Property registrations in the Mumbai real estate market from January to July 2023 were the second highest on record with over 72,700 registrations, while registration revenue collection of close to Rs 6,500 crore was the highest, according to data from Maharashtra’s Inspector General of Registrations and Stamps (IGR).

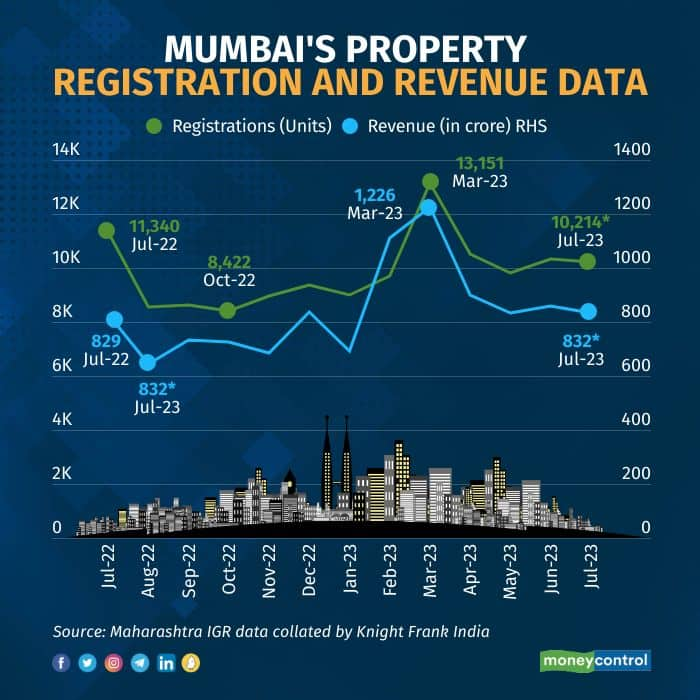

In the first seven months of 2022, Mumbai reported 78,101 registrations and Rs 5,280 crore as revenue from registrations, according to Knight Frank India, a real estate consultancy that collated the data.

"The city in the first seven months of 2023 registered a total of 72,706 units, leading to a substantial revenue collection of over Rs 6,453 crore for the state exchequer. Highest compared to the same period since 2013," Knight Frank India said in its report on July 31.

"This surge in property registrations has significantly benefited the Government of Maharashtra. The rise in revenue can be credited to several contributing factors, such as the higher value of properties being registered and the increased stamp duty rate," the report added.

The current stamp duty for purchasing a property in Maharashtra ranges between 5 percent and 7 percent. The registration fee is Rs 30,000 for properties worth more than Rs 30 lakh and 1 percent of the value of the property for homes below Rs 30 lakh.

In January 2023, the city reported 9,001 property registrations and a revenue to the state exchequer of Rs 692 crore. In February, registrations stood at 9,684 and the revenue at Rs 1,112 crore, while in March, the city reported 13,151 registrations and over Rs 1,143 crore revenue.

The higher numbers for February and March owe to the large number of high-value transactions—above Rs 10 crore—transacted in the financial capital.

This was after Budget 2023-24 imposed a Rs 10-crore cap on the reinvestment of capital gains from the sale of long-term assets, including property, which became effective from April 1, 2023. No such cap was applicable earlier.

Moneycontrol had reported on March 30 that there were as many as 130 transactions involving properties valued above Rs 10 crore in Mumbai in February 2023, totalling Rs 5,595 crore, according to data from Zapkey.com.

This number is historically the highest compared to deals closed in February of previous years. Compared with 75 deals in February 2022, there were 130 transactions in February 2023, a 75 percent increase.

Top dealsThe largest contributor to the registration department’s revenue in February and March 2023 came from the 28 housing units worth Rs 1,238 crore that were purchased by family members and associates of D’Mart founder Radhakrishna Damani in Mumbai.

Another much-talked-about deal was to do with Bajaj Auto chairman Niraj Bajaj, who bought a sea-facing triplex apartment in the posh Malabar Hill area of South Mumbai for Rs 252.5 crore, followed by the family members of industrialist JP Taparia, founder of contraceptive maker Famy Care, purchasing six sea-facing properties worth around Rs 369 crore in the same building from real estate developer Lodha.

What happened in the second quarter of 2023?In April 2023, Mumbai reported 10,514 registrations and registration revenue went above Rs 900 crore, while in May 2023, the numbers went down to 9,823 registrations and Rs 833 crore in revenue, followed by June 2023 registering 10,319 registrations and revenue of Rs 859 crore.

In July 2023, the registration number stood at 10,214, fetching a revenue of Rs 832 crore from registrations.

According to real estate brokers, the number of registrations in May, June and July have risen owing to multiple factors.

Also read: Homebuyers feel the pinch as Maharashtra collects Rs 1,800 crore Metro cess from property registrationsHiren Pandya, a real estate broker focused on the central suburbs of Mumbai, said, "The summer vacation months are preferred by homebuyers to book apartments and move in, and hence April, May and June witnessed a spike in registration numbers. Further, several homebuyers also booked units and utilised the 30 to 45 days’ window to complete the registration process and shift into the apartment."

There are times when homebuyers book the apartment but execute the agreement along with other formalities of stamp duty and registration after a gap of 30 to 45 days in order to arrange for funds or if the homebuyer is awaiting clearances from the bank for a home loan.

"With the onset of the monsoon, site visits and closures slow down and the overall registrations also take a hit. In our opinion, the next few months are likely to witness a momentary slowdown, however, the long-term direction surely remains upward, and the Mumbai real estate sector seems to be on a strong footing," ANAROCK, a real estate consultancy, said in its report released on July 31.

Another reason brokers ascribed to the steady momentum of registrations is the Reserve Bank of India’s (RBI) pause in hiking its policy rate that determines lending rates for home loans. According to brokers, this has instilled confidence in buyers of affordable housing.

Increase in transactions above Rs 1 croreFurther, over the past few years, there has been a consistent upward trend in the proportion of property registrations for properties valued at Rs 1 crore and above. The share of registrations for properties worth Rs 1 crore-plus has risen from 48 percent in 2020 to approximately 57 percent in 2023, Knight Frank India said in its report.

The report added, "The increase in property prices, combined with a notable rise of 250 basis points in interest rate during this period, has had an impact on property registrations below the Rs 1 crore mark. However, registrations for properties priced at Rs 1 crore and above have remained relatively unaffected by these changes."

"As a result, there has been a noticeable positive impact on the share of property registrations for properties priced above Rs 1 crore, indicating a sustained demand in this higher price segment of the market," the report further added.

Also read: Luxury home sales: Mumbai reports Rs 11,400 crore of luxury home sales in first half of 2023, says report“The demand in Mumbai's residential market continues in the face of various challenges as consumers display enthusiasm for homeownership. Notably, there has been a considerable increase in the share of properties priced at Rs 1 crore and above. This can be attributed partly to the growing preference for larger homes and the rise in property prices. Additionally, the relatively better affordability of higher segment consumers has also contributed to this trend," said Shishir Baijal, chairman and managing director, Knight Frank India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.