On November 7, 2022, Unacademy, India’s second-most valued edtech startup, faced another round of layoffs. Cofounder and CEO Gaurav Munjal, who typically uses Slack to convey decisions internally, informed the team that the company would be downsizing by another 10 percent.

This meant about 350 additional employees would lose their jobs.

The decision came barely four months after Munjal emphatically declared that there would be no more layoffs at the edtech unicorn, last valued at $3.4 billion.

Unacademy had already laid off over 800 employees since the start of 2022. During the previous round of layoffs in July, Munjal emphasised that the company would not fire employees again and would instead focus on other cost-cutting initiatives to weather the slowdown.

These measures included restricted travel for top management executives, scrapping free meals for employees at offices, and finding ways to accommodate laid off employees internally.

But this assurance didn’t cut ice.

Employees were certain there would be more layoffs in the months ahead as the company was experiencing a massive growth slowdown in its core offerings, while its new initiatives were failing to fire.

“I worked with Unacademy since December 2019 and my first two years were great. But since last year, there was suddenly some sort of chaos. It felt like we were venturing into too many things and this was not helping us,” said a former senior employee who was laid off in March, requesting anonymity.

The employee said Unacademy seemed to be biting off more than it could chew.

“The company forayed and shut down too many verticals very quickly. You must have a solid plan before starting out, especially when you are burning cash. The Covid tailwind was perhaps prompting the management to do this but anyone within the company could see that it wasn’t quite working and this meant that there would be more layoffs, more pain,” the employee said speaking to Moneycontrol in mid-April.

At least six more people closely associated with Unacademy who spoke with Moneycontrol on condition of anonymity concurred with this assessment. As things stand, the company has had two more rounds of layoffs after having committed to not doing any. These two rounds of layoffs were also unstructured and dragged on for months, employees told Moneycontrol.

Chaos in the middle

When Munjal announced the layoffs in November, he said the affected employees would receive a detailed communication from HR within 48 hours.

An account manager of educators, who was with the company for more than 17 months, neither received any note in the following two days nor any mail from HR that month.

“When the layoffs were announced, I was very certain that I would be among them,” the account manager told Moneycontrol. “Our team was told there was a shortage of manpower due to mass layoffs and resignations and so everyone had to put in extra hours. But I wasn’t given any and when I didn’t receive any communication (about layoffs) for almost a month, I was pleasantly surprised.”

However, in the first week of December, the account manager got the mail from HR, which said the full and final settlement along with severance benefits would be paid soon. Moneycontrol has reviewed a copy of the mail.

Other employees too got mails only in December. According to the account manager, the SoftBank-backed edtech company has laid off almost 2,000 employees since the start of 2022.

“Unacademy has laid off a lot more than what is publicly known and this has been done very silently,” the account manager said.

“The company is perhaps trying to save its image by showing a smaller number of layoffs but right after one big layoff round is announced, there are more (layoffs) that happen. The team strength is down to 2,500 from over 6,000 as of April 2022. It feels like they do one round of layoffs and a couple of weeks later, realise that they need more rationalisation, so they do another.”

To be sure, other than the layoffs, many employees have also resigned since April last year, bringing down Unacademy’s team strength.

The apparently arbitrary nature of the layoffs and the unclear conversations with employees are perhaps signs of the chaos at Unacademy, where the management is trying to find bankable verticals for the future, with growth for its main offering – the online learning platform for competitive exams – slowing.

Search for basics

The account manager, who was with Unacademy since 2020 and serving in a mid-level managerial position, said that in the past 12 months (since April last year), the work culture had changed significantly as the company tightened expenditure.

“We were told to rationalise costs significantly within teams and this was totally new from how it used to be until 2021. There were very few celebrations in the office, even for certain big events,” the account manager said.

The account manager shared an instance where his team decided to go out and celebrate on their own in Bengaluru after they achieved a big milestone. According to him, previously, such celebrations would happen at the office with pizzas.

According to a person closely associated with the investors of Unacademy, 2020 and 2021 were the years when Unacademy tried to build a strong foothold in newer verticals. The funding environment helped. But Munjal was not able to find a vertical that would yield cash.

