The Reserve Bank of India (RBI) on June 8 said it will allow non-banking prepaid payment instruments issuers to issue e-RUPI vouchers, said RBI Governor Shaktikanta Das.

The e-RUPI vouchers are pre-paid digital instruments that a beneficiary gets on his phone in the form of an SMS or QR code.

“These measures will make the benefits of e-RUPI digital voucher accessible to a wider set of users and further deepen the penetration of digital payments in the country,” Das said in his monetary policy review speech on June 8.

The central bank also proposed to enabling issuance of e-RUPI vouchers on behalf of individuals to simplify the process of issuance and redemption.

Also read: RBI MPC meeting: Central bank to issue guidelines on technical write-offs for all regulated entities

What is e-RUPI?

Prime Minister Narendra Modi on August 2. ,2021, launched e-RUPI, a cashless and contactless instrument for digital payment. e-RUPI is a one-time contactless, cashless voucher-based mode of payment that helps users redeem the voucher without a card, digital payments app, or internet banking access.

Purpose-specific e-RUPI vouchers are now issued by 21 banks in partnership with the National Payments Corporation of India (NPCI) for specific reasons such as payment of hospital bills, etc.

Some of those 22 banks are Axis Bank, Bank of Baroda, Canara Bank, HDFC Bank, ICICI Bank, Indian Bank, IndusInd Bank, Kotak Mahindra Bank, Punjab National Bank, State Bank of India and Union Bank of India.

e-RUPI is different from Central Bank Digital Currency (CBDC). e-RUPI is a person and purpose specific digital voucher.

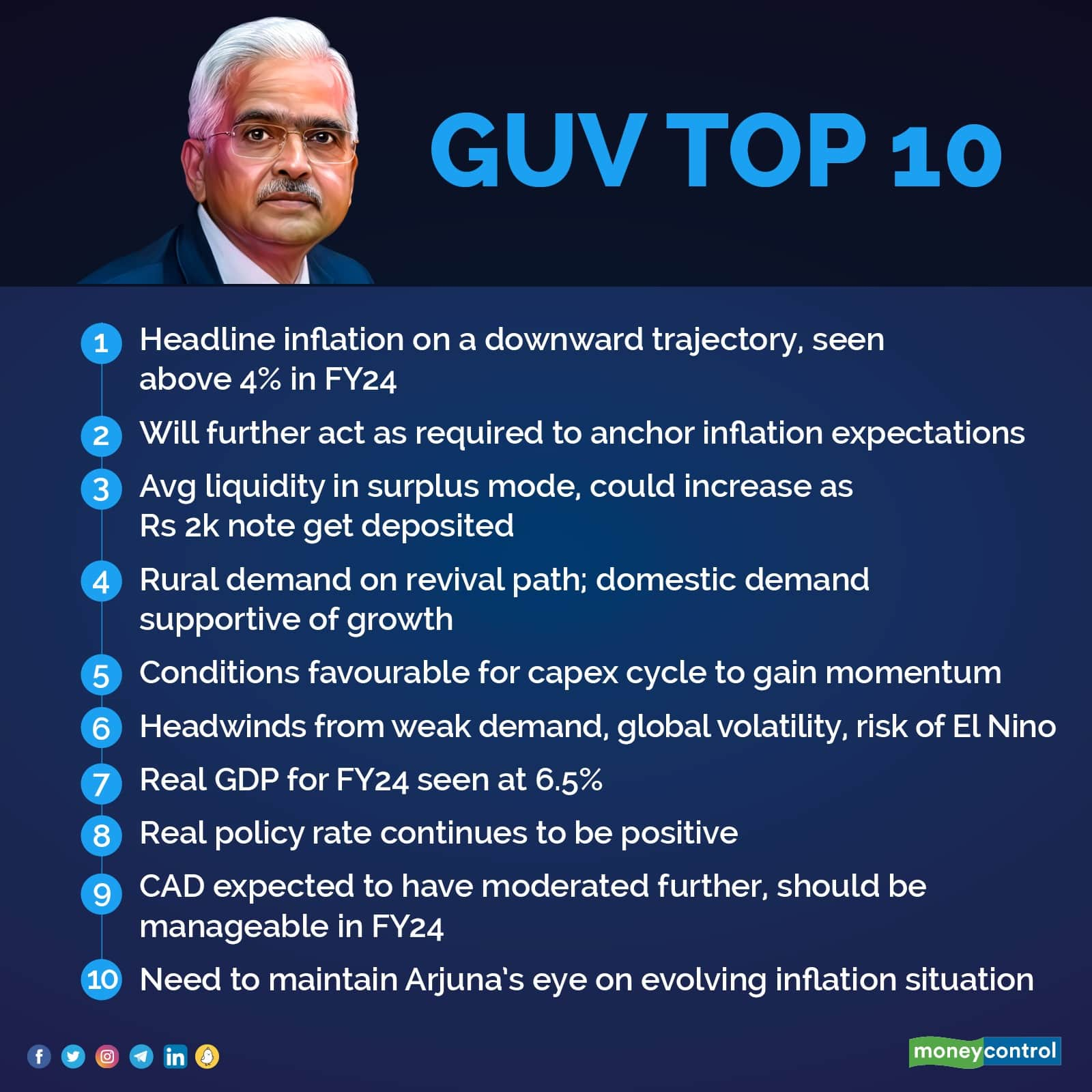

Repo rate unchanged

The Reserve Bank of India's Monetary Policy Committee (MPC) on June 8 retained the repo rate, the key short-term lending rate, at 6.5 percent in line with the expectations but sounded caution about a likely uptick in inflation print.

While announcing the decision, RBI Governor Shaktikanta Das also signalled the central bank’s readiness to act in keeping with the incoming data. Since May 2022, the regulator has hiked the repo rate by 250 basis points to counter the inflationary pressure.

Also read: RBI Policy: MPC retains repo rate at 6.5%, sounds caution on inflation

One basis point is one-hundredth of a percentage point.

High inflation, which has remained a key concern for policymakers, has begun cooling off in recent months. The retail inflation rate dropped sharply for the second straight month, hitting an 18-month low of 4.7 percent in April, but still stays above the RBI's target of 4 percent.

Economic growth is picking up pace, with the March quarter GDP reading of 6.1 percent beating economist consensus by a wide margin and signalling that the recovery is on track.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.