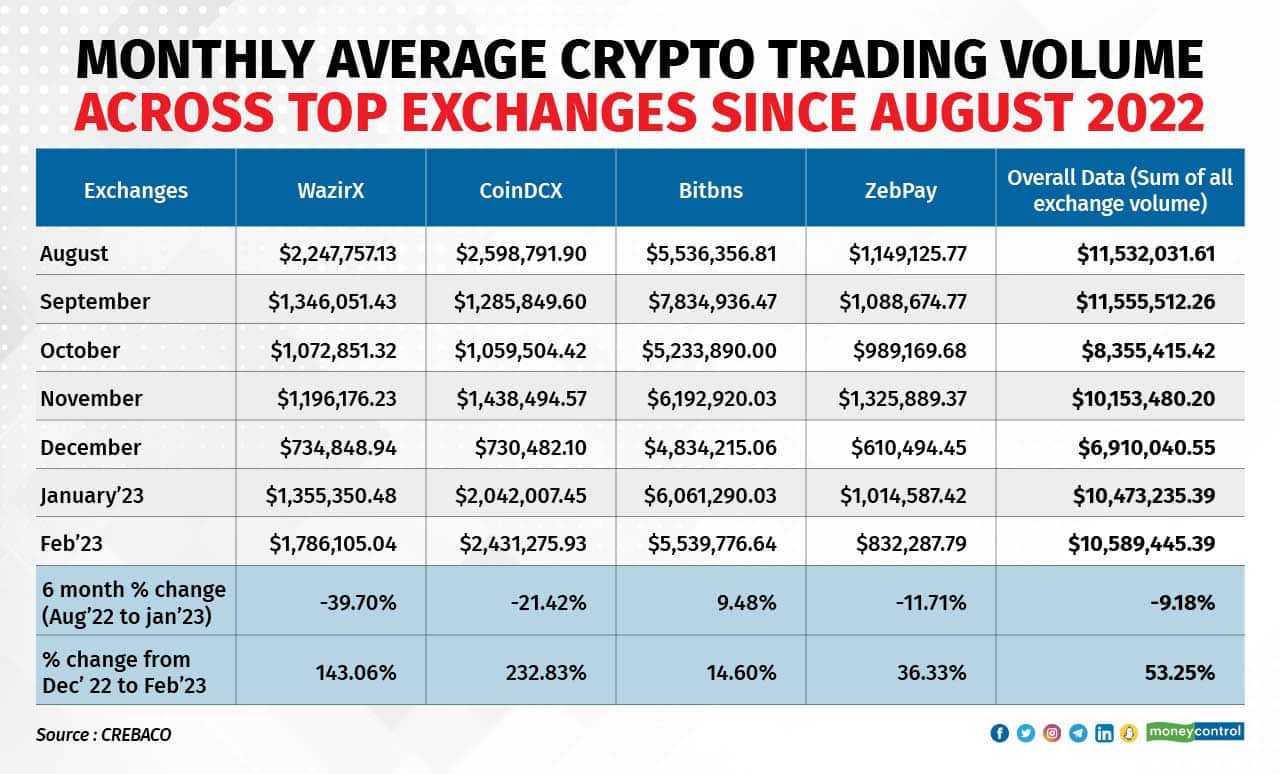

Top Indian crypto exchanges such as WazirX, CoinDCX, BitBNS, and ZebPay have started to see a slow but steady recovery in monthly trading volume since the beginning of January 2023, after a year of drastic drops and fluctuations, particularly since August 2022.

The overall monthly average of trading volume across exchanges grew by over 53 percent between December 2022 and February 2023, according to data from crypto research firm CREBACO Global. The top tokens traded during this period were Bitcoin, Ethereum, Binance coin, XRP (Ripple), and Cardano.

Interestingly, Bitbns has recently surpassed the trading volumes of WazirX, which was once India's largest crypto exchange in terms of trading volume and user base.

These volumes, however, remain far below their peak in early 2022. From January 2022 to December 2022, the average trading volume on these exchanges fell by more than 90.44 percent. This was primarily due to a drop in global crypto token prices last year, which was followed by the implementation of a 30% income tax on crypto gains and a 1% TDS on all crypto transactions exceeding Rs 10,000 in India, amid ongoing regulatory concerns. The collapse of FTX in November worsened the situation.

In January 2023, the market value of cryptocurrencies surpassed $1 trillion, a threshold that had not been reached since November 2022. However, industry insiders are uncertain about whether this upward trend will continue.

According to Rajagopal Menon, Vice President at WazirX, the bear market for crypto is still not over and most analysts remain convinced of it.

“A resurgent Bitcoin drove the cryptocurrency market rally…A more than 5% rally in both Bitcoin and Ether was the driving force behind these gains. But despite the market rally, most cryptocurrencies didn't change much at the end of February. This is because an enthusiastic rally to start 2023 stalled in February,” he told Moneycontrol.

