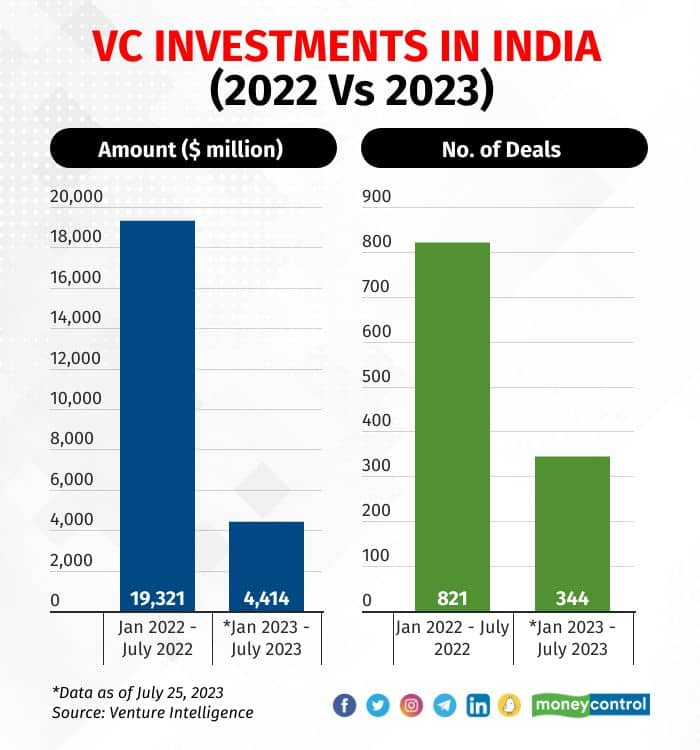

Funding to Indian startups tanked about 77 percent in the first seven months of 2023 compared to the same period last year, worsening the fund crunch at a time when industry watchers warn about the overestimation of India's internet market.

Indian startups recorded $4.4 billion in private equity and venture capital (PE/VC) funding in the January-July period, down from $19.3 billion a year ago, according to data shared by Venture Intelligence. Startups in India secured only 344 funding deals in this period against 821 in the first seven months 2022, data shows.

Startup Funding 2023 vs 2022

Startup Funding 2023 vs 2022

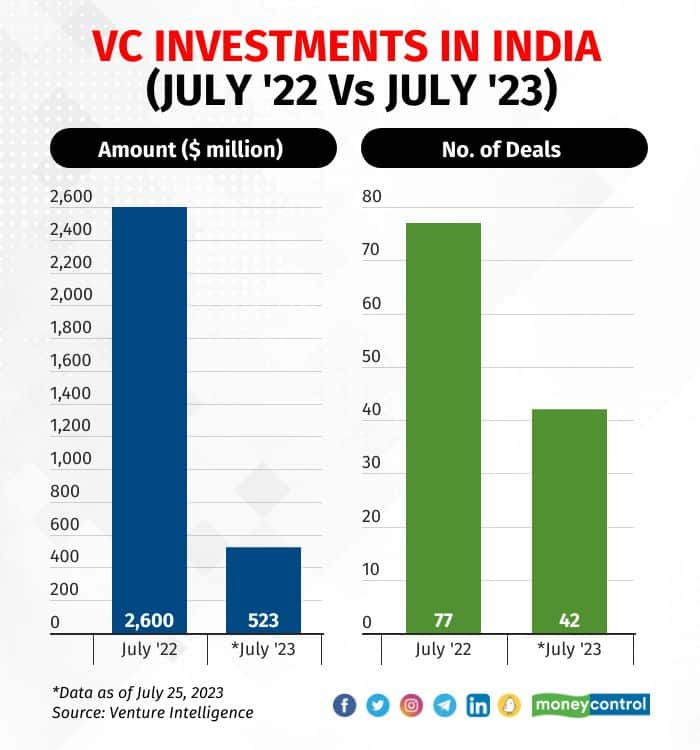

Funding this month

In July alone, investors participated in about 42 funding rounds and invested $523 million, against $2.6 billion invested across 77 funding rounds in the year-ago period.

While the funding amount plunged close to 80 percent year-on-year in July 2023, the number of deals also fell close to 45 percent compared to the same month in the previous year.

The funding amount also fell slightly from $546 million in about 44 deals in June. To be sure, the data is limited to the funding deals that were announced till July 25.

This also comes at a time when a growing list of industry watchers including founders like Cuemath’s Manan Khurma, Phonepe’s Sameer Nigam, and Zerodha’s Nithin Kamath and venture capitalists warn about the overestimation of India's internet market, which seems to be slowing post the pandemic-led boost.

