Ray Dalio, billionaire investor and founder of Bridgewater Associates, released his inaugural Country Power Score Index, which, in his own words, analyses “what makes countries healthy and unhealthy, and how policymakers’ decisions impact the trajectories of their countries.”

The list places the US on top in a state of gradual decline, while China is No. 2 in rapid ascent. India is ranked 7th in ascent.

In tweets posted on May 25, Dalio said the report comes from his 50-year experience as a global macro-investor and added that he “likes to quantitatively measure” impact to help build systems for better decision-making.

The power score index shows the levels of 18 types of strengths and combines them into an aggregate measure of power for the top 24 countries. Besides current placements, the index can be used as a “good leading indicator of future conditions” and “serve as a guide for policymakers to produce improved outcomes.”

“These power indices measure the strengths of influences such as education, innovation and technology development, the civility of the people, economic output... reserve currency status, military, and many others. They, in turn, are combined into one overall reading of each country’s power. Because they are quantitatively measured, one can see the relative strengths of countries in all of these dimensions... and can see whether the country is strengthening or weakening in these several ways,” he wrote with a link to his research.

The key takeawaysThe US: The US appears to be a strong power (#1 among major countries today) in gradual decline.

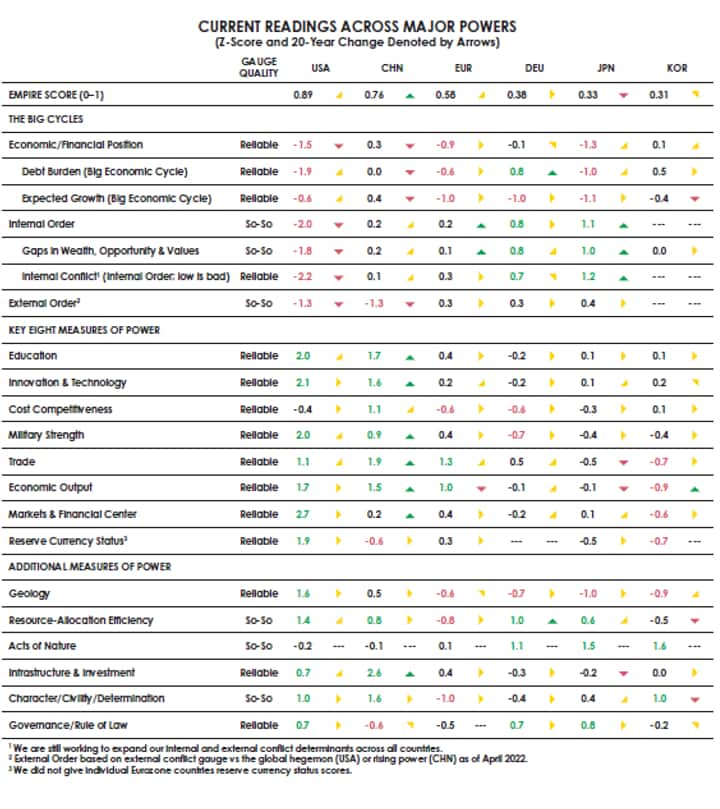

Current readings for major powers: USA, China, Eurozone, Germany, Japan, Korea (Source: Power Score Index, Ray Dalio)

Current readings for major powers: USA, China, Eurozone, Germany, Japan, Korea (Source: Power Score Index, Ray Dalio)— The key strengths that put the US in this position are its strong capital markets and financial centre, its innovation/technology, its strong military, its high level of education, its reserve currency status, its high economic output, and its wealth of natural resources.

— Its weaknesses are its unfavourable economic/financial position and its large domestic conflicts.

— For the US, the big cycles look mostly unfavourable. It is in an unfavourable position in its economic and financial cycles. Further, internal disorder is a high risk and external disorder is a risk.

