline in funding during the same period. According to the data, K-12 and test prep startups have raised $1.78 billion so far this year, compared to $4.13 billion in the first 11 months of 2021.

Employees have felt the need to upskill themselves as a result of technology companies around the world laying off millions of people across departments, industry observers said. Companies such as Ronnie Screwvala's upGrad, SoftBank-backed Eruditus, and Blackstone-backed Simplilearn, among others, have thus seen continued demand for their offerings.

Mayank Kumar, managing director and co-founder of upGrad, said during a Moneycontrol Masterclass in July that the higher education and upskilling space is counter-cyclical because learners tend to upskill themselves during times of job loss and recessionary fears.

In addition to raising millions of dollars from investors, edtech companies in the higher education and upskilling space have expanded to newer categories, acquired companies, and laid off very few employees, while some of the country's largest and most-funded edtech startups have laid off thousands of employees and slowed expansion.

“In India, you have Scaler, upGrad, Great Learning and you have global players like Emeritus and Simplilearn, overall all these companies are doing really well, and they are counter-cyclical because even in a global economic downturn or a tough environment people invest in their education, they invest in what they feel will help them do well professionally,” said Mujtaba Wani, Partner at GSV Ventures, an investor in Eruditus and Simplilearn.

“As long as education companies can continue to bring the promise or prospect of a brighter future, a better career, and a higher salary. They will do really well,” Wani added.

Expansion drive

upGrad announced earlier this month that it will invest $30 million in the next year to launch ten global institutes under its new brand UGDX. Three of them would be in the US, with the San Francisco unit going live in January 2023, one in Singapore, and one in the Middle East, according to the company.

The company also said that it has signed new leases for 3,35,000 square feet in the last few months to be used for office spaces, offline campuses, learner housing, studios, and training rooms for teachers and faculty. UpGrad also plans to hire 1,400 team members between November 2022 and March 2023 across India and global offices.

“We have seen a stronger demand for outcome-focused pedagogy coming out of domestic markets, and therefore, we felt it was timely for us to strengthen our portfolio and create a lifelong learning suite inclusive of campus and job-linked programs, study abroad offerings, short form to executive programs to Degrees, Master's and Doctorate to further support our growth momentum,” said Kumar of upGrad.

Similarly, Tiger Global-backed Scaler, which offers a structured programme for learners to upskill their technological capabilities, announced in September that it will hire 600 people by December. According to the company, it currently employs 1,800 people.

Scaler co-founder Abhimanyu Saxena told Moneycontrol in an interview in May that the company will invest heavily in digital campaigns to raise awareness about upskilling. According to Saxena, the company has also set aside Rs 100 crore for marketing in 2022.

Scaler has also forayed into the higher education space with Scaler Neovarsity, which offers an ECTS-accredited online Master of Science (MS) in Computer Science programme, the company said in a statement shared in August. Understanding the global need for upskilling, Scaler has also launched operations in the US, the company added.

Kunal Shah-backed Masai School, which offers courses in software development and data analytics, also announced earlier this month that it will launch two new course categories and expand its existing software development and data analytics skilling courses.

Earlier this month, during its $10 million Series B funding round led by Omidyar Network India, Masai School onboarded sporting stalwarts Mithali Raj and Bhaichung Bhutia as investors and partners.

Simplilearn founder Krishna Kumar, recently in a media statement, said that the edtech platform will aggressively expand in international markets, which will contribute nearly 70% of its overall revenue by FY24 (2023-24). The Blackstone-backed startup recently raised $45 million in a new funding round led by GSV Ventures.

Bullish outlook

Higher edtech and upskilling platforms have seen continued demand for their offerings, whereas K-12 and test preparation platforms have witnessed a decline in demand. upGrad expects a near 100 percent growth on year in FY23 (2022-23), Kumar had told Moneycontrol in an interaction. In FY22, the company's revenue doubled to Rs 626 crore.

Simplilearn, like upGrad, expects strong revenue growth in FY23 and FY24. Kumar, the company's founder, said that he expects the company to generate $200 million in revenue in FY24. In an interview with Mint, Kumar also said that the company's revenue will exceed Rs 1,000 crore in FY23. Simplilearn's revenue in FY22 was close to Rs 500 crore.

Eruditus also expects its FY23 booking revenue to double year-over-year, Ashwin Damera, co-founder of the company had said in a media interview in June. According to an Inc42 report, Masai School also expects a sixfold increase in FY23 revenue. The company's annual revenue projection is Rs 120 crore. In FY22, Masai School clocked a revenue of Rs 19 crore.

In a recent interview with Business Standard, Byju's-owned Great Learning stated that it expects revenue to exceed Rs 1,000 crore in FY23.

Similarly, Newton School, an upskilling platform for software developers, expects to be profitable by the end of the current fiscal year, according to its co-founder Siddharth Maheshwari, who spoke to Moneycontrol earlier this year. Scaler has also stated that it intends to achieve operational profitability by December of this year.

The optimistic outlooks of higher edtech companies contrast with those catering to the K-12 and test preparation segments. Moneycontrol previously reported that Unacademy expects only about 15% growth in calendar year 2022. According to a person with direct knowledge of the matter, Vedantu is also experiencing slower growth this year compared to the previous two years.

Acquisition Spree

While organic growth in higher edtech and upskilling platforms appears promising, startups in the segment have also taken the inorganic route to accelerate growth, particularly in the last nine months.

Simplilearn acquired Fullstack Academy, a US-based bootcamp education company, earlier this week in order to expand and scale its presence in North America.

In May, Byju's-owned Great Learning acquired Northwest Executive Education for $100 million in cash and stock. The platform offers long-format comprehensive programmes from international educational institutions, including MIT, UC Berkeley, Yale, UCLA, University of Chicago, and National University of Singapore, among others.

upGrad has also been on an acquisition spree this year. The Ronnie Screwvala-led company acquired about 13 companies, since the start of 2022.

Explaining the company’s strategy behind acquisitions, Kumar of upGrad had told Moneycontrol how the company was looking to create a platform for learners that starts from post-K-12 to retirement.

Additionally, Edtech companies are allocating funds for mergers and acquisitions. Scaler had earmarked $50 million for mergers and acquisitions for FY23. Earlier in March, the company acquired online learning platform Applied Roots for $50 million.

In a media interview in January, Eruditus' co-founder Damera said that the company had set aside $1 billion for mergers and acquisitions for the calendar year 2022. The company also raised $350 million in overseas acquisition debt financing from the CPPIB (Canada Pension Plan Investment Board) in March.

However, a source close to Eruditus stated that the company was "very close" to acquiring an edtech company for about $550 million, but the deal fell through because the target company did not meet certain prerequisites.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.