When the COVID-19 pandemic struck in 2020, Paisabazaar lost 90 percent of revenue almost immediately because financial institutions that were its partners stopped lending.

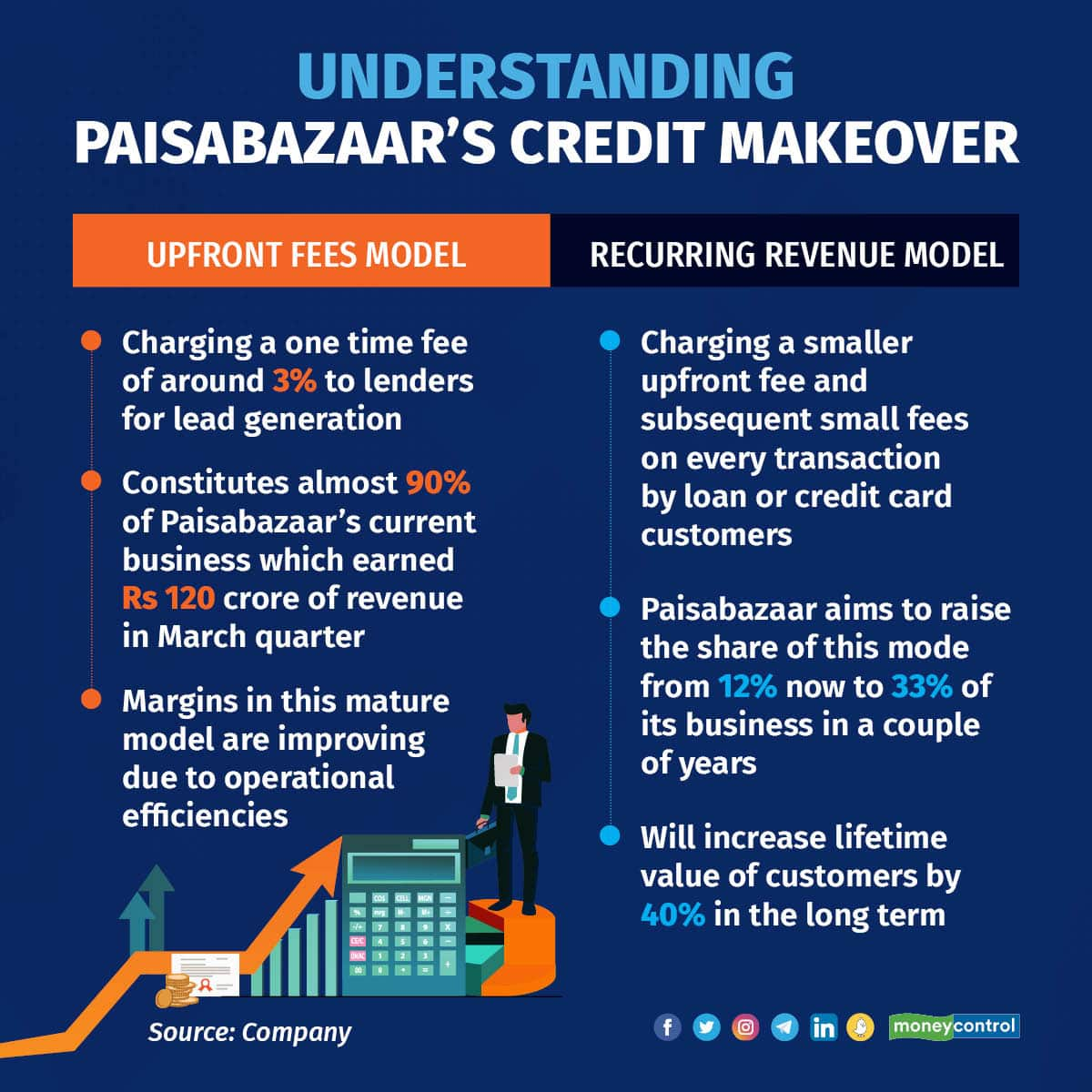

At the time, the credit arm of PB Fintech used to earn all its income in upfront fees to generate leads for credit cards and loans. Drawing from that experience, Paisabazaar has since set itself on the path of making its revenue stream more resilient to macro shocks.