“And with things changing rapidly in 2022, he has been trying to find a business that will give him a strong ground for years to come. It is funny that he has found it in offline, something that he wanted to disrupt when he started out. But the offline and online combination for test preparation seems to be the future for Unacademy with other things contributing in some manner,” the person added.

Slowing core growth

Unacademy began as an online platform for students preparing for medical and engineering college entrance examinations and other tests. It was started by second-time entrepreneur Munjal with Roman Saini and Hemesh Singh in 2015. Munjal ran Unacademy as a YouTube channel since 2010.

Before Unacademy, Munjal founded Flat.chat, a real estate platform for college students and bachelors. He sold it to CommonFloor in 2014, which was acquired by Quikr in 2015 and shut down.

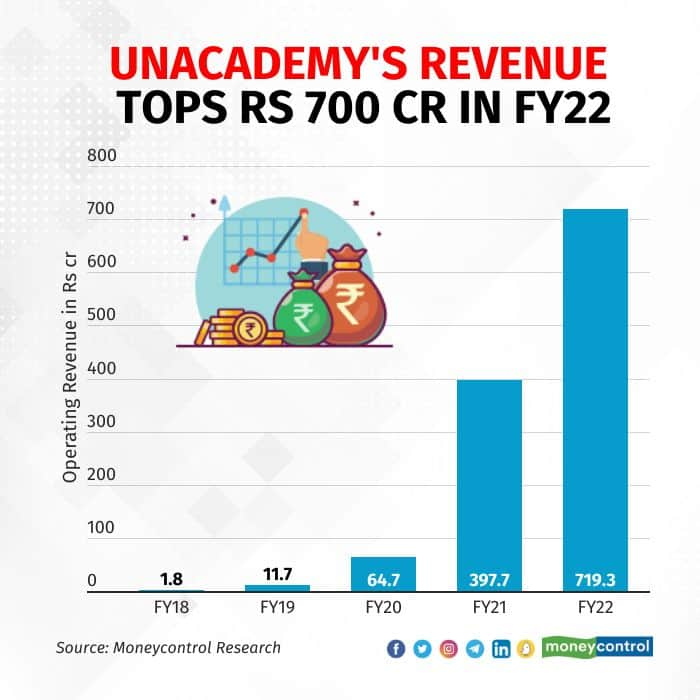

Unacademy rapidly gained popularity among students, particularly as smartphone sales skyrocketed. Collaborating with innovative and new-age content platforms helped Unacademy expand its reach and boost revenue to over Rs 60 crore in FY20. The strategy was simple – hire star teachers from YouTube and other coaching hubs and use them to attract students.

