Digit Insurance was crowned as the first unicorn of 2021. Now, the startup backed by Canadian billionaire investor Prem Watsa's Fairfax may be angling for another first—the first major unicorn brave enough to go public after the recent meltdown in tech stocks.

The company filed draft documents for an initial public offering (IPO) on August 16, looking to raise Rs 1,250 crore from a fresh issue of shares and through an offer for sale of 10.94 crore equity shares for an undisclosed amount. According to sources, the size of the IPO is likely to be around Rs 5,000 crore.

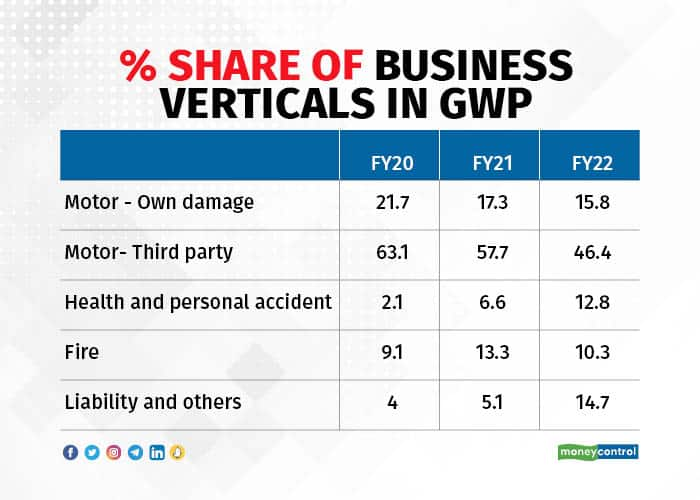

Digit Insurance provides motor, health, travel, fire and other small-ticket insurance and has a market share of 2.4 percent in the general insurance space.

Here are five charts that summarise the company's key metrics, financials and current shareholding:

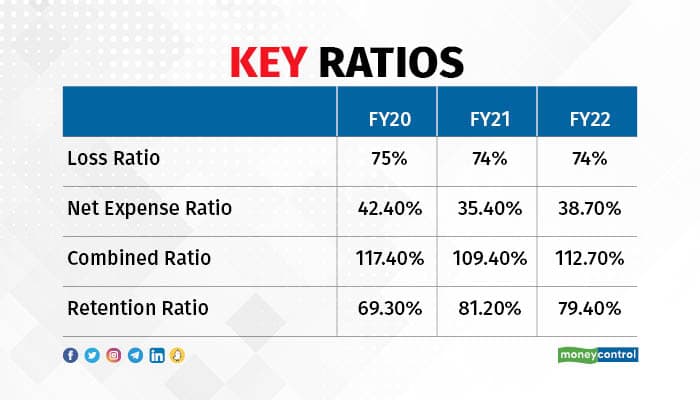

The company's loss widened from Rs 122.7 crore in FY21 to Rs 295.8 in FY22. Total premiums written by the company before deducting commissions, ie Gross Written Premiums, stood at Rs 5,267 crore in FY22.

Motor insurance makes up more than half of the startup’s gross written premiums. The share of health and personal accident as well as fire insurance has gone up in the past two years.

The company said that proceeds from the issue will be used for augmenting the capital base and the expansion of business and improving solvency margin, consequently solvency ratio.

According to the insurance act, the firm has to maintain a minimum solvency ratio of 1.50x. As of March 31, 2022, its solvency ratio was 2.01x.

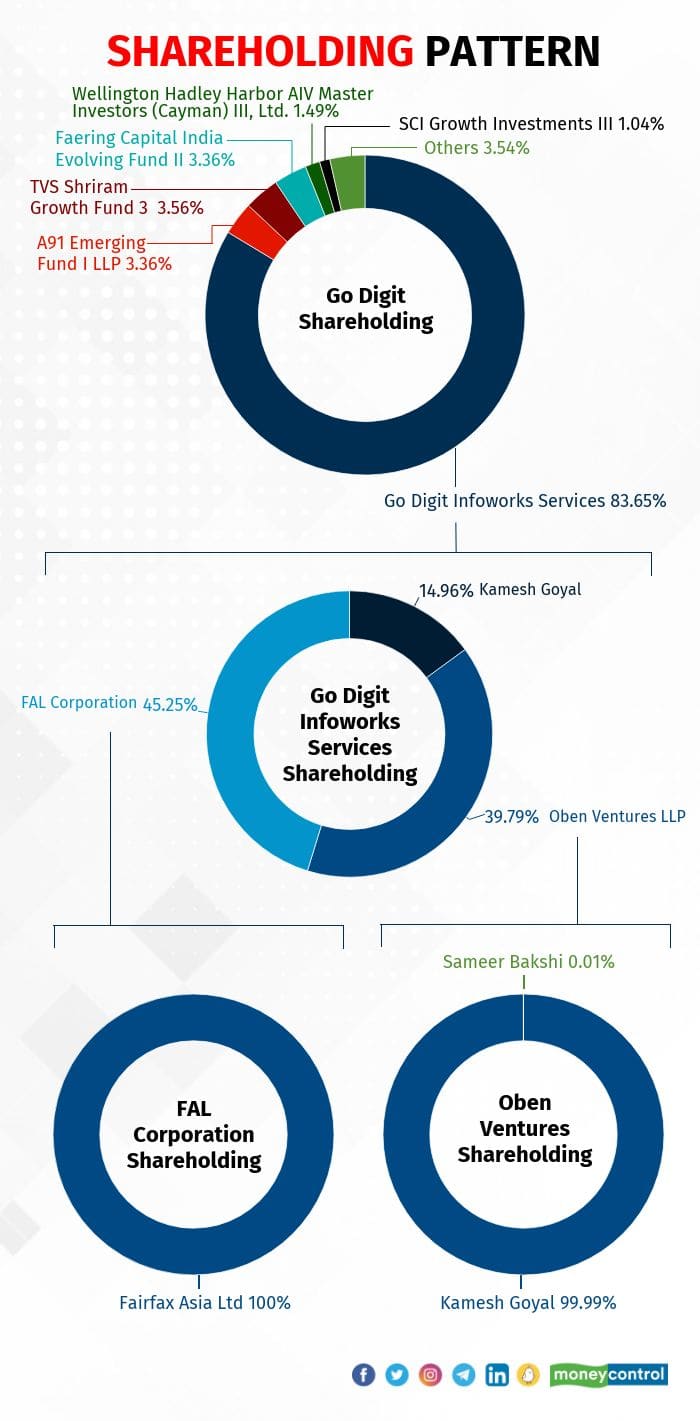

As per the DRHP, the shareholders selling stake through the offer for sale include promoter entity Go Digit Infoworks Services Private Limited, which holds around 83.65 percent stake in the startup, besides other individuals.

The majority stake in Go Digit Infoworks Services Private Limited is owned by the company's founder and chairman Kamesh Goyal, along with Watsa's Fairfax Holdings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.