As the row between fintech BharatPe and its estranged cofounder Ashneer Grover has unravelled, the role of its board of directors, primarily comprising multinational venture capital funds, has come under scrutiny, with governance experts questioning to what extent they are responsible or accountable.

BharatPe’s now-ousted cofounder Ashneer Grover and wife Madhuri Jain Grover, who held a vague but crucial position called head of controls, are facing charges of fraud and misappropriation from its board, which is conducting a governance review to cull out and fix malpractices. But how these investors and board members, including Sequoia Capital India, Tiger Global Management and others, let these issues fester for years, and in some cases turn a blind eye to them is unclear.

Unlike a listed company which has independent directors who may call out instances of misgovernance or poor practices, private companies such as BharatPe consist largely of investor board members, whose job is to protect all stakeholders’ interests and the value of their shares. They do not have the level of independence or rigour that boards of public companies usually have, people said.

While board members are presented monthly or quarterly updates, business plans, and attend and vote at board meetings meant to decide the company’s direction, they do not have immediate or easy access to granular details of a business, such as which recruitment firm was used to hire candidates, whether invoices were accounted for appropriately, or whether it paid taxes on time-- all issues for which BharatPe is currently being probed.

“The investors were happy to see valuations go up constantly. Increasing valuations blinds investors to hard reality,” said Mohandas Pai, former board member of Infosys and chairman of Aarin Capital Partners, adding that a private company’s board has far less power than a public company.

BharatPe’s board earlier this month said, "The Grover family and their relatives engaged in extensive misappropriation of company funds, including, but not limited to, creating fake vendors through which they siphoned money away from the company’s expense account and grossly abused company expense accounts in order to enrich themselves and fund their lavish lifestyles."

Governance experts contend that BharatPe’s board erred in letting Madhuri Jain stay and hold an outsized role in the company. Jain, a design graduate, was head of controls at the $3 billion payments firm, a role which involved clearing payments, invoices and salaries to employees among other things.

“How can a designer and founder’s wife be the head of internal controls? The board should have seen that as a huge conflict of interest. They should have appointed an internal auditor and checked this. Because this is not a small startup (where relatives often hold positions and may be acceptable),” said Shriram Subramanian, founder and managing director of InGovern, a proxy advisory firm.

BharatPe declined to comment via a spokesperson while its investors and Grover did not respond to queries seeking comment

BharatPe, which started as a QR-code aggregator and then forayed with gusto into business lending, buy-now-pay-later loans and gold loans saw its valuation burgeon from zero to $3 billion in three years. The temptation of fast growth and soaring riches led investors to overlook misappropriation of funds. While the board could have collectively advised or asked Grover, co-founder and managing director, about his wife’s role and replaced her with a professional executive, they chose not to do so because they did not want to upset a founder who had made them wealthy in a quick time and grown the business fast.

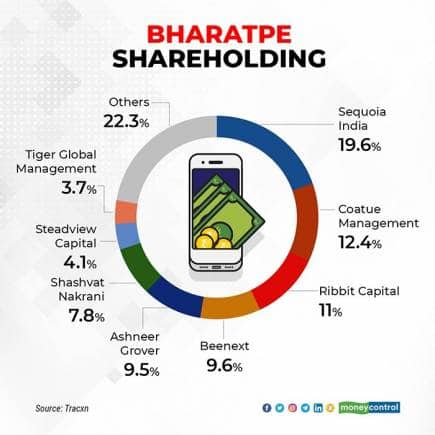

For instance, Sequoia’s 19.6% stake in BharatPe is worth about $580 million at its last valuation on paper, over 10 times what it has invested, and bigger than its entire $550 million venture fund for India and Southeast Asia raised in 2020. Similarly, early investors Ribbit Capital and Beenext own 1% and 9.6% respectively, their stakes worth at least over 5-10 times what they invested.

The events also shed light on the uneasy dynamic founders and investors share at fast-growing internet startups, especially when they disagree with each other, irrespective of whether or not they express it.

“In a startup it is difficult for investors to step in (and take action) very early because it might end up pissing off the founders and these investors are dependent to a large extent on an extraordinary founder to create value for them. So they also don't easily step in even when there is a red flag. So a red flag continues to be ignored till it becomes almost fatal,” said serial entrepreneur K Ganesh, promoter of Tata-owned BigBasket.

“Venture capitalists don’t have a deep commitment to building institutions and organisations. They want to get a 10x return and exit within a reasonable timeframe. They are not going to shake up anything as long as the founder is getting new investors and higher valuations...they are not as committed to long term building and that’s okay because venture capital is a different beast,” he added on a Twitter Spaces session.

More recently, BharatPe also appointed former SBI Chairman Rajnish Kumar and ex-Union Bank Chairman Kewal Handa as independent board members, a move possibly meant to boost governance and mimic a listed company. However, Moneycontrol reported that Kumar is not an independent director but a non-executive director, and holds shares (ESOPs) in BharatPe, significantly reducing his independence, although it was done with the board’s approval

While BharatPe’s board seemingly did enable its founder and management to get away with issues, its hand in larger purported fraud is questionable. While on paper it may seem ludicrous that a board member does not know of fraud in a company, these things can be notoriously hard to detect.

“If a founder has the proclivity to commit fraud, no one can really stop him. Frauds can be committed by founders or employees or stakeholders. Fraud risk mitigation should be the remit of any board of a large company. Company needs to have robust internal controls, processes and business practices to prevent fraud,” Subramanian said.

In the daily course of business, investors do not routinely investigate companies, but they conduct due diligence before making their investment. Because they cannot access granular data daily, they also usually perform background checks on the founder because they are trusting him. Further, BharatPe has also been audited by Deloitte, one of the Big 4 audit firms. Neither diligence firms during investment nor the auditor has flagged these fraudulent transactions or conflicts of interest. Diligence by venture firms involves calls to customers, vendors and examining books of accounts while an audit involves selective vouching and verification of some transactions to see whether they pass muster.

A preliminary report from Alvarez and Marsal said BharatPe had non-existent vendors, in addition to faking hiring consultants, where money paid to these consultants went to Jain instead. Further, these invoices were created by Shwetank Jain, her brother.

Aarin’s Pai said that despite previous lapses, he wouldn’t hold the board fully responsible for the mess at the company. “Once things came out they acted fast, but shareholders were not keeping their eyes open before that,” he said.

Following a leaked audio clip where Grover allegedly gave death threats to a Kotak employee for not getting allocation to Nykaa’s IPO and boorish behaviour on the entrepreneurship show Shark Tank India, BharatPe’s board sent Grover on a ‘leave of absence’ meant to last until March 31. Matters snowballed thereafter, with Alvarez and Marsal and PwC appointed for a governance probe and Grover claiming that investors were arm-twisting him and that current CEO Suhail Sameer is a “puppet of the investors.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.