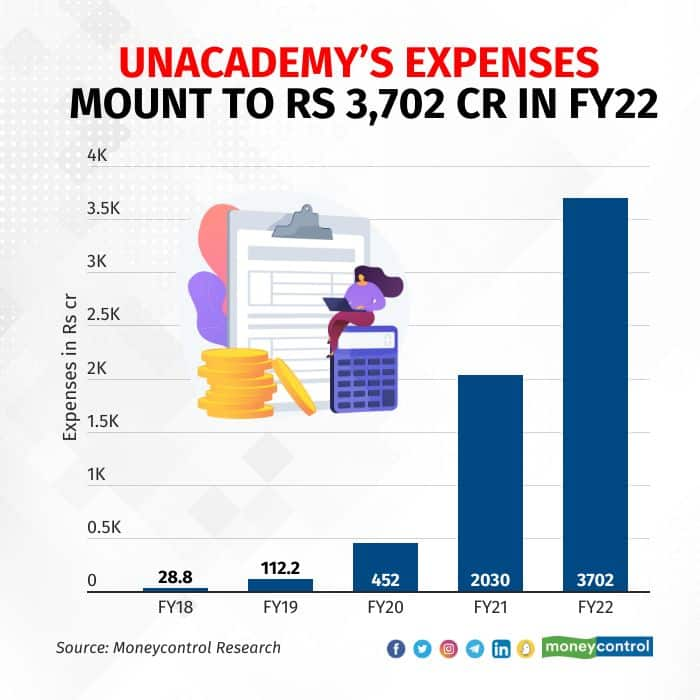

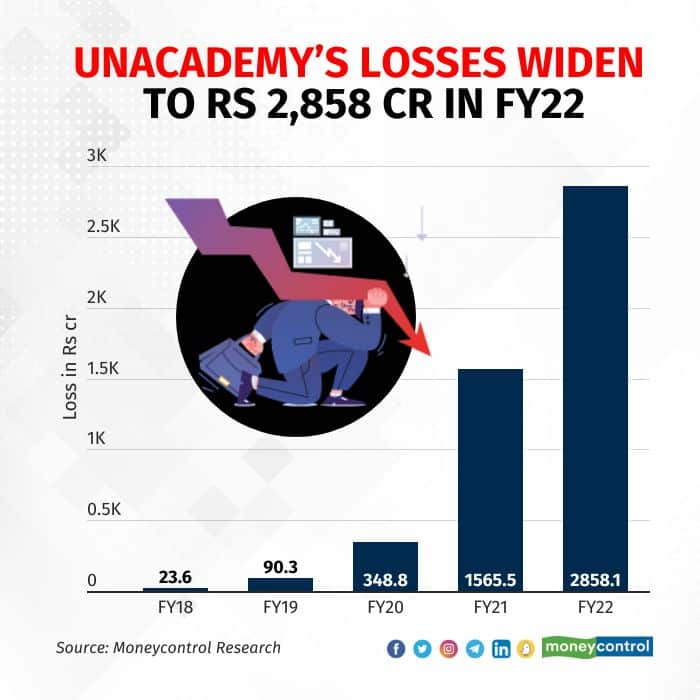

The pandemic proved to be a game-changer for Unacademy, just as it was for other e-learning companies globally. Unacademy's operating revenue, which was mostly derived from its core business, grew over six times in FY21, reaching almost Rs 400 crore. The company invested heavily in hiring talent and building its brand to meet the surging demand for online learning.

In FY22, Unacademy continued to grow rapidly, with its operating revenue surpassing the Rs 750 crore mark. The company also made several acquisitions to fuel growth. But the post-pandemic boost soon ran out of juice.

Although Unacademy was expected to experience slower growth after the pandemic due to high baseline figures and the reopening of physical tuition centres, its core revenue is expected to decline this year (the calendar year 2023), causing concern.

Unacademy's core business is predicted to decline about 15 percent in 2023, according to Munjal. In the last week of April, Munjal had given a business update to his team on Slack. Unacademy now aims to generate Rs 620 crore in the calendar year 2023.

Offline revival

In a virtual interaction with Moneycontrol in the last week of April, Munjal said, “During Covid, we did a lot of marketing. Some of that marketing was inefficient. When we stopped inefficient marketing, our baseline revenue fell. We overestimated the growth that will come from online.”

Munjal is a huge fan of Apple and Steve Jobs and has modelled himself and his company on the legendary but mercurial founder. He has emulated Jobs’ approach of designing standout products, integrating technology into them, and pushing employees to the brink in pursuit of this grand vision.

Employees have been scared of Munjal, his brutal feedback and the pressure that comes with working at Unacademy, similar to Apple and Jobs. Moneycontrol had done an in-depth profile on Munjal in 2022.

“Suddenly, offline bounced back massively and this happened with every other company. We will de-grow 10-15 percent in the online test prep business. But now that the baseline is set and the inefficient marketing has been stopped, next year, growth in online will be back,” he added.

Acquisitions, initiatives failing

The explosive growth of online learning platforms during the pandemic prompted large edtech companies to pursue acquisitions to boost growth and expand their target market.

Unacademy too made a number of significant acquisitions, while also diversifying into new verticals. However, the vast majority of these new ventures failed to meet Unacademy's expectations.