— In terms of the eight key measures of power, the US has the largest capital markets and the strongest financial centre among major countries. Its equity markets are a majority of the world total (59 percent of total market cap and 66 percent of volume), and a majority of global transactions take place in US dollars (55 percent). It also has the strongest reading on technology and innovation among major countries and the strongest military among major countries.

China: China appears to be a strong power (#2 among major countries today) in rapid ascent.

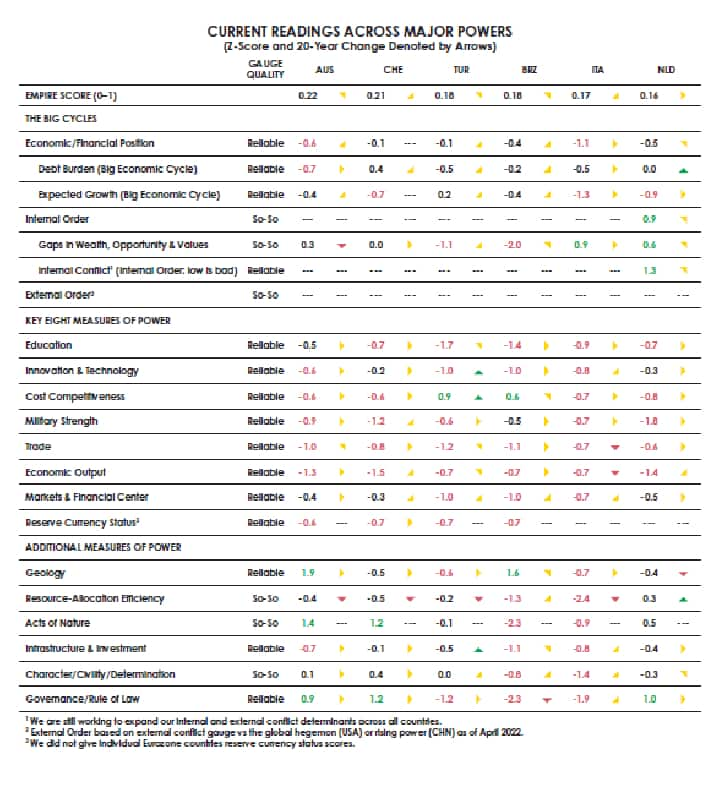

Current readings for major powers: Australia, Switzerland, Turkey, Brazil, Italy and Netherlands (Source: Power Score Index, Ray Dalio)

Current readings for major powers: Australia, Switzerland, Turkey, Brazil, Italy and Netherlands (Source: Power Score Index, Ray Dalio)— Key strengths that put China in this position are its infrastructure and investment, its importance to global trade, its high level of education, its innovation/technology, its people’s self-sufficiency and strong work ethic, and its strong military.

— China is in a somewhat favourable position in its economic and financial cycles. Its internal disorder is a low risk and external disorder is a risk.

— In terms of the eight key measures of power, China is the largest exporter among major countries (14 percent of global exports). It has the second-strongest position in education among major countries; and the second-strongest reading on technology and innovation among major countries.

