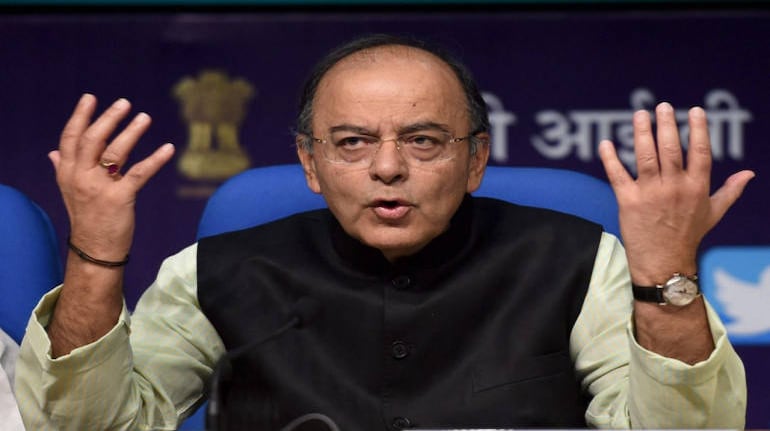

Two days after finance minister Arun Jaitley said that homebuyers who have invested their money with developers should get their apartments and that the government’s “full sympathy” is with them, homebuyers in Noida and Greater Noida have written to him demanding that the government instruct banks to stop their EMIs till they get their flats.

“More than 3 lakh homebuyers of this region are paying bank EMIs in the hope of getting flats in the future. Out of this approximately 1.5 lakh, flat buyers have no hope getting a flat, still, they are forced to pay EMI to banks. Builders (Amrapali, Jaypee, Earth etc) are becoming bankrupt or are in jail or not doing any construction at the site,” the letter by NEFOWA dated August 16 said.

“Our request is to please look into the matter seriously and instruct banks to stop EMI till we get our flats. We flat buyers have a double burden of paying rent as well as paying EMI,” the letter said.

“We want our right to own a house for which we have paid the builder, not sympathy,” says Indrish Gupta, co-founder, Noida Extension Flat Owners Welfare Association (Nefowa).

“We have paid taxes to the government – collected as service and VAT against the house purchased. The government has the responsibility to either refund the money or reinvest it with a co-developer and get the projects completed. A solution has to be found,” he says.

As many as 40,000 home buyers have been left high and dry after the Allahabad bench of the National Company Law Tribunal (NCLT) last week admitted IDBI Bank’s plea for initiating insolvency proceedings against Jaypee Infratech for defaulting on a Rs 526-crore loan. While some buyers have paid the full amount to the company, there are others who may have paid either 60 percent or perhaps 90 percent of the amount.

NCLT appointed insolvency professional Anuj Jain as CEO of Jaypee Infratech. He has been given six months to revive the company. This period can be extendable by another three months. In the meantime, homebuyers have been given two weeks (until August 24) to raise claims related to their investment in the Jaypee projects.

Jaitley had said earlier this week that those buyers who have paid money to developers should get their apartments. “Our full sympathy” is with the aggrieved homebuyers. He had also said that there was a provision for running a company under insolvency proceedings. “Those who are aggrieved can get remedy under this law (the Insolvency and Bankruptcy Code).”

While some experts are of the opinion that homebuyers should stop paying their EMIs as the obligation to deliver the apartment to the buyer has not been met by the developer, others say that doing so will impact their credit rating.

“Homebuyers should stop paying their EMIs. There was a tripartite agreement between the bank, developer and the customer. The deliverer was expected to deliver the project for which the bank was to pay the money and the buyer pays their EMIs” says Vivek Kohli, senior partner and co-founder Zeus Law.

“In this case of Jaypee Wishtown, since the developer has not been able to deliver several towers in the project, where is the question of paying EMIs? Also, whatever money has been paid by the bank, it is still secure as it has an asset, a mortgage on an asset that is yet to be developed on the land. Unfortunately, the customer has nothing, no property title transfer papers, just an allotment letter. Among the three, the customer is perhaps the worst placed and to expect that the worst hit person will continue to discharge his obligation while the developer, the propounder of the tripartite agreement has not met his obligation, is not fair.”

Some experts say that stopping EMIs is not the right solution. The biggest concern, if buyers stop servicing their home loans, it will impact their credit rating and hamper their future ability to raise any kind of loan.

Some loan experts suggest that homebuyers can try and negotiate with their bank and reduce their monthly EMI outgo and increase the tenure of their loan to the maximum, 30 years if possible.

This may help reduce their exposure and give them enough time to wait and see the dust settle and a solution emerge over the issue. Perhaps in some months, a third party may take over the project and complete it.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.