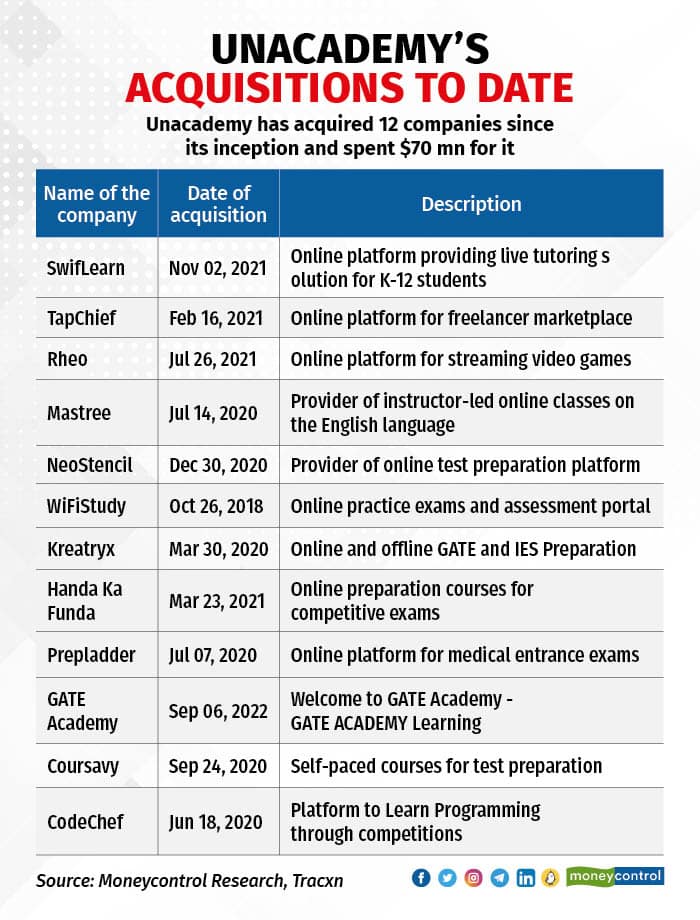

Tracxn data shows that Unacademy acquired 12 edtech startups from March 2020 to December 2021, spending over Rs 500 crore ($70 million) on these deals. The company expanded into K-12 (kindergarten to grade 12) education with the acquisition of Mastree and Swiflearn, but quickly closed down these operations. In an interview with The Morning Context, Munjal admitted the company's K-12 ventures were driven by FOMO (fear of missing out).

Unacademy also acquired video game streaming platform RheoTV in 2021, only to shut it down. All the closures resulted in an impairment charge of over Rs 143 crore in FY22.

“Looking back, we may have been a little distracted. We have since shut down the experiments that were not working. PrepLadder, Graphy and Offline Centres were experiments too, and they’re doing very well,” Munjal told Moneycontrol.

“Offline Centres and Graphy started as experiments for us and they are going to be huge businesses for us. With Mastree and Swiflearn, we realised that the one-on-one market does not have a business model so we quickly shut it down.”

In FY23, two more of Unacademy's acquisitions faced trouble. Relevel, an upskilling programme launched in January 2021 to compete with Scaler Academy, failed to deliver on its promise to successfully place candidates, leading to negative feedback from customers.

Unacademy launched Relevel after acquiring TapChief for Rs 25 crore, plus compulsorily convertible debentures worth over Rs 26 crore. In January 2023, Unacademy shut down Relevel and laid off 40 employees.

Shortly thereafter, Unacademy's largest acquisition to date, the post-graduate medical college entrance exam platform PrepLadder, experienced an exodus of doctors-turned-educators who had been with PrepLadder since its inception.

More than half of these teachers left, accusing Unacademy of deception and cheating, and later filed a legal case against the edtech company. Unacademy has never talked about PrepLadder and the problems it faced with its educators on record to Moneycontrol.

Unacademy also postponed the launch of its offline coaching institute, PrepLadder Neuros, due to a lack of interest from potential students amid issues with teachers at PrepLadder, Moneycontrol reported.

While Unacademy expects to generate about Rs 200 crore from PrepLadder in 2023, implying a 9 percent growth over 2022, people close to the company said the vertical is likely to report a drop in revenue in the current financial year. The 9 percent growth projection is significantly lower than the 30 percent growth PrepLadder posted until FY22.