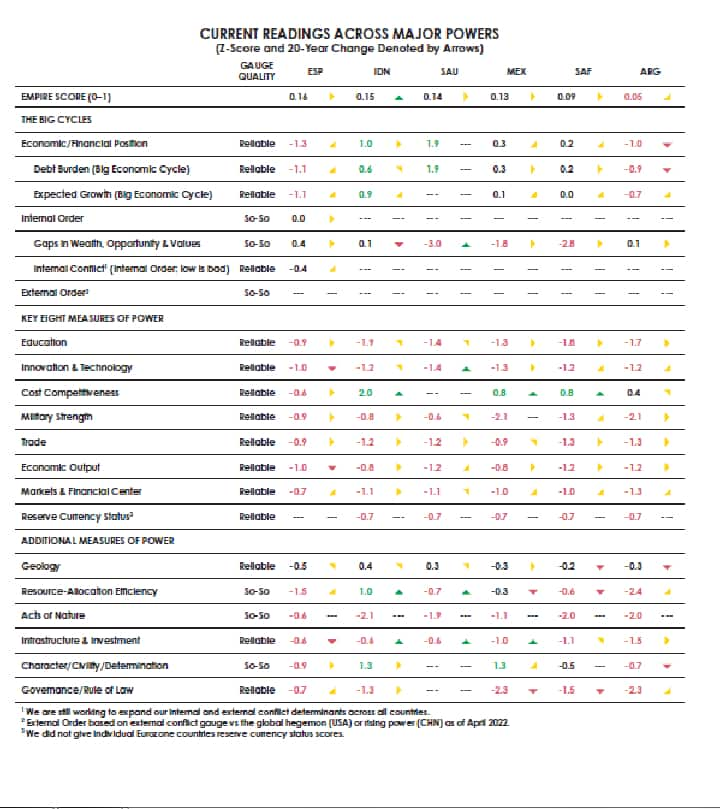

Current readings for major powers: Spain, India, Saudi Arabia, Mexico, South Africa and Argentina (Source: Power Score Index, Ray Dalio)

Current readings for major powers: Spain, India, Saudi Arabia, Mexico, South Africa and Argentina (Source: Power Score Index, Ray Dalio)India: India appears to be a middle-of-the-pack power (#7 among major countries today) in ascent.

— Key strengths of India are its strong economic and financial position and its cost-competitive labour (on a quality-adjusted basis).

— Its weaknesses are its poor innovation and technology for its size of population, its weak relative position in education, and its corruption and inconsistent rule of law.

—India is in a highly favourable position in its economic and financial cycles, with a low debt burden and high expected real growth over the next 10 years (6.4 percent per year).

Current readings for major powers: Key drivers of India's power score (Source: Power Score Index, Ray Dalio)

Current readings for major powers: Key drivers of India's power score (Source: Power Score Index, Ray Dalio)— India has slightly more foreign debt than foreign assets (net IIP is -12 percent of GDP). Non-financial debt levels are low (122 percent of GDP), though government debt levels are typical for major countries today (75 percent of GDP). The bulk (94 percent) of these debts are in its own currency, which mitigates its debt risks.

— In terms of the eight key measures of power, India has the cheapest labour among major countries. This has been netted against its bad reading on innovation and technology and its weak relative position in education.

Other countries>> Among other countries analysed, Europe took the #3 spot among major countries, with key indicators showing a relative decline due to low productivity gains in its labour markets and inefficient allocation of labour and capital.

>> Also on the index are Argentina, Indonesia, Japan, Mexico, South Korea, South Africa and Saudi Arabia, among others.

BackgroundThe power score index is part of Dalio’s New York Times bestseller Principles for Dealing with The Changing World Order - Why Nations Succeed and Fail. The book “examines history’s most turbulent economic and political periods to reveal why the times ahead will likely be radically different from those we’ve experienced in our lifetimes—but similar to those that have happened many times before,” as per Dalio’s website.

Also Read | Bookstrapping: 'Principles for dealing with the changing world order' By Ray Dalio

Dalio also has a 43-minute animated video on Principles for Dealing with The Changing World Order, which highlights and summarises key points in the book.

Dalio's website features a range of his discussions and interviews, including a talk with Henry Kissinger at the Center for Strategic and International Studies (CSIS) on statecraft and economies; an interview with Fareed Zakaria discussing the changing world order and international economic trajectory; and a bout on Hank Paulson’s Straight Talk Podcast, where he and the former US Treasury Secretary discuss the current economic situation, US-China relations, and world leaders. You can find them here.

“As a global macro-investor, I discovered early on that I needed to understand the cause-effect relationships that drive conditions and market movements, and that I needed to study many cases through history in order to gain that understanding. That's because many circumstances that I encountered never happened in my lifetime but happened many times before,” said Dalio.

Dalio called the research and changing conditions forecast by his studies over many years as “highly controversial” and added that over time, the results seem “fairly obvious… but remain non-conventional.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.