As Russian President Vladimir Putin visits India for the 23rd India–Russia Annual Summit on December 4-5, Moneycontrol examines the trade ties, local-currency transactions, and crude oil cooperation between the two nations.

Trade

Total merchandise trade between India and Russia was worth $68.7 billion in FY25, a growth of 5 percent on-year.

But trade between India and Russia remains heavily skewed, with Indian exports at less than $5 billion annually, while imports stand at around $64 billion, largely driven by New Delhi’s purchases of crude oil from Moscow.

An increase in Russian oil purchases, with New Delhi having little to offer in exports, has widened the trade gap.

Engineering goods remain India’s top export to Russia at $1.3 billion in FY25, followed by electronic goods worth $862.5 million and drugs and pharmaceuticals at $577.2 million. Other major shipments include organic and inorganic chemicals, marine products, and ready-made garments.

Some of India’s top imports from Russia in FY25 include crude oil at nearly $57 billion, animal and vegetable fats and oils at $2.4 billion, fertilisers at $1.8 billion, and pearls, precious, and semi-precious stones at $433.93 million.

India has been attempting to diversify its exports, especially amid steep tariffs from the US, with many goods facing reciprocal duties of 50 percent. Against this backdrop, New Delhi is also exploring a free trade agreement with the Russia-led Eurasian Economic Union (EAEU).

India and the EAEU bloc, on August 20, signed the terms of reference (ToR) to launch negotiations for an FTA in Moscow. ToR provides a framework for talks.

The two nations also pledged to increase bilateral trade to over $100 billion by 2030 during Prime Minister Narendra Modi's Moscow visit in 2024.

Oil conundrum

Putin’s visit comes at a time when India’s purchases of Russian oil is expected to decline in December as refiners turned to alternatives to avoid breaching stringent US sanctions on key Kremlin-linked exporters came into effect on November 21.

India’s crude oil imports from Russia averaged 1.8 million barrels per day (bpd) in November, accounting for more than 35 percent of its total crude import mix, according to real-time data analytics firm Kpler, as cited in media reports.

The November imports, which compare with 1.5-1.6 million bpd of Russian oil flow in October, are expected to be a five-month high, driven by increased imports before the November 21 deadline, the report said.

The sharp drop seen earlier is due to the US sanctions on Russian refiners Rosneft and Lukoil, which are likely to temporarily reshape India’s crude import flows, even if they do not alter New Delhi’s long-term strategy of maintaining a diversified, cost-advantaged supply mix.

India had rapidly increased purchases of crude oil from Russia thanks to deep discounts, with purchases rising from less than one percent of the total oil imported in the pre-Ukraine war period to almost 40 percent of the country's total oil purchases.

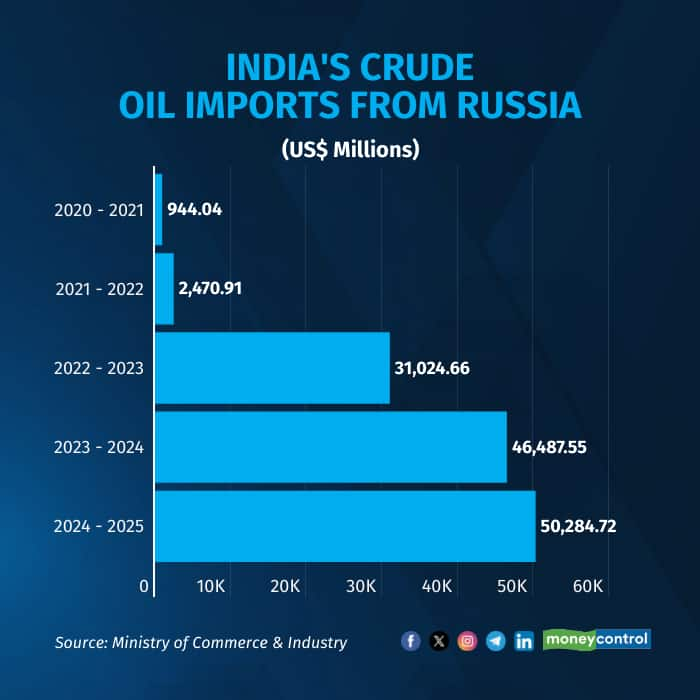

Data shows New Delhi’s crude oil imports from Russia increased by approximately 20-fold from 2021–22 to 2024–25.

However, of late, growth in imports has slowed, partly as discounts have diminished and also due to tighter sanctions from Western nations such as the US and Europe.

During April to October 2025, crude oil imports from Moscow slowed to $26.7 billion, a drop of nearly 19 percent on year.

Despite near-term declines, experts believe a complete halt to Russian imports is unlikely. Discounted Russian barrels remain attractive for margins, and India’s energy policy continues to prioritise affordability and security over geopolitical considerations.

Ajay Srivastava of the Global Trade Research Initiative said in a note on December 3 that, in the energy sector, New Delhi is expected to pursue long-term crude contracts with non-US-sanctioned Russian firms, revive Indian investments in Russian energy projects, and advance nuclear cooperation beyond Kudankulam.

Cooperation in critical minerals, manufacturing and maritime connectivity linking India with Russia’s Far East may also be discussed, Srivastava said.

Rupee-Ruble

Most trade between India and Russia is conducted in local currencies or a third currency like the dirham, given the pressure on dollar transactions due to Western sanctions. This has also been a key part of New Delhi’s efforts to internationalise the rupee.

Especially for discounted Russian oil, payments are increasingly being de‑dollarised and routed through UAE dirhams, rupees, and yuan to work around sanctions.

However, given the lopsided trade profile, with significantly higher imports from Moscow than India’s exports, the rupee-ruble trade has yet to gain traction.

Recently, the Engineering Exports Promotion Council of India highlighted that Indian exporters are facing payment delays due to sanctions on Russian banks.

The Council noted that the rupee-ruble trade mechanism has faced challenges, with some multinational banks of Indian origin reportedly refusing payments from Russia and not issuing e-BRCs, fearing potential losses in North America and Europe due to sanctions on Russia.

“There is a need to establish a robust and reliable direct rupee–ruble exchange mechanism for settling financial transactions between the two countries. This can be announced monthly, which will help the exporting community do business with Russia,” EEPC India suggested.

India started exploring a rupee settlement mechanism with Russia soon after the invasion of Ukraine in February 2022, but this practice failed to pick up, given the skewed trade balance between the two sides.

Back in September 2023, Russia's Foreign Minister Sergei Lavrov reiterated that Moscow has billions of rupees stored in Indian banks that "unfortunately cannot be used right now", but India had proposed some ways in which this money can be invested.

India and Russia are in talks to establish a direct exchange rate for their local currencies to boost trade between the two nations, Moneycontrol had reported earlier.

The central banks of the two nations began talks last year to determine the modalities for identifying this exchange rate.

The idea is to avoid pegging the exchange rate to the dollar or any other third currency; however, the initiative is still under development and has not yet been officially implemented.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!