Also Read: India’s market is 'definitely' overestimated: SoftBank’s Rajeev Misra

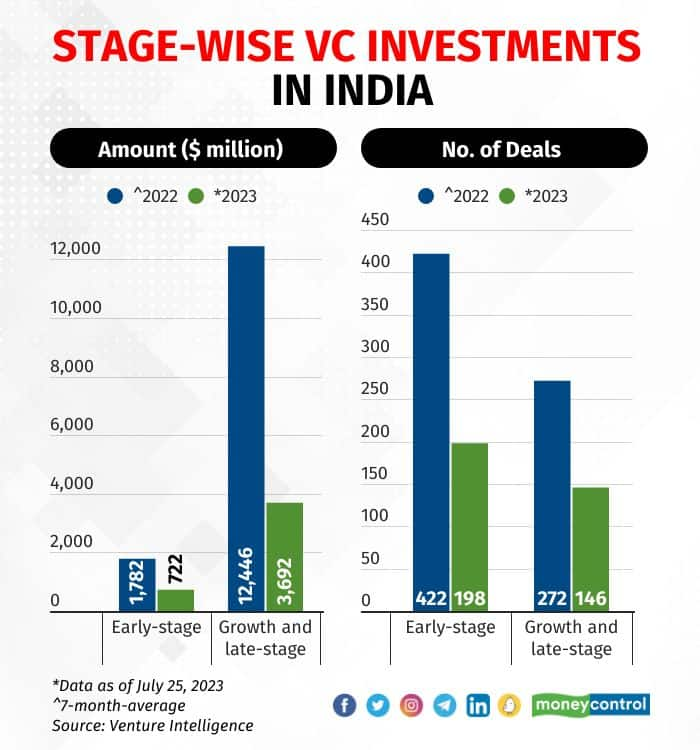

Stage-wise funding

In the January-July 2023 period, 198 early-stage deals were recorded. Deals in this stage tanked about 55 percent from the seven-month average of 2022 which stood at 442 deals. In terms of money invested, startups received $722 million, a 59 percent decline from $1.8 billion, a seven-month average of 2022.

Stage-wise funding

Stage-wise funding

Growth and late-stage investments also remained under pressure.

Till July 2023, startups in this stage secured $3.7 billion in funding across 146 deals against a seven-month average of $12.4 billion raised across 272 late and growth-stage deals in the seven-month period in 2022.

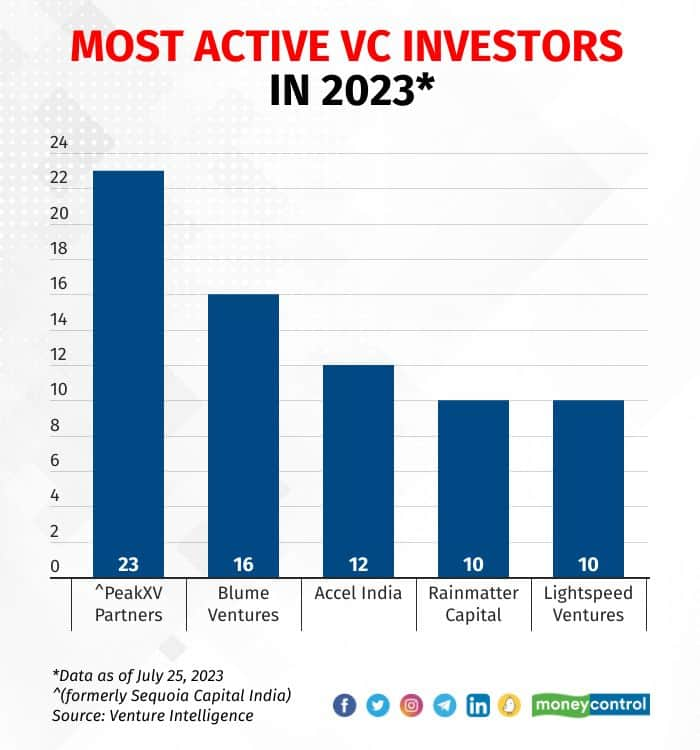

Top investors and deals till July

Peak XV Partners (previously Sequoia India) led the charts, making about 21 deals in the first seven months of 2023. Blume Ventures, which signed 16 deals, pushed Accel India to the third rank with 12 investments this year. Others on the list of most active investors included Rainmatter Capital and Lightspeed Ventures with 10 investments each.

Most active investors in 2023 so far

Most active investors in 2023 so far

Among the top deals of 2023 so far, eyewear brand Lenskart maintained its top position for its $500 million fundraise in March followed by Builder.ai with a $250 million fundraising in May. Infra.Market, Zetwerk and InsuranceDekho also raised $150 million each.

Top startup funding deals in 2023 so far

Top startup funding deals in 2023 so far

Notably, this month Veritas Finance, an NBFC (non-banking financial company) raised $146 million from Multiples PE, Avendus PE, and IFC. Other important deals this month included Genleap’s $50 million and RenewBuy’s $40 million funding rounds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.