Krishna Karwa Moneycontrol Research

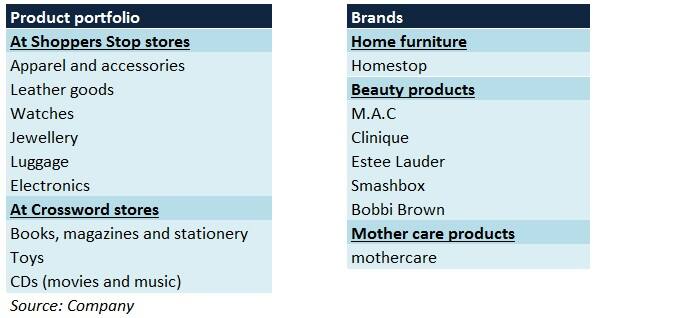

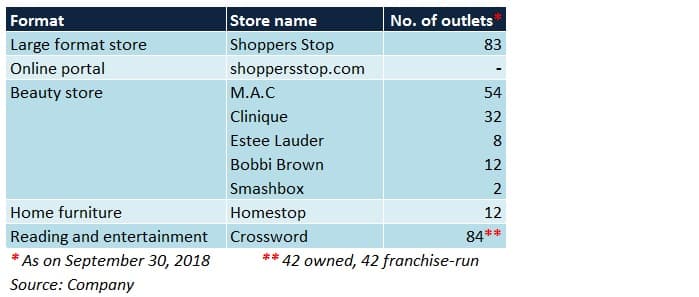

Shoppers Stop, a part of the K Raheja group, is among India’s largest retailers. The company operates 258 departmental stores spanning 4.27 million square feet, in 38 cities across the country. Its ‘First Citizen Loyalty Programme’ covers nearly 5.7 million members.

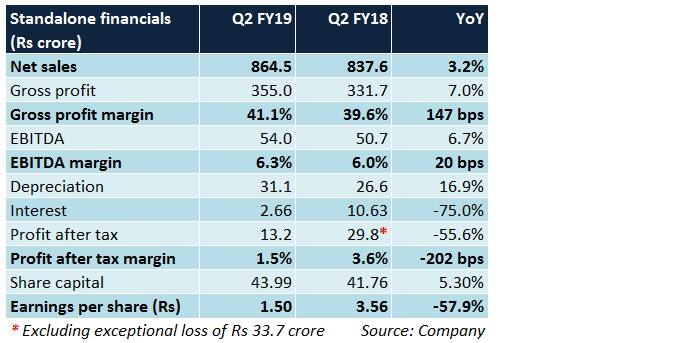

Q2 review

Same-store sales growth (SSSG) was aided by healthy demand during the Durga Puja festival, primarily in eastern India. During this time, sales grew by nearly 20 percent YoY in the region, whereas the contribution of private labels to revenue during Durga Pooja stood at 14 percent as against 10 percent (excluding the festival days) in Q2 FY19.

Despite an uptick in gross margin YoY (due to accounting standard adjustments), higher investments in developing the omnichannel (integration of online and offline retailing) and a hike in other expenses, growth in operating margin was muted.

What will drive sales growth?

The management targets SSSG to be in the range of 7-8 percent in Q3 and 5-6 percent in Q4. This will be on the back of seasonally favourable factors such as onset of the wedding and festive season, introduction of end of season sale schemes periodically and launch of new collections.

In H2 FY19, in terms of network augmentation, the plan is to add three Shoppers Stop outlets (taking the total additions to four in FY19) and 10 beauty stores (versus six added in H1 FY19).

To enhance brand visibility, kiosks and experience centres will be set up in stores other than the ones in Mumbai and Bengaluru. To facilitate personalisation, Shoppers Stop will extend its ‘personal shopper offering’ (PSO) services in new geographies. Currently, PSO services are available in 9 cities only.

Shoppers Stop’s ‘Click & Collect’ services, which entail ordering something online and collecting it from an outlet, are active in more than 50 stores pan-India. With a fulfilment centre base of 37 outlets and 4 warehouses, the company is capable of delivering products to over 25,000 pin codes.

Women’s ethnic wear has been a fast-growing segment. Demand outlook on this front is expected to stay robust in the coming months.

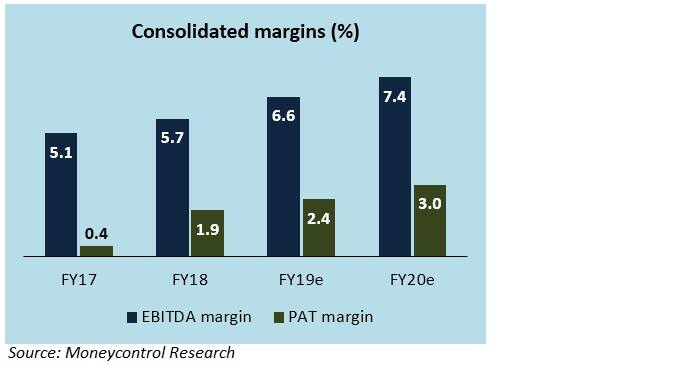

What will boost margins?

The share of high-margin private label brands is anticipated to increase from 10-15 percent at present to 30-35 percent by FY20.

Scaling up omnichannel operations will help normalise expenses (as a percentage of revenue). This initiative can enhance customer experience substantially, which could lead to better conversions.

To rationalise rent costs, the management is considering opening small-sized department stores in tier II/III cities from H2 FY20.

The number of Diwali sale days have been reduced to 36 this year as against 51 last year.

Shoppers Stop is positioning itself as a comprehensive lifestyle brand by laying impetus on the branded beauty segment in particular. Such products command better margins than apparel.

Long-term debt is likely to be repaid in entirety by FY19-end from the proceeds of Hypercity sale (to Future Retail) and 5 percent stake sale (to Amazon).

Risks

Fashion trends are subject to frequent and unforeseen changes at regular intervals. This could lead to a major inventory build-up and compel Shoppers Stop to liquidate the same at discounted rates, which may dent margins.

Sluggish same-store sales growth (or degrowth for that matter) is an issue that has plagued Shoppers Stop's financials for quite a while. Unless some concrete steps are taken to address this issue, a significant portion of the incremental top-line will be derived from new stores, which isn't ideal from a cash flow perspective.

Competitive intensity (from e-commerce majors and other branded/unbranded/unorganised brick-and-mortar retailers) is high in the segments in which Shoppers Stop operates.

Should you invest?

‘First Citizen Loyalty Programme’, which includes 5.7 million shoppers at the end of Q2 FY19, is one of Shoppers Stop’s primary USPs (unique selling propositions). Each fiscal year, the company derives nearly 70-80 percent of its total top-line from customers in this category. Therefore, an uptrend in the number of buyers under this scheme, as seen in recent years, is an encouraging sign.

Considering how pivotal blending offline and online retailing is in today’s times, Shoppers Stop’s tie-up with Amazon couldn’t have been timed better as it enables both to leverage each other’s strengths.

New design studios and sourcing processes will help identify new garmenting patterns and achieve economies of scale, respectively.

Given India’s large and diverse population, the consumption theme is here to stay. Consequently, prospects for consumer-focused sectors such as retail are undoubtedly promising.

At 33 times its 2-year forward earnings, Shoppers Stop trades at optically expensive valuations. Nevertheless, in the aftermath of the sharp correction, we recommend investing in this stock for the long haul.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.