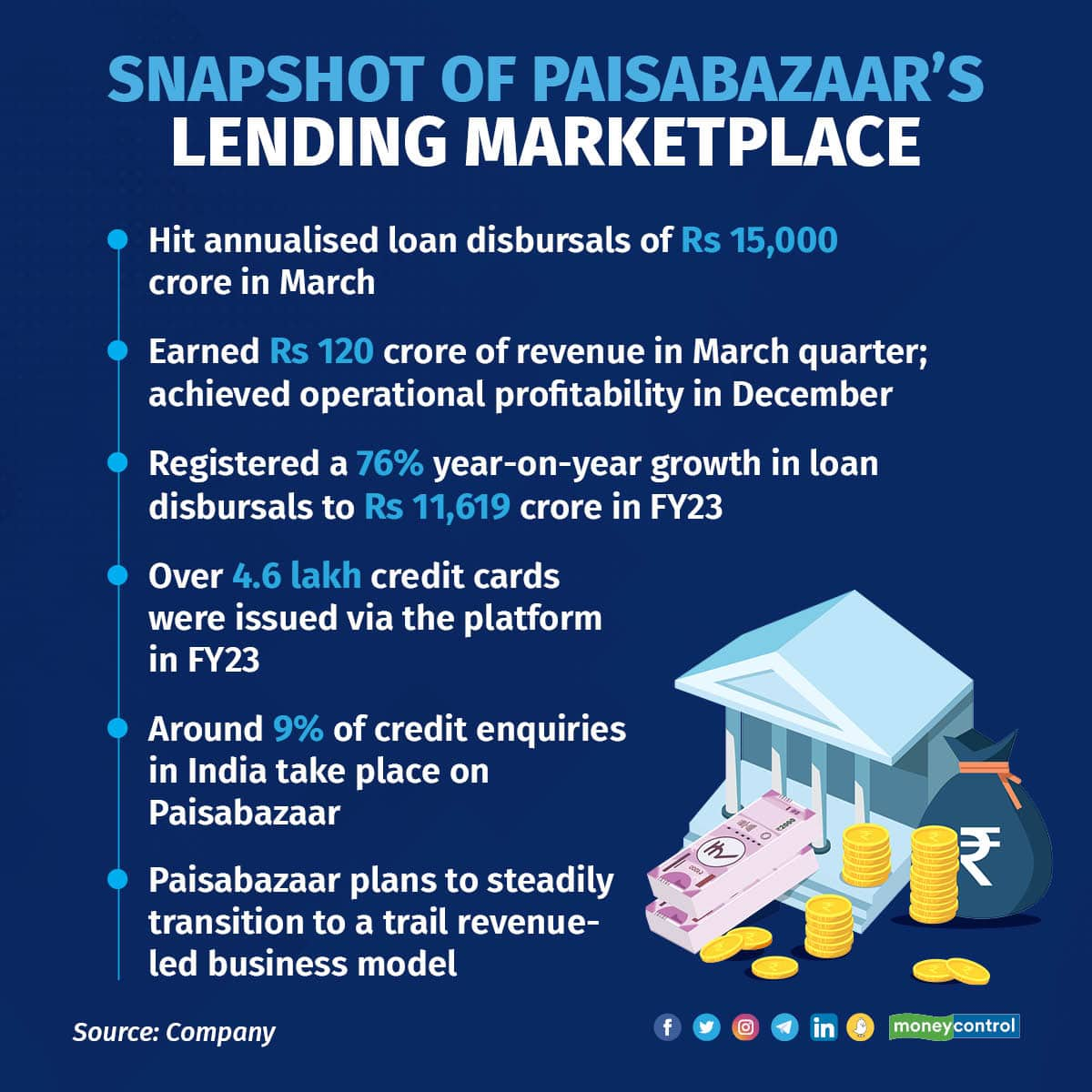

Paisabazaar reached an annualised loan disbursal rate of over Rs 15,000 crore in the March quarter. It registered a 76 percent year-on-year (YoY) growth rate in loan disbursals to Rs 11,619 crore in FY23.

To be sure, Paisabazaar already makes up a significant chunk of PB Fintech’s business. Of the Rs 869 crore of operating revenue earned by PB Fintech in March quarter, the credit segment accounted for Rs 120 crore.

Now, around 12 percent of Paisabazaar’s revenue is recurring in nature — it takes a cut when customers pay Equated Monthly Instalments (EMIs) to its partner lending institutions or make a new transaction on their credit cards.

And, the credit marketplace wants to raise the contribution of the recurring model to 22 percent by the end of FY24 and to a third of the business in a couple of years.