Sathvik Vishwanath, co-founder and CEO of Unocoin, said that the rally in trading volumes in India has been considerably smaller when compared to global exchanges.

“In the last couple of months, there has been a bullish trend but it is nothing compared to how the rest of the world has reacted (in terms of trading volumes). One of the issues being the way how TDS plays out in India, making it a bit challenging here,” he said.

“Binance alone has a trading volume of over $30 billion and in India, together we are barely crossing $10 million, the difference is huge. There’s quite a bit of catch up to do,” Vishwanath added.

Parth Chaturvedi, Crypto Ecosystem Lead, CoinSwitch said, “We have seen a brisk buying activity when the prices were going up. For the long-term such opportunities should be seen for building your dollar cost averaging. Don’t invest lump sum right now but keep investing whenever pricing moves downwards. In the long-run the story remains intact on why Bitcoin and Ethereum demand the pricing that it has.”

In the context of cryptocurrency, dollar cost averaging means investing in smaller and more frequent purchases rather than large or irregular crypto purchases.

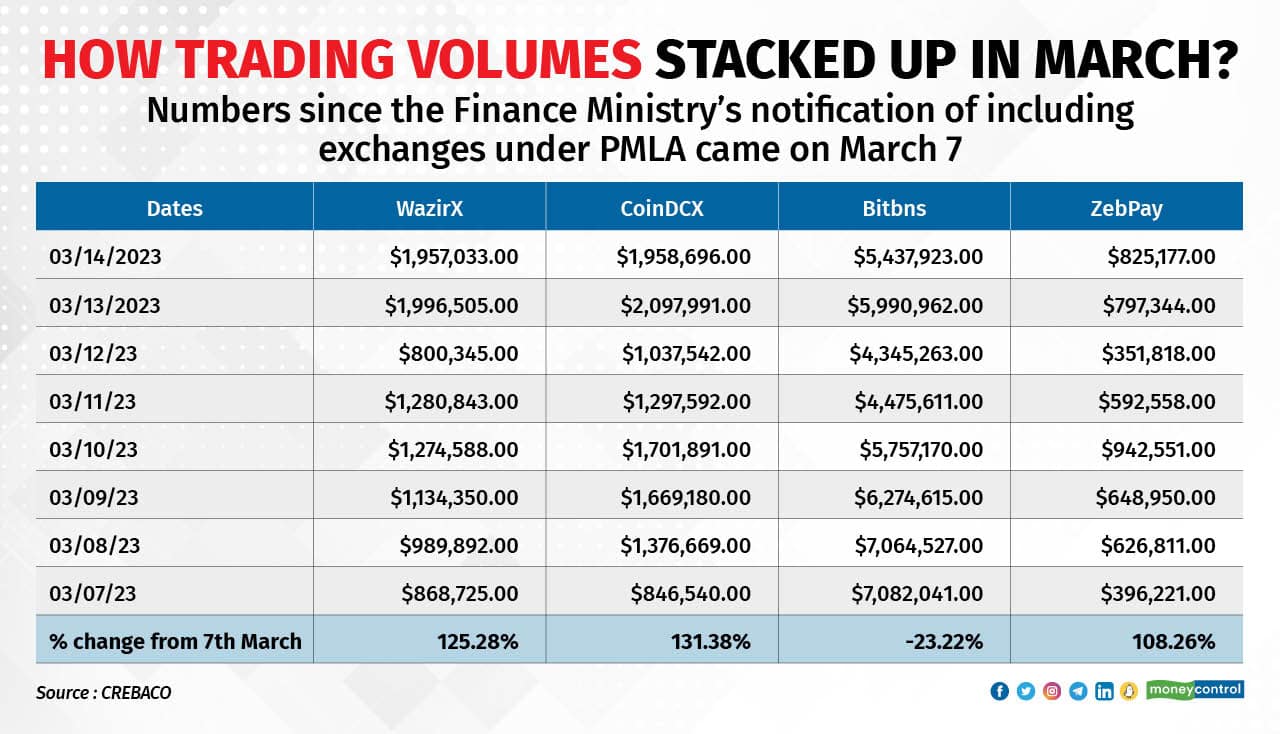

Volumes get PMLA pushTrading volumes have remained steady in March, particularly since March 7 when the Finance Minister announced that crypto or virtual asset businesses would be brought under the purview of the Prevention of Money Laundering Act, 2002 (PMLA). This move has given the sector some legitimacy.

Moreover, implementing Know Your Customer (KYC) policies to prevent fraudulent activities will become increasingly important.

Since March 7, trading volumes have increased by more than 100 percent across exchanges, with the exception of Bitbns, which has been accused of concealing a hacking incident from last year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.