Munjal said PrepLadder was the most successful acquisition for Unacademy to date and while it will grow in early double digits this year, it will grow about 50 percent next year.

The edtech investor observed that Byju's has been more successful in its acquisition strategy as the company now has two major cash cows – Great Learning and Aakash – to help mitigate risks from its core business. In contrast, none of Unacademy's acquisitions appears to be performing as well.

To be sure, Byju’s is mired in other challenges, with the latest setback being searches conducted by the Enforcement Directorate on the offices and residence of Byju’s and founder Byju Raveendran on April 29 under the Foreign Exchange Management Act. The startup also came under scrutiny over the past year (since April 2022) for alleged mis-selling, accounting malpractices, and mass layoffs.

However, Byju’s has maintained that it is a routine check and the company is coordinating duly with ED.

Leaner business model

With slower growth and acquisitions failing to deliver, Unacademy undertook cost-cutting initiatives, including four large rounds of layoffs since April last year. Unacademy has let go almost 1,500 employees officially and a large number left the company over the past 12 months (since April 2022), reducing its employee count to about 2,500 from more than 6,000 as of April last year.

In July 2022, when Munjal said there would be no more layoffs, he also said the founders and top management executives would take salary cuts. Later, he said the pay cuts could go to as much as 25 percent and would be revised in April 2024. Munjal also said the company should “embrace frugality” as a core value.

A few weeks later, Munjal took to Twitter to say the company would not sponsor the Indian Premier League from 2023. Unacademy has been a sponsor for IPL since 2020. This year, the company is not even advertising during the IPL.

In February, Munjal said the company would skip cash appraisals for FY24 and would compensate the staff with employee stock options, Moneycontrol reported.

These cost-cutting initiatives, along with the layoffs, helped Unacademy to reduce its cash burn significantly. According to people close to the company, Unacademy’s monthly burn was down to about Rs 20 crore from over Rs 200 crore in 2021.

Last week, Munjal said the company will have funding for 116 months at the end of 2023, with Rs 1,977 crore cash in the bank. He said Unacademy had 32 months of funding runway as of December 2022, when it had about Rs 2,300 crore in the bank, implying a monthly expenditure of more than Rs 70 crore.

The person closely associated with investors of Unacademy said the company has made the right moves towards a leaner business model.

“I don’t think anything went wrong. If I had to change things, I would do less marketing, but I wouldn’t do less acquisitions. Unacademy has a culture of experimentation. Maybe two or three out of 10 experiments would work, but the ones that will work, work very well,” said Munjal.

“Graphy, Unacademy Centres and some of our online test prep categories are really, really big. While PrepLadder was successful, Mastree, Swiflearn and Relevel didn't work out. So overall, I don’t regret any of the experimentation.”

Offline offers hope

Munjal has increasingly shifted focus to offline coaching centres, which go against Unacademy's original goal of tech-driven disruption but are proven to be a dependable and lucrative business model. Byju’s and PhysicsWallah, too, are leaning towards an omnichannel play to maximise growth.

Unacademy currently operates 10 offline centres across India for test preparation coaching and plans to open 58 more centres by the end of the year, according to an internal memo. By the end of 2023, the company aims to reach 55,000 learners and generate Rs 400 crore of revenue from offline coaching centres, making it the second-largest revenue-grossing vertical within the Unacademy group.

While some argue that offline growth is slower than online, the current situation in India shows that even a small growth in offline would be considered good. Profitability may be challenging initially, requiring significant investment in real estate and teacher recruitment, but once established, profitable coaching centres are commonplace.

With offline expected to perform better than online, the common investors of Unacademy initiated talks with Byju’s-owned Aakash Educational Services to explore a potential merger of the two education giants, Moneycontrol reported exclusively in March.

The reliance on offline centres offers a glimmer of hope for Unacademy amid the struggles faced by edtech companies in India. However, only time will tell whether this approach will be enough for the SoftBank-backed unicorn to weather the storm and survive the turbulence.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.