Recurring model“For example, if I want to do a credit card issuance on my platform for a bank in a normal commercial model, I will make an upfront fee of let's say Rs 3,000, as soon as the card is issued. And then over the life of the credit card, say 6 years, I would make nothing else,” said Naveen Kukreja, co-founder and CEO of Paisabazaar.

“In the new model, I won’t make an upfront commission of Rs 3,000, but only a percentage of that. But I am delaying my revenue and linking it to the consumer spend on the credit card. We now have about 13-14 months of data and it is in line with what we had assumed. So, every time a consumer spends, we make a certain percentage of that,” he added.

This new revenue model is not just expected to mitigate Paisabazaar against black-swan events like COVID-19. The company is also confident that the co-creation business will help it increase its take rate up to 1.4 times i.e. generate 40 percent more revenue over the lifetime of the product.

This means that the take rate of around 3 percentage points in the upfront fee model could now go up to a blended LTV (life-time value) of around 4.2 percentage points. According to the company, 40 percent of the credit cards issued on the platform and 30 percent of the loans disbursed by it in March were through this new model.

Kukreja said that this upside doesn’t necessarily come with more risk, as the company doesn’t offer any First Loan Default Guarantees (FLDGs).

FLDG is an arrangement between a fintech company and Regulated Entity (RE), such as banks and Non-Banking Financial Companies (NBFCs), wherein the fintech compensates the RE to a certain extent if the borrower defaults.

While the decrease in upfront fees and increase in the trail component means that Paisabazaar has taken a hit on the revenue front in the past few quarters, Kukreja contends that profitability has not been hurt because operational efficiencies have helped pad up margins.

According to the company, notwithstanding the new business model where revenue is delayed over the lifetime of a customer’s usage of the credit product, the recovery of the Customer Acquisition Cost (CAC) has not changed much — it still remains under a month.

“Our margin on new business — give or take — is only about 40 percent. So we are only spending 60 percent of what we make. And that is the weighted average of the mix of co-created and upfront fee revenues,” said Kukreja.

“The margin has remained stable over the last three or four quarters which means that we have not allowed the recurring revenue model to cause a drop in the margin. And as the ratio of the recurring segment to upfront fees increases over the next 6-18 months, I am hoping that we will be able to inch up the margins in the business,” he added.

Interestingly, while PB Fintech turned operationally profitable on an adjusted EBITDA (Earnings Before Interest, Tax, Depreciation and Amortisation) level in the March quarter, Paisabazaar was a step ahead in achieving break-even in the December quarter.

In a post-earnings analyst call last week, the company’s management said that it was confident of turning out a net profit in FY24. Kukreja has the same hope for the credit arm.

As a result of the pandemic-induced digitisation, fintech unicorns and upstarts thought of kirana stores and Small and Medium Enterprises (SMEs) as the next growth vector. They launched digital ledger platforms, SaaS-based payroll services, and innovative credit products targeting this cohort of customers. SaaS is short for software as a service.

Paisabazaar took a more measured approach. It has a sizable SME loans segment, which is about a fifth of its business. The average ticket size of loans in this segment is in the range of Rs 4-5 lakh for the company.

One important point of difference between Paisabazaar and most of its peers in the fintech credit space is that it has steered clear of passing fads in the sector like trying to sell value-added services to small businesses with credit on top and not participating in the Buy Now Pay Later (BNPL) gold rush of 2021-22.

“BNPL is a very point-of-sale product in the way it is offered at checkout pages or offline stores, whereas we are a credit marketplace. When you look at the segment, Bajaj Finance is the biggest player… and we didn’t see a way we could offer a more differentiated product,” said Kukreja.

“But we do have a small-ticket personal loans product that might have benefitted a little from the decline in BNPL,” he added.

Fast-growing and highly-funded BNPL start-ups such as ZestMoney, Uni, Slice and others have had a difficult time keeping up with regulatory flux in the segment. This happened as India’s central bank tightened lending rules to make it increasingly more difficult for unlicensed fintech players to offer loans digitally.

“BNPL platforms were not reporting their disbursals to the credit bureaus which was not a healthy practice for the fintech ecosystem. One of the positive things to have happened is that the regulator brought in a rule to make it mandatory to report BNPL to the credit bureaus and tagged it as a personal loan, ” said the Paisabazaar chief.

“Again, some of the unlicensed BNPL players were basically renting licences, which was very dangerous for the industry. The regulator has put a stop to